Find the degrees of freedom.

Obtain the critical value.

State the conclusion.

Answer to Problem 31CE

The degrees of freedom are 68.

The critical value is

The predictor ‘BachDeg%’ is significant.

Explanation of Solution

Calculation:

The given information is that, the dataset of ‘Noodles & Company Sales, Seating, and Demographic data’ contains

The formula for the test statistic for coefficient of predictor

Where,

The formula for degrees of freedom is,

Where, n is the total number of observations, k is the number of predictors.

Software procedure:

Step by step procedure to obtain test statistics using MegaStat software is given as,

- • Choose MegaStat >Correlation/Regression>Regression Analysis.

- • SelectInput ranges, enter the variable range for ‘Seats-Inside, Seats-Patio, MedIncome, MedAge, BachDeg%’ as the column of X, Independent variable(s)

- • Enter the variable range for ‘Sales/SqFt’ as the column of Y, Dependent variable.

- • Click OK.

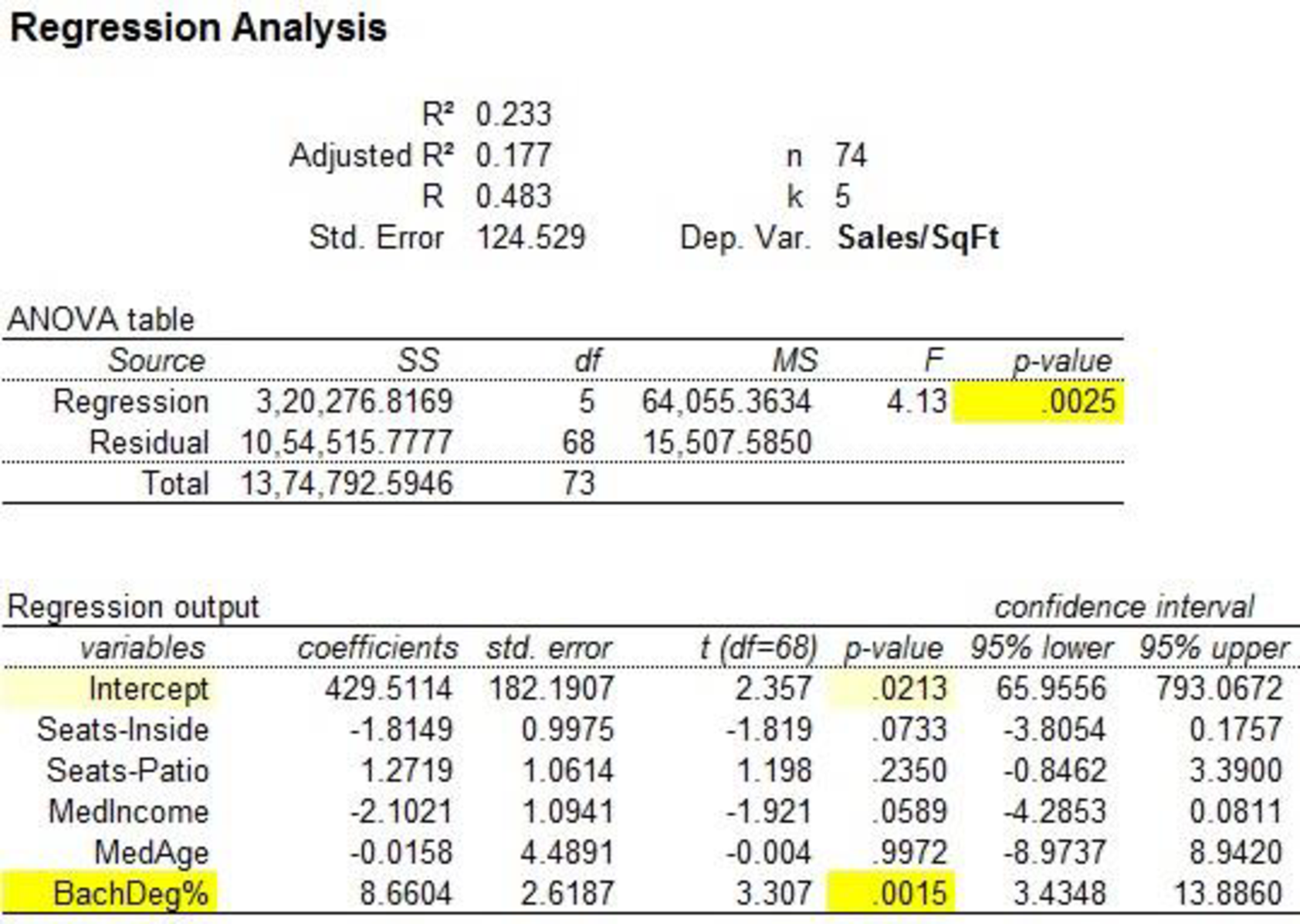

Output using MegaStatsoftware is given below:

The test statistic for predictor seats-inside is –1.819.

The test statistic for predictor seats-patio is 1.198.

The test statistic for predictor MedIncome is –1.921.

The test statistic for predictor MedAge is –0.004.

The test statistic for predictor BachDeg% is 3.307.

Substitute 74 for n, and 5 for k in the degrees of freedom formula.

The degrees of freedom are 68.

Software procedure:

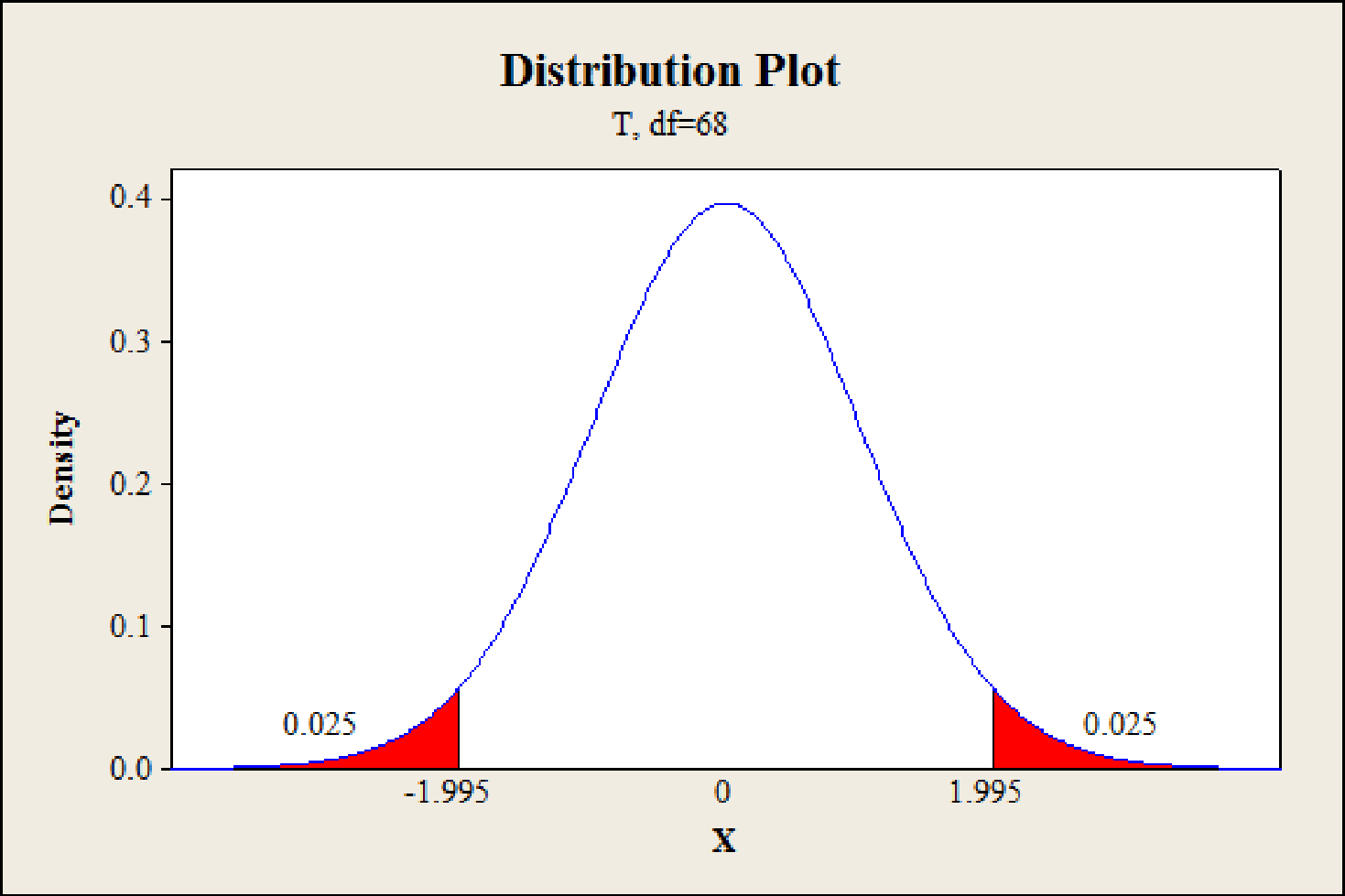

Step by step procedure to obtain the critical value using MINITAB software is given as,

- • Choose Graph > Probability Distribution Plot choose View Probability > OK.

- • From Distribution, choose ‘t’ distribution.

- • In Degrees of freedom, enter 68.

- • Click the Shaded Area tab.

- • Choose probability and Two Tail for the region of the curve to shade.

- • Enter the data value as 0.05.

- • Click OK.

The output of the software is,

Hence, the critical value for 68 degrees of freedom with 0.05, level of significance is

Decision rules:

- • If test statistic value lies between positive and negative critical value, then do not reject null hypothesis.

- • Otherwise, reject the null hypothesis.

Coefficient of Seats-Inside:

That is variable Seats-Inside is not related to Sales/SqFt.

Alternative hypothesis:

That is variable Seats-Inside is related to Sales/SqFt.

Conclusion:

The value of test statistic is –1.819.

The critical values are –1.995 and 1.995.

The test statistic value lies between positive and negative critical value.

That is,

Hence the null hypothesis is not rejected.

The predictor Seats-Inside is not significant.

Coefficient of Seats-Patio:

That is variable Seats-Patio is not related to Sales/SqFt.

Alternative hypothesis:

That is variable Seats-Patio is related to Sales/SqFt.

Conclusion:

The value of test statistic is 1.198.

The critical values are –1.995 and 1.995.

The test statistic value lies between positive and negative critical value.

That is,

Hence the null hypothesis is not rejected.

The predictor Seats-Patio is not significant.

Coefficient of MedIncome:

That is variable MedIncome is not related to Sales/SqFt.

Alternative hypothesis:

That is variable MedIncome is related to Sales/SqFt.

Conclusion:

The value of test statistic is –1.921.

The critical values are –1.995 and 1.995.

The test statistic value lies between positive and negative critical value.

That is,

Hence the null hypothesis is not rejected.

The predictor MedIncome is not significant.

Coefficient of MedAge:

That is variable MedAge is not related to Sales/SqFt.

Alternative hypothesis:

That is variable MedAge is related to Sales/SqFt.

Conclusion:

The value of test statistic is –0.004.

The critical values are –1.995 and 1.995.

The test statistic value lies between positive and negative critical value.

That is,

Hence the null hypothesis is not rejected.

The predictor MedAge is not significant.

Coefficient of BachDeg%:

That is variable BachDeg% is not related to Sales/SqFt.

Alternative hypothesis:

That is variable BachDeg% is related to Sales/SqFt.

Conclusion:

The value of test statistic is 3.307.

The critical values are –1.995 and 1.995.

The test statistic value is greater than the positive critical value.

The test statistic value does not lie between positive and negative critical value.

That is,

Hence the null hypothesis is rejected.

The predictor BachDeg% is significant.

Hence, the predictor BachDeg% significantly from zero at

Want to see more full solutions like this?

Chapter 13 Solutions

Applied Statistics in Business and Economics

- Q.3.2 A sample of consumers was asked to name their favourite fruit. The results regarding the popularity of the different fruits are given in the following table. Type of Fruit Number of Consumers Banana 25 Apple 20 Orange 5 TOTAL 50 Draw a bar chart to graphically illustrate the results given in the table.arrow_forwardQ.2.3 The probability that a randomly selected employee of Company Z is female is 0.75. The probability that an employee of the same company works in the Production department, given that the employee is female, is 0.25. What is the probability that a randomly selected employee of the company will be female and will work in the Production department? Q.2.4 There are twelve (12) teams participating in a pub quiz. What is the probability of correctly predicting the top three teams at the end of the competition, in the correct order? Give your final answer as a fraction in its simplest form.arrow_forwardQ.2.1 A bag contains 13 red and 9 green marbles. You are asked to select two (2) marbles from the bag. The first marble selected will not be placed back into the bag. Q.2.1.1 Construct a probability tree to indicate the various possible outcomes and their probabilities (as fractions). Q.2.1.2 What is the probability that the two selected marbles will be the same colour? Q.2.2 The following contingency table gives the results of a sample survey of South African male and female respondents with regard to their preferred brand of sports watch: PREFERRED BRAND OF SPORTS WATCH Samsung Apple Garmin TOTAL No. of Females 30 100 40 170 No. of Males 75 125 80 280 TOTAL 105 225 120 450 Q.2.2.1 What is the probability of randomly selecting a respondent from the sample who prefers Garmin? Q.2.2.2 What is the probability of randomly selecting a respondent from the sample who is not female? Q.2.2.3 What is the probability of randomly…arrow_forward

- Test the claim that a student's pulse rate is different when taking a quiz than attending a regular class. The mean pulse rate difference is 2.7 with 10 students. Use a significance level of 0.005. Pulse rate difference(Quiz - Lecture) 2 -1 5 -8 1 20 15 -4 9 -12arrow_forwardThe following ordered data list shows the data speeds for cell phones used by a telephone company at an airport: A. Calculate the Measures of Central Tendency from the ungrouped data list. B. Group the data in an appropriate frequency table. C. Calculate the Measures of Central Tendency using the table in point B. D. Are there differences in the measurements obtained in A and C? Why (give at least one justified reason)? I leave the answers to A and B to resolve the remaining two. 0.8 1.4 1.8 1.9 3.2 3.6 4.5 4.5 4.6 6.2 6.5 7.7 7.9 9.9 10.2 10.3 10.9 11.1 11.1 11.6 11.8 12.0 13.1 13.5 13.7 14.1 14.2 14.7 15.0 15.1 15.5 15.8 16.0 17.5 18.2 20.2 21.1 21.5 22.2 22.4 23.1 24.5 25.7 28.5 34.6 38.5 43.0 55.6 71.3 77.8 A. Measures of Central Tendency We are to calculate: Mean, Median, Mode The data (already ordered) is: 0.8, 1.4, 1.8, 1.9, 3.2, 3.6, 4.5, 4.5, 4.6, 6.2, 6.5, 7.7, 7.9, 9.9, 10.2, 10.3, 10.9, 11.1, 11.1, 11.6, 11.8, 12.0, 13.1, 13.5, 13.7, 14.1, 14.2, 14.7, 15.0, 15.1, 15.5,…arrow_forwardPEER REPLY 1: Choose a classmate's Main Post. 1. Indicate a range of values for the independent variable (x) that is reasonable based on the data provided. 2. Explain what the predicted range of dependent values should be based on the range of independent values.arrow_forward

- In a company with 80 employees, 60 earn $10.00 per hour and 20 earn $13.00 per hour. Is this average hourly wage considered representative?arrow_forwardThe following is a list of questions answered correctly on an exam. Calculate the Measures of Central Tendency from the ungrouped data list. NUMBER OF QUESTIONS ANSWERED CORRECTLY ON AN APTITUDE EXAM 112 72 69 97 107 73 92 76 86 73 126 128 118 127 124 82 104 132 134 83 92 108 96 100 92 115 76 91 102 81 95 141 81 80 106 84 119 113 98 75 68 98 115 106 95 100 85 94 106 119arrow_forwardThe following ordered data list shows the data speeds for cell phones used by a telephone company at an airport: A. Calculate the Measures of Central Tendency using the table in point B. B. Are there differences in the measurements obtained in A and C? Why (give at least one justified reason)? 0.8 1.4 1.8 1.9 3.2 3.6 4.5 4.5 4.6 6.2 6.5 7.7 7.9 9.9 10.2 10.3 10.9 11.1 11.1 11.6 11.8 12.0 13.1 13.5 13.7 14.1 14.2 14.7 15.0 15.1 15.5 15.8 16.0 17.5 18.2 20.2 21.1 21.5 22.2 22.4 23.1 24.5 25.7 28.5 34.6 38.5 43.0 55.6 71.3 77.8arrow_forward

- In a company with 80 employees, 60 earn $10.00 per hour and 20 earn $13.00 per hour. a) Determine the average hourly wage. b) In part a), is the same answer obtained if the 60 employees have an average wage of $10.00 per hour? Prove your answer.arrow_forwardThe following ordered data list shows the data speeds for cell phones used by a telephone company at an airport: A. Calculate the Measures of Central Tendency from the ungrouped data list. B. Group the data in an appropriate frequency table. 0.8 1.4 1.8 1.9 3.2 3.6 4.5 4.5 4.6 6.2 6.5 7.7 7.9 9.9 10.2 10.3 10.9 11.1 11.1 11.6 11.8 12.0 13.1 13.5 13.7 14.1 14.2 14.7 15.0 15.1 15.5 15.8 16.0 17.5 18.2 20.2 21.1 21.5 22.2 22.4 23.1 24.5 25.7 28.5 34.6 38.5 43.0 55.6 71.3 77.8arrow_forwardBusinessarrow_forward

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning