Teagan Fitzgerald is the owner of Newport Jewelry, a store specializing in gold, platinum, and special stones. During the past year, in response to increased demand, Teagan doubled her selling space by expanding into the vacant building space next door to her store. This expansion has been expensive because of the need to increase inventory and to purchase new store fixtures and equipment, including carpeting and state-of-the-art built-in fixtures. Teagan notes that the company’s cash position has gone down and she is worried about future demands on cash to finance the growth.

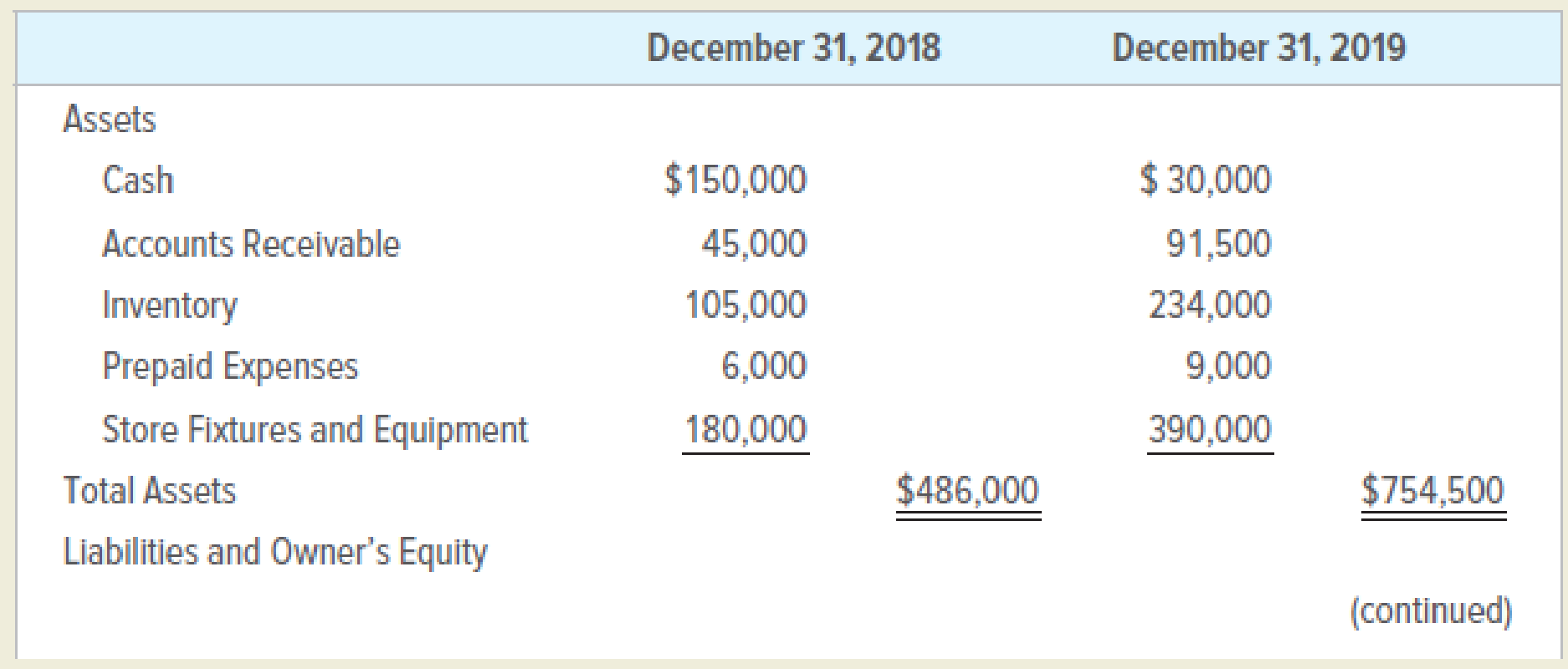

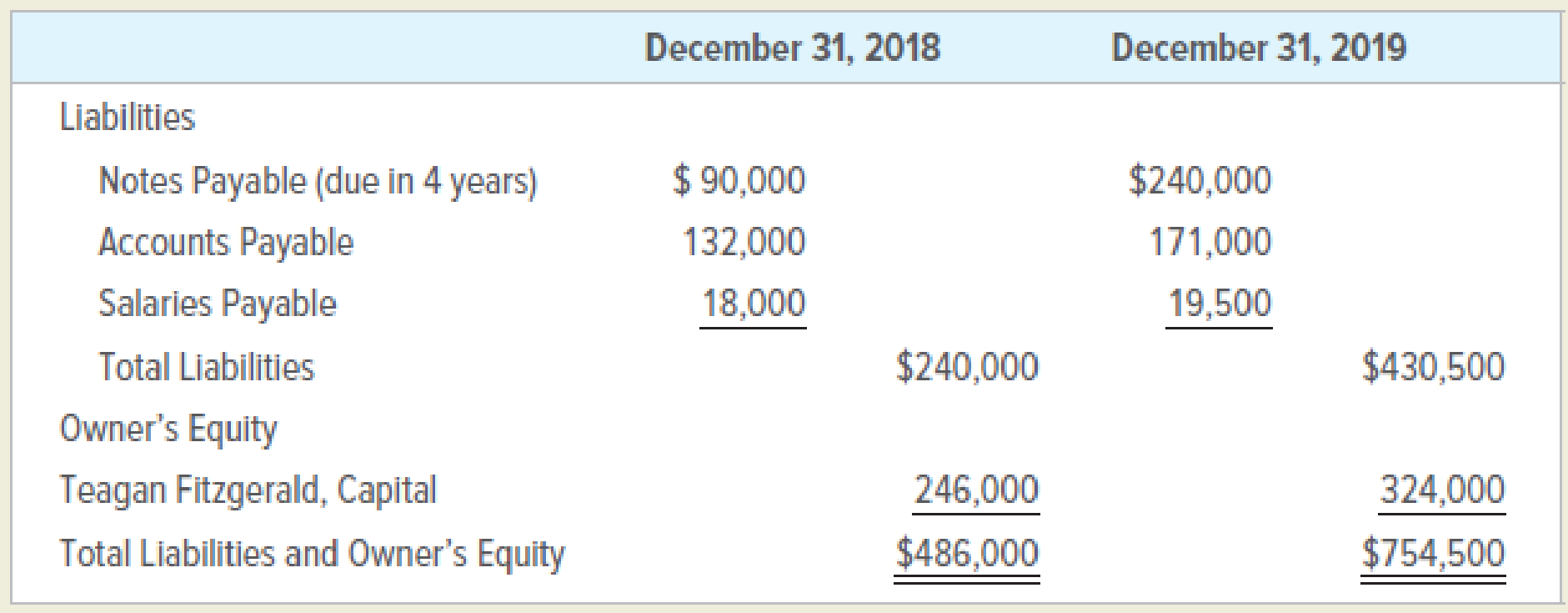

Teagan presents you with a statement showing the assets, liabilities, and her equity for year-end 2018 and 2019, and asks your opinion on the company’s ability to pay for the recent expansion. She did not have income and expense data available at the time. She commented that she had not made any new investment in the business in the past two years and was not financially able to do so presently. The information presented is shown below:

INSTRUCTIONS

- 1. Prepare classified balance sheets for Newport Jewelry for December 31, 2018, and December 31, 2019. (Ignore

depreciation. ) - 2. Based on the information presented in the classified balance sheets, what is your opinion of Newport Jewelry’s ability to pay its current bills in a timely manner?

- 3. What is the advantage of a classified

balance sheet over a balance sheet that is not classified?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College