Concept explainers

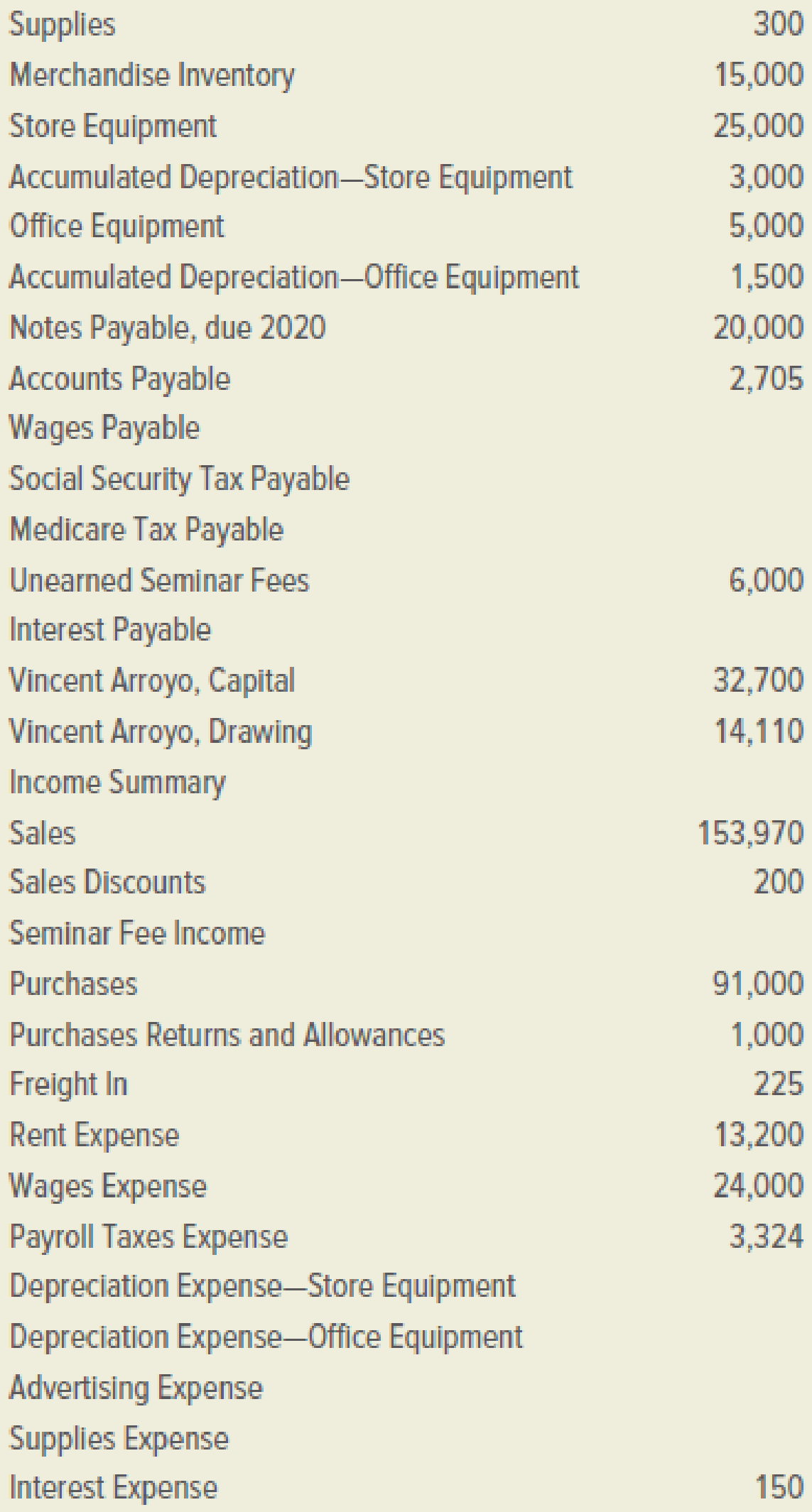

The Artisan Wines is a retail store selling vintage wines. On December 31, 2019, the firm’s general ledger contained the accounts and balances below. All account balances are normal.

INSTRUCTIONS:

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

ADJUSTMENTS:

a.–b. Merchandise inventory at December 31, 2019, was counted and determined to be $13,000.

c. The amount recorded as prepaid advertising represents $480 paid on September 1, 2019, for 12 months of advertising.

d. The amount of supplies on hand at December 31 was $160.

e. Depreciation on store equipment was $3,000 for 2019.

f. Depreciation on office equipment was $1,125 for 2019.

g. Unearned seminar fees represent $6,000 received on November 1, 2019, for six seminars. At December 31, four of these seminars had been conducted.

h. Wages owed but not paid at December 31 were $500.

i. On December 31, 2019, the firm owed the employer’s social security tax ($31.00) and Medicare tax ($7.25).

j. The note payable bears interest at 6 percent per annum. One month’s interest is owed at December 31, 2019.

Analyze: What was the amount of revenue earned by conducting seminars during the year ended December 31, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

- Fixed selling costs arearrow_forwardResult of the distribution?arrow_forwardStanley Woodworks manufactures wooden cabinets and can either make or buy a specific cabinet door component. The cost to manufacture the component is $12 for direct materials, $9 for direct labor, and $11 for variable overhead. Additionally, a supervisor is required to oversee production of the component at an annual salary cost of $60,000. If Stanley Woodworks requires 120,000 components per year, the maximum purchase price per unit they should consider paying is $__. Answer thisarrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning