Concept explainers

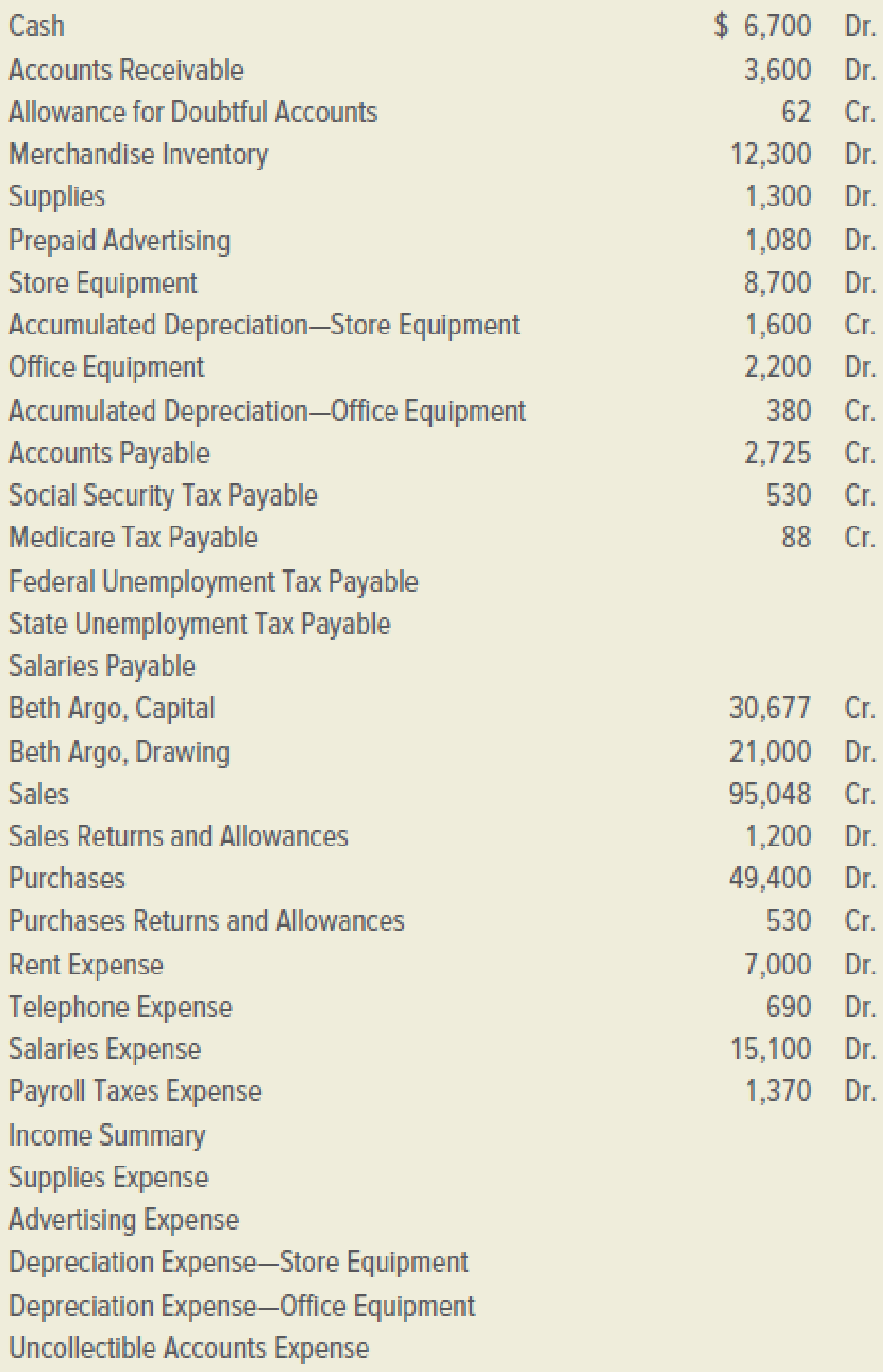

The Green Thumb Gardener is a retail store that sells plants, soil, and decorative pots. On December 31, 2019, the firm’s general ledger contained the accounts and balances that appear below.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments below in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

ACCOUNTS AND BALANCES

ADJUSTMENTS

a.–b. Merchandise inventory on December 31, 2019, is $13,321.

c. During 2019, the firm had net credit sales of $45,000; the firm estimates that 0.5 percent of these sales will result in uncollectible accounts.

d. On December 31, 2019, an inventory of the supplies showed that items costing $325 were on hand.

e. On October 1, 2019, the firm signed a six-month advertising contract for $1,080 with a local newspaper and paid the full amount in advance.

f. On January 2, 2018, the firm purchased store equipment for $8,700. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $700.

g. On January 2, 2018, the firm purchased office equipment for $2,200. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $300.

h. On December 31, 2019, the firm owed salaries of $1,930 that will not be paid until 2020.

i. On December 31, 2019, the firm owed the employer’s social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $1,930 of accrued wages.

j. On December 31, 2019, the firm owed federal

Analyze: By what amount were the assets of the business affected by adjustments?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning