Concept explainers

Obtain all data that is necessary from the worksheet prepared for Healthy Eating Foods Company in Problem 12.5A at the end of Chapter 12. Then follow the instructions to complete this problem.

INSTRUCTIONS

- 1. Record

adjusting entries in the general journal as of December 31, 2019. Use 25 as the first journal page number. Include descriptions for the entries. - 2. Record closing entries in the general journal as of December 31, 2019. Include descriptions.

- 3. Record reversing entries in the general journal as of January 1, 2020. Include descriptions.

Analyze: Assuming that the firm did not record a reversing entry for salaries payable, what entry is required when salaries of $6,000 are paid on January 3?

Problem 12.5A

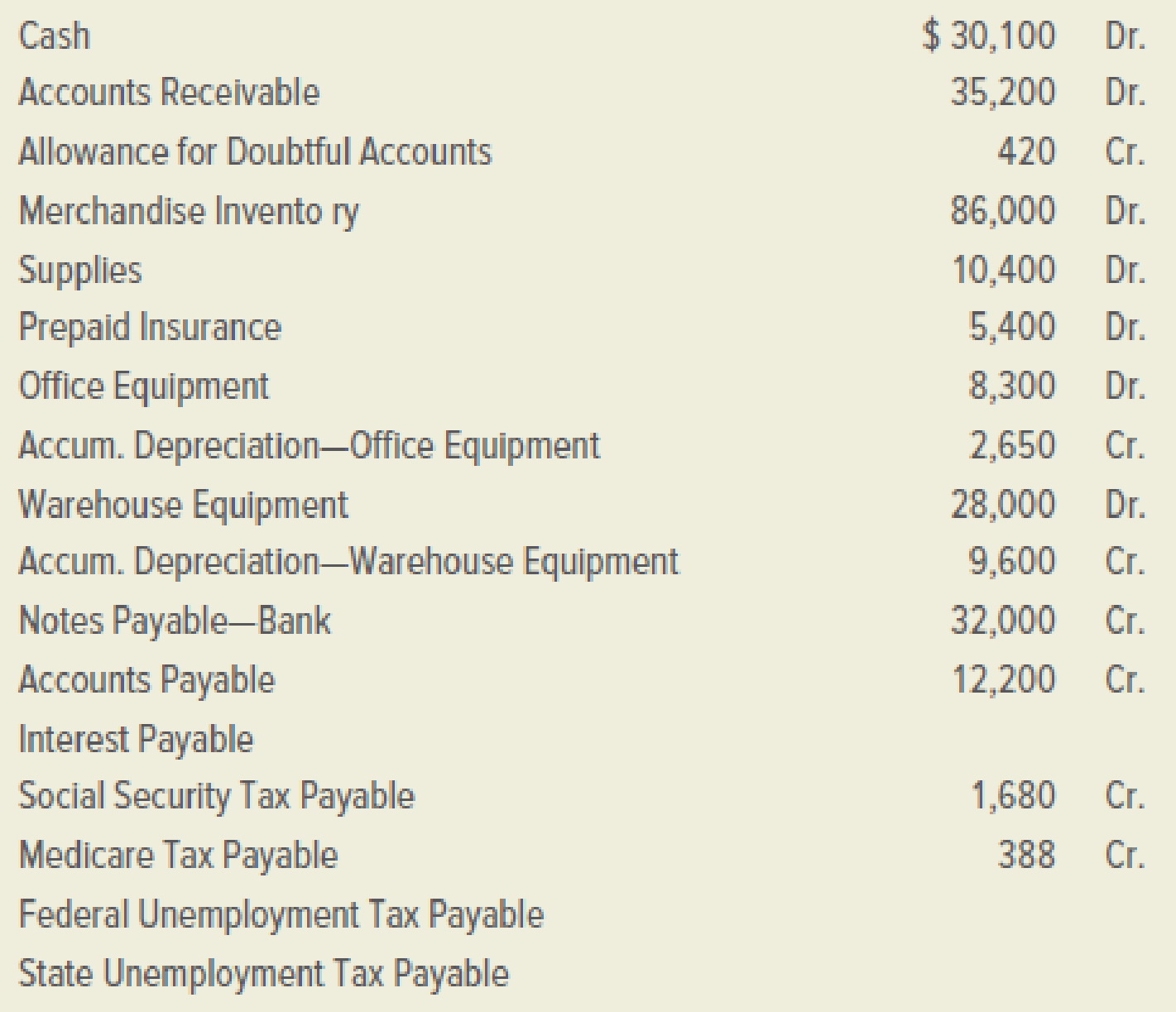

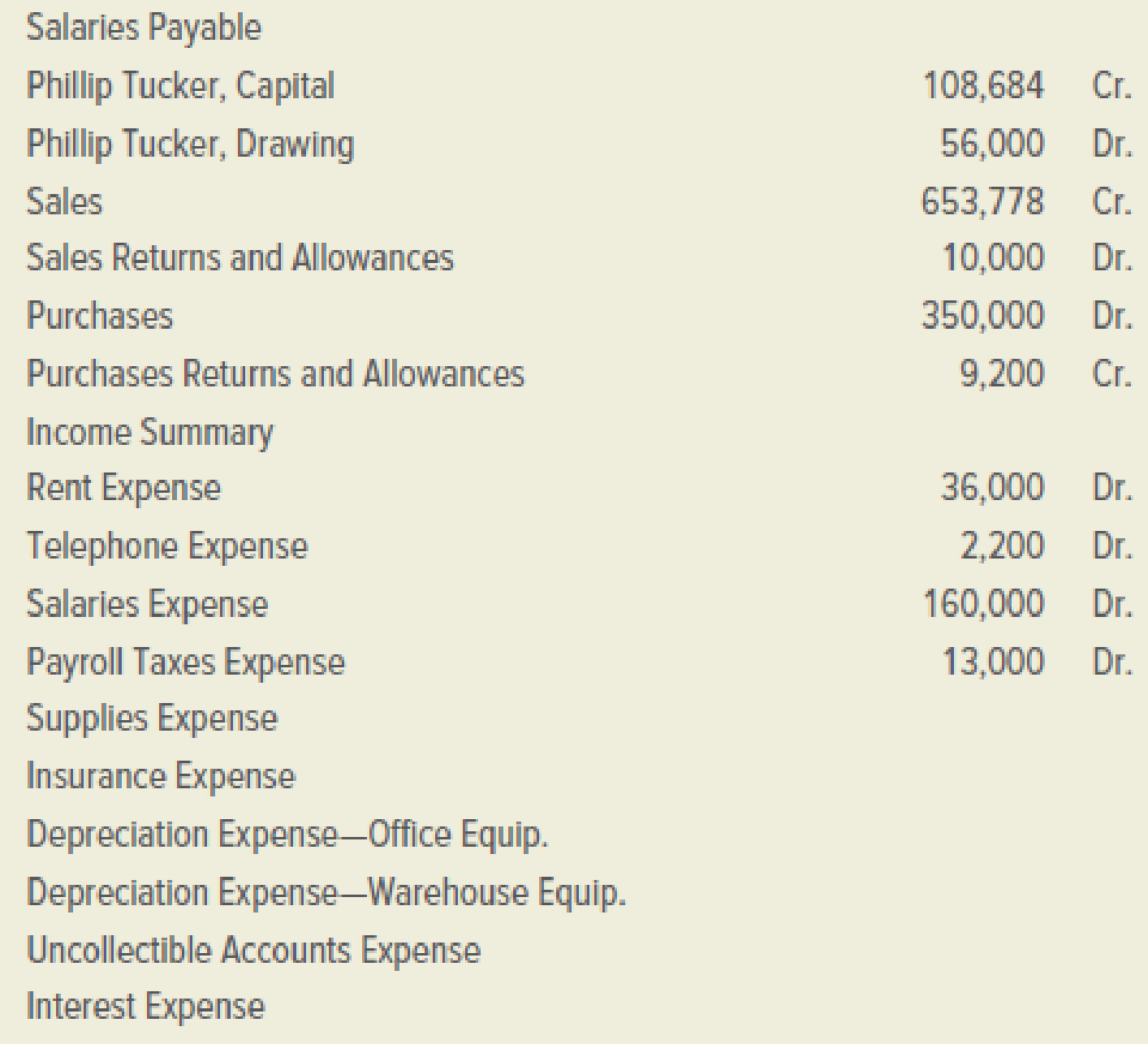

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 2019, the firm’s general ledger contained the accounts and balances that follow.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

Note: This problem will be required to complete Problem 13.4A in Chapter 13.

ACCOUNTS AND BALANCES

ADJUSTMENTS

a.–b. Merchandise inventory on December 31, 2019, is $78,000.

c. During 2019, the firm had net credit sales of $560,000; past experience indicates that 0.5 percent of these sales should result in uncollectible accounts.

d. On December 31, 2019, an inventory of supplies showed that items costing $1,180 were on hand.

e. On May 1, 2019, the firm purchased a one-year insurance policy for $5,400.

f. On January 2, 2017, the firm purchased office equipment for $8,300. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $350.

g. On January 2, 2017, the firm purchased warehouse equipment for $28,000. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,000.

h. On November 1, 2019, the firm issued a four-month, 12 percent note for $32,000.

i. On December 31, 2019, the firm owed salaries of $5,000 that will not be paid until 2020.

j. On December 31, 2019, the firm owed the employer’s social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,000 of accrued wages.

k. On December 31, 2019, the firm owed the federal

Analyze: When the financial statements for Healthy Eating Foods Company are prepared, what net income will be reported for the period ended December 31, 2019?

1.

Journalize the adjusting entries as on December 31, 2019.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Pass the adjusting entry for the given transaction:

| General Journal | Page - 25 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $86,000 | ||

| Merchandise Inventory | $86,000 | |||

| (To record the beginning inventory) | ||||

| December 31 | Merchandise Inventory | $78,000 | ||

| Income Summary | $78,000 | |||

| (To record the closing inventory) | ||||

| December 31 | Uncollectible Accounts Expense | $2,800 | ||

| Allowance for Doubtful Accounts | $2,800 | |||

| (To record the estimated loss on the net credit sale) | ||||

| December 31 | Supplies Expense | $9,220 | ||

| Supplies | $9,220 | |||

| (To record the Supplies used) |

Table (1)

| General Journal | Page - 26 | |||

| Date | Description | Post Ref. | Debit | Credit |

| 2019 | ||||

| December 31 | Insurance expense | $3,600 | ||

| Prepaid Insurance | $3,600 | |||

| (To record the prepaid insurance) | ||||

| December 31 | Depreciation Expense - Office Equipment | $1,325 | ||

| Accumulated Depreciation - Office Equipment | $1,325 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Depreciation Expense - Warehouse Equipment | $4,800 | ||

| Accumulated Depreciation - Warehouse Equipment | $4,800 | |||

| (To record the depreciation on equipment) | ||||

| December 31 | Interest expense | $640 | ||

| Interest Payable | $640 | |||

| (To record the interest payable) | ||||

| December 31 | Salaries Expense | $5,000 | ||

| Salaries Payable | $5,000 | |||

| (To record the salaries payable) | ||||

| December 31 | Payroll Taxes Expense | $682.50 | ||

| Federal Unemployment Tax Payable | $30.00 | |||

| State Unemployment Tax Payable | $270.00 | |||

| Social Security Tax Payable | $310.00 | |||

| Medicare Tax Payable | $72.50 | |||

| (To record the taxes on accrued wages) |

Table (2)

2.

Journalize the closing entries as on December 31, 2019.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Pass the closing entries:

| General Journal | Page - 27 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Sales | $653,778 | ||

| Purchases Returns and allowances | $9,200 | |||

| Income Summary | $662,978 | |||

| (To record the closing entry for the income) | ||||

| December 31 | Income Summary | $55,710 | ||

| PT Capital | $55,710 | |||

| (To record the closing entry for the capital) | ||||

| December 31 | PT Capital | $56,000 | ||

| PT Drawings | $56,000 | |||

| (To record the closing entry for the capital) |

Table (3)

| General Journal | Page - 28 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2019 | ||||

| December 31 | Income Summary | $599,267.50 | ||

| Sales Returns and Allowances | $10,000 | |||

| Purchases | $350,000 | |||

| Rent Expense | $36,000 | |||

| Telephone Expense | $2,200 | |||

| Salaries Expense | $165,000 | |||

| Payroll Taxes Expense | $13,682.50 | |||

| Supplies Expense | $9,220 | |||

| Insurance expense | $3,600 | |||

| Depreciation Expense - Office Equipment | $1,325 | |||

| Depreciation Expense - Warehouse Equipment | $4,800 | |||

| Uncollectible Accounts Expense | $2,800 | |||

| Interest Expense | $640 | |||

| (To record the closing entry for the expenses) |

Table (4)

3.

Journalize the reversing entries as on January 1, 2020 and identify the journal entry to be passed if Salaries are paid on January 3, 2020.

Explanation of Solution

Reversing entries: Reversing entries are those entries which are recorded at the beginning of the year, to reverse or set right the adjusting entries made in the end of the previous accounting year, in order to maintain the records according to accrual basis principle.

Pass the reversing entries:

| General Journal | Page - 29 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 1 | Interest Payable | $640 | ||

| Interest Expense | $640 | |||

| (To record the reversing entry for interest payable) | ||||

| January 1 | Salaries Payable | $5,000 | ||

| Salaries Expense - Office | $5,000 | |||

| (To record the reversing entry for salaries payable) | ||||

| January 1 | Social Security Tax Payable | $310.00 | ||

| Medicare Tax Payable | $72.50 | |||

| Federal Unemployment Tax Payable | $30.00 | |||

| State Unemployment Tax Payable | $270.00 | |||

| Payroll Taxes Expense | $682.50 | |||

| (To record the reversing entry for payroll taxes payable) |

Table (5)

| General Journal | Page - 30 | |||

| Date | Description | Post Ref | Debit | Credit |

| 2020 | ||||

| January 3 | Salaries Payable | $5,000 | ||

| Salaries Expense | $1,000 | |||

| Cash | $6,000 | |||

| (To record the payment of salaries ignoring the payroll taxes) |

Table (6)

Want to see more full solutions like this?

Chapter 13 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- Assume Bright Cleaning Service had a net income of $300 for the year. The company's beginning total assets were $4,500, and ending total assets were $4,100. Calculate Bright Cleaning Service's Return on Assets (ROA). A. 6.50% B. 7.25% C. 6.98% D. 5.80%arrow_forwardwhat is the investment turnover?arrow_forwardA California-based company had a raw materials inventory of $135,000 on December 31, 2022, and $115,000 on December 31, 2023. During 2023, the company purchased $160,000 worth of raw materials, incurred direct labor costs of $230,000, and manufacturing overhead costs of $340,000. What is the total manufacturing cost incurred by the company? A. $720,000 B. $750,000 C. $705,000 D. $735,000arrow_forward

- PLEASE HELP WITH THIS PROBLEM. ALL RED CELLS ARE EMPTY OR INCORRECT.arrow_forwardSuppose during 2023, BlueStar Shipping reported the following financial information (in millions): Net Sales: $40,000 Net Income: $150 Total Assets at Beginning of Year: $26,000 • Total Assets at End of Year: $24,800 Calculate the following: (a) Asset Turnover (b) Return on Assets (ROA) as a percentagearrow_forwardprovide correct answer accounting questionarrow_forward

- Kubin Company’s relevant range of production is 11,000 to 14,000 units. When it produces and sells 12,500 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 7.20 Direct labor $ 4.20 Variable manufacturing overhead $ 1.70 Fixed manufacturing overhead $ 5.20 Fixed selling expense $ 3.70 Fixed administrative expense $ 2.70 Sales commissions $ 1.20 Variable administrative expense $ 0.70 Required: For financial accounting purposes, what is the total product cost incurred to make 12,500 units? For financial accounting purposes, what is the total period cost incurred to sell 12,500 units? For financial accounting purposes, what is the total product cost incurred to make 14,000 units? For financial accounting purposes, what is the total period cost incurred to sell 11,000 units?arrow_forwardChoose a manufacturing company then discuss the following: First, name your company and list its main products and direct materials used. What is spoilage? Give an example of spoilage that might occur during the manufacturing of the company's product. What is scrap? Give an example of scrap that might occur during the manufacturing of the company's product. What does rework mean? Give an example of rework that might occur during the manufacturing of the company's product. A leading manufacturer recently said, "What has been regarded as normal spoilage in the past will not acceptable as normal spoilage in the future? What are they talking about? What do you think are the external or internal factors that may affect the level of normal spoilage in the future?arrow_forwardThe accounting equation helps keep financial records balanced. It shows that a company's assets are always equal to its liabilities plus stockholders' equity (Assets = Liabilities + Equity). This equation helps track how money moves in and out of a business. When a company buys or sells something, the equation makes sure everything is recorded correctly. Respond to the above paragrapharrow_forward

- What is the role of the accounting equation in the analysis of business transactions?arrow_forwardExplain how this theory can help individuals in at least two fields (business, medical, education, etc.) better work in intercultural settings. Define the theory based on credible sources. Discuss the development of the theory: how it originated and came to its current status. Evaluate your scholarly sources, providing a brief comment on the theoretical aspects of each. Discuss the link(s) between your chosen theory and career field. Discuss the implications of your case on individuals, society, and the public. How does an increased intercultural understanding affect these different groups? In 8-10 pages in length. The paper should include support for the topic, your analyses and position(s) by citing course readings, and include at least five credible sources that you chose for your annotated bibliography. A credible source is defined as: a scholarly or peer-reviewed journal articlearrow_forwardwhich one is correct option?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning