Clearview Window Company manufactures windows for the home-building industry. The window frames are produced in the Frame Division. The frames are then transferred to the Glass Division, where the glass and hardware are installed. The company’s best-selling product is a three-by-four-foot, doublepaned operable window.

The Frame Division also can sell frames directly to custom home builders, who install the glass and hardware. The sales price for a frame is $80. The Glass Division sells its finished windows for $190. The markets for both frames and finished windows exhibit

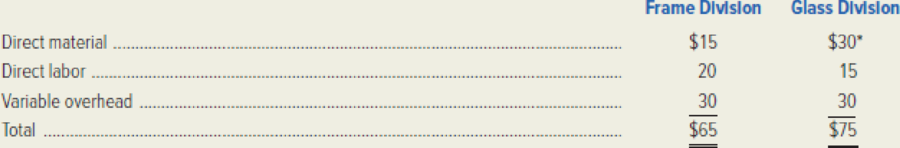

The standard variable cost of the window is detailed as follows:

*Not including the transfer price for the frame.

Required:

- 1. Assume that there is no excess capacity in the Frame Division.

- a. Use the general rule to compute the transfer price for window frames.

- b. Calculate the transfer price if it is based on standard variable cost with a 10 percent markup.

- 2. Assume that there is excess capacity in the Frame Division.

- a. Use the general rule to compute the transfer price for window frames.

- b. Explain why your answers to requirements (1a) and (2a) differ.

- c. Suppose the predetermined fixed-overhead rate in the Frame Division is 125 percent of direct-labor cost. Calculate the transfer price if it is based on

standard full cost plus a 10 percent markup.- d. Assume the transfer price established in requirement (2c) is used. The Glass Division has been approached by the U.S. Army with a special order for 1,000 windows at $155. From the perspective of Clearview Window Company as a whole, should the special order be accepted or rejected? Why?

- e. Assume the same facts as in requirement (2d). Will an autonomous Glass Division manager accept or reject the special order? Why?

- f. Comment on any ethical issues you see in the questions raised in requirements (2d) and (2e).

- 3. Comment on the use of full cost as the basis for setting transfer prices.

1.

a)

Calculate the transfer price for window frames using the general rule by assuming that there is no excess capacity.

Explanation of Solution

Transfer price: The price charged for the goods and services transferred among the divisions are referred to as transfer price.

Calculate the transfer price for window frames using the general rule.

Thus, the transfer price using the general rule by assuming there is no excess capacity for window frames is $80.

1.

b)

Compute the transfer price based on the standard variable cost with a 10 percent mark-up.

Explanation of Solution

Compute the transfer price based on the standard variable cost with a 10 percent mark-up.

Thus, the transfer price based on the standard variable cost is $71.50.

2.

a.

Calculate the transfer price for window frames using the general rule by assuming that there is excess capacity.

Explanation of Solution

Calculate the transfer price for window frames using the general rule by assuming that there is excess capacity.

Thus, the transfer price using the general rule by assuming there is excess capacity for window frames is $65.

2.

b.

Explain the reasons for the difference in the requirements (1a) and (2a).

Explanation of Solution

As there is no excess capacity, the opportunity cost which is forgone is the contribution margin on an external sale if the frame is transferred to the Glass Division. Thus, the contribution margin equals to $15

2.

c.

Compute the transfer price based on the standard full costs plus a 10 percent mark-up.

Explanation of Solution

Step1: Calculate the fixed overhead per frame.

Step 2: Compute the transfer price based on the standard full costs plus a 10 percent mark-up.

Thus, the transfer price based on the standard full costs plus a 10 percent mark-up is $99.

2.

d.

Identify and explain the reasons whether the special order should be accepted or rejected.

Explanation of Solution

Calculate the incremental contribution per window in special order for Company CW.

| Particulars | Amount ($) | Amount ($) |

| Incremental revenue per window | 155 | |

| Incremental cost per window, for Company CW: | ||

| Direct material (Frame Division) | 15 | |

| Direct labor (Frame Division) | 20 | |

| Variable overhead (Frame Division) | 30 | |

| Direct material (Glass Division) | 30 | |

| Direct labor (Glass Division). | 15 | |

| Variable overhead (Glass Division) | 30 | |

| Total variable (incremental) cost | 140 | |

| Incremental contribution per window in special order for Company CW | $ 15 |

Table (1)

As incremental revenue exceeds the incremental cost for the Company CW. Thus, the Company CW should accept the special order.

2.

e.

Identify and explain the reasons whether the special order should be accepted or rejected by an autonomous Glass Division Manager.

Explanation of Solution

Calculate the incremental contribution per window in special order for Company CW.

| Particulars | Amount ($) | Amount ($) |

| Incremental revenue per window | 155 | |

| Incremental cost per window, for the Glass Division: | ||

| Transfer price for frame [from requirement 2(c)] | 99 | |

| Direct material (Glass Division) | 30 | |

| Direct labor (Glass Division) | 15 | |

| Variable overhead (Glass Division) | 30 | |

| Total incremental cost | 174 | |

| Incremental loss per window in special order for Glass Division | ($19) |

Table (1)

The autonomous Glass Division Manager can reject the special order as the Glass Division’s reported net income would be decreased $19 for each window that are given in the order.

2.

f.

Comment on the ethical issues that are raised in the requirements (2d) and (2e).

Explanation of Solution

The ethical issue in the requirements are the effects that a division manager should try to act within the best interests of the whole company, even if that action seemingly conflicts with the division’s best interests. In complicated transfer pricing situations, it is not always as clear that the company’s optimum action is as it is in this rather simple scenario.

3.

Comment on the usage of full cost as a basis for setting the transfer prices.

Explanation of Solution

The use of a transfer price based on the Frame Division's full cost has initiated a cost that is a fixed cost for the complete company to be seen as a variable cost in the Glass Division. This misrepresentation of the firm's true cost behaviour has resulted in an incentive for an improper decision to make by the Glass Division manager.

Want to see more full solutions like this?

Chapter 13 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- What amount should be reported on the balance sheet for inventory on these general accounting question?arrow_forwardprovide answerarrow_forwardOn January 1, 2015, Accounts Receivable was $37,000. Sales on account for 2015 totaled $196,000. The ending balance of Accounts Receivable was $66,000. What is the amount of cash collected from customers?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education