Concept explainers

Target service costs, value engineering, activity-based costing. Lagoon is an amusement park that offers family-friendly entertainment and attractions. The park boasts more than 25 acres of fun. The admission price to enter the park, which includes access to all attractions, is $35. To earn the required rate of

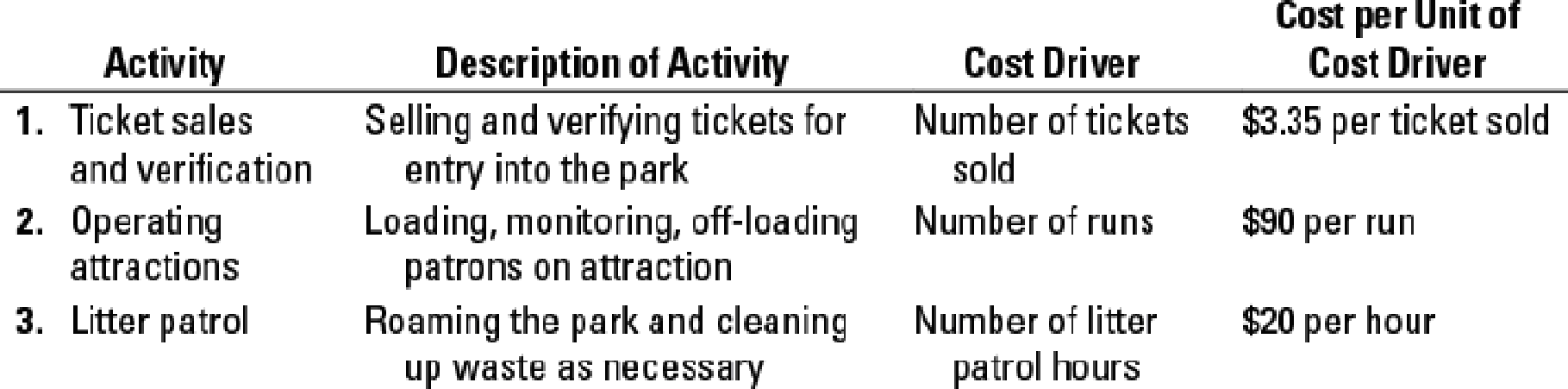

The following information describes the existing operations:

- a. The average number of patrons per week is 55,000.

- b. The total number of runs across all attractions is 11,340 runs each week.

- c. It requires 1,750 hours off litter patrol hours to keep the park clean.

In response to competitive pressures and to continue to attract 55,000 patrons per week, Lagoon has decided to lower ticket prices to $33 per patron. To maintain the same level of profits as before, Lagoon is looking to make the following changes to reduce operating costs:

- a. Reduce the cost of selling and verifying tickets by $0.35 per ticket sold.

- b. Reduce the total number of runs across all attractions by 1,000 runs by reducing the operating hours of some of the attractions that are not very popular.

- c. Increase the number of refuse containers in the park at an additional cost of $250 per week. This will decrease the litter patrol hours by 20%.

The cost per unit of cost driver for all other activities will remain the same.

- 1. Will Lagoon achieve its target operating income of 35% of revenues at ticket prices of $35 per ticket before any operating changes?

- 2. After Lagoon reduces ticket prices and makes the changes and improvements described above, will Lagoon achieve its target operating income in dollars calculated in requirement 1? Show your calculations.

- 3. What challenges might managers at Lagoon encounter in achieving the target cost? How might they overcome these challenges?

- 4. A new carbon tax of $3 per run is proposed to be levied on the energy consumed to operate the attractions. Will Lagoon achieve its target operating income calculated in requirement 1? If not, by how much will Lagoon have to reduce its costs through value engineering to achieve the target operating income calculated in requirement 1?

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

COST ACCOUNTING

- General Accounting questionarrow_forwardProvide answer general Accountingarrow_forwardCompare and contrast experiences you have had with your own and other people’s monochromic time orientation and polychronic time orientation and how you can account for any differences in time orientation in your workplace communications in the future.arrow_forward

- Your career is expanding with an opportunity to support your company's growth in a non-U.S. country. Choose a country that you believe is a viable expansion option. Support your choice for this country by learning about the country's political, economic, and legal system. Share this information with your classmates by summarizing how these areas would contribute to the successful expansion project.arrow_forwardPlease given correct answer general accountingarrow_forwardAnswer? ? Financial accounting questionarrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning