Megatronics Corporation, a massive retailer of electronic products, is organized in four separate divisions. The four divisional managers are evaluated at year-end, and bonuses are awarded based on ROI. Last year, the company as a whole produced a 13 percent return on its investment.

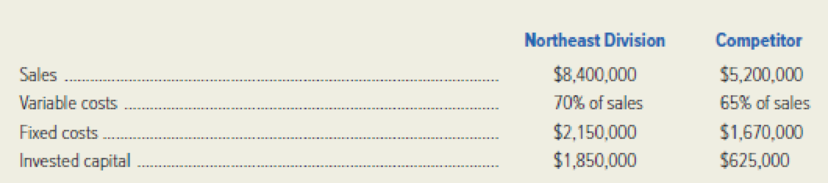

During the past week, management of the company’s Northeast Division was approached about the possibility of buying a competitor that had decided to redirect its retail activities. (If the competitor is acquired, it will be acquired at its book value.) The data that follow relate to recent performance of the Northeast Division and the competitor:

Management has determined that in order to upgrade the competitor to Megatronics’ standards, an additional $375,000 of invested capital would be needed.

Required: As a group, complete the following requirements.

- 1. Compute the current ROI of the Northeast Division and the division’s ROI if the competitor is acquired.

- 2. What is the likely reaction of divisional management toward the acquisition? Why?

- 3. What is the likely reaction of Megatronics’ corporate management toward the acquisition? Why?

- 4. Would the division be better off if it didn’t upgrade the competitor to Megatronics’ standards? Show computations to support your answer.

- 5. Assume that Megatronics uses residual income to evaluate performance and desires a 12 percent minimum

return on invested capital. Compute the current residual income of the Northeast Division and the division’s residual income if the competitor is acquired. Will divisional management be likely to change its attitude toward the acquisition? Why?

1.

Calculate the current return on investment of northeast division of company M and calculate the return on investment of northeast division of Company M if competitor is acquired.

Explanation of Solution

Return on investment (ROI): Return on investment evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Calculate the current return on investment of northeast division of company M and calculate the return on investment of northeast division of Company M if competitor is acquired as follows:

Current return on investment of northeast division:

Return on investment of northeast division if competitor is acquired:

Working note (1):

Calculate the net income of northeast division.

| Particulars | Amount in ($) |

| Sales revenue | $8,400,000 |

| Less: Variable cost | $5,880,000 |

| Less: Fixed cost | $2,150,000 |

| Income | $370,000 |

Table (1)

Working note (2):

Calculate the variable cost of northeast division after acquisition.

Working note (3):

Calculate the net income of northeast division after acquisition.

| Particulars | Amount in ($) |

| Sales revenue | $13,600,000 |

| Less: Variable cost (2) | $9,260,000 |

| Less: Fixed cost | $3,820,000 |

| Income | $520,000 |

Table (2)

2.

State the reaction of division management towards the acquisition.

Explanation of Solution

State the reaction of division management towards the acquisition as follows:

Division management will be against to the acquisition because return on investment of northeast division would decrease from 20% to 18.25% and it will provide less compensation to divisional management since the bonuses are awarded on the basis of return on investment (ROI).

3.

State the reaction of corporate management towards the acquisition

Explanation of Solution

Corporate management will be favor to the acquisition because competitor’s return on investment of 24% (5) is more than return on investment of northeast division (20%) and it will provide more compensation to corporate management even if the addition investment is made by competitor.

Working note (4):

Calculate the net income of competitor.

| Particulars | Amount in ($) |

| Sales revenue | $5,200,000 |

| Less: Variable cost | $3,380,000 |

| Less: Fixed cost | $1,670,000 |

| Income | $150,000 |

Table (3)

Working note (5):

Calculate the return on investment of competitor.

4.

Explain whether the division would be better off if it did not upgrade.

Explanation of Solution

Explain whether the division would be better off if it did not upgrade as follows:

Yes, the division would be better if it did not upgrade, because the divisional return on investment would increase from 18.25% to 21.01% (5). However, the absence of upgrade would lead to long run problems and customer would be confused by the two different retail environments from one business outlets.

Working note (5):

Calculate the combined return on investment before the additional investment of competitor.

5.

Calculate the current residual income of northeast division and residual income of northeast division after acquisition and explain whether the divisional management would be likely to change its attitude toward the acquisition.

Explanation of Solution

Calculate the current residual income of northeast division and residual income of northeast division after acquisition as follows:

Current residual income of northeast division:

| Particulars | Amount in ($) |

| Divisional profit | $ 370,000 |

| Less: Imputed interest charge | $222,000 |

| Residual income | $ 148,000 |

Table (4)

Residual income of northeast division after acquisition:

| Particulars | Amount in ($) |

| Divisional profit | $ 520,000 |

| Less: Imputed interest charge (6) | $342,000 |

| Residual income | $ 178,000 |

Table (5)

Working note (6):

Calculate the combined imputed interest charge.

Explain whether the divisional management would be likely to change its attitude toward the acquisition as follows

Yes, divisional management should change its attitude because the residual income has increased from $148,000 to $178,000 after acquisition.

Want to see more full solutions like this?

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Step by step answerarrow_forwardWhy does stakeholder diversity influence disclosure choices? [Financial Accounting MCQ] (1) Diversity creates problems (2) Standard reports satisfy everyone (3) Users want identical information (4) Different information needs require varied reporting approachesarrow_forwardVariable costing would be?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning