Concept explainers

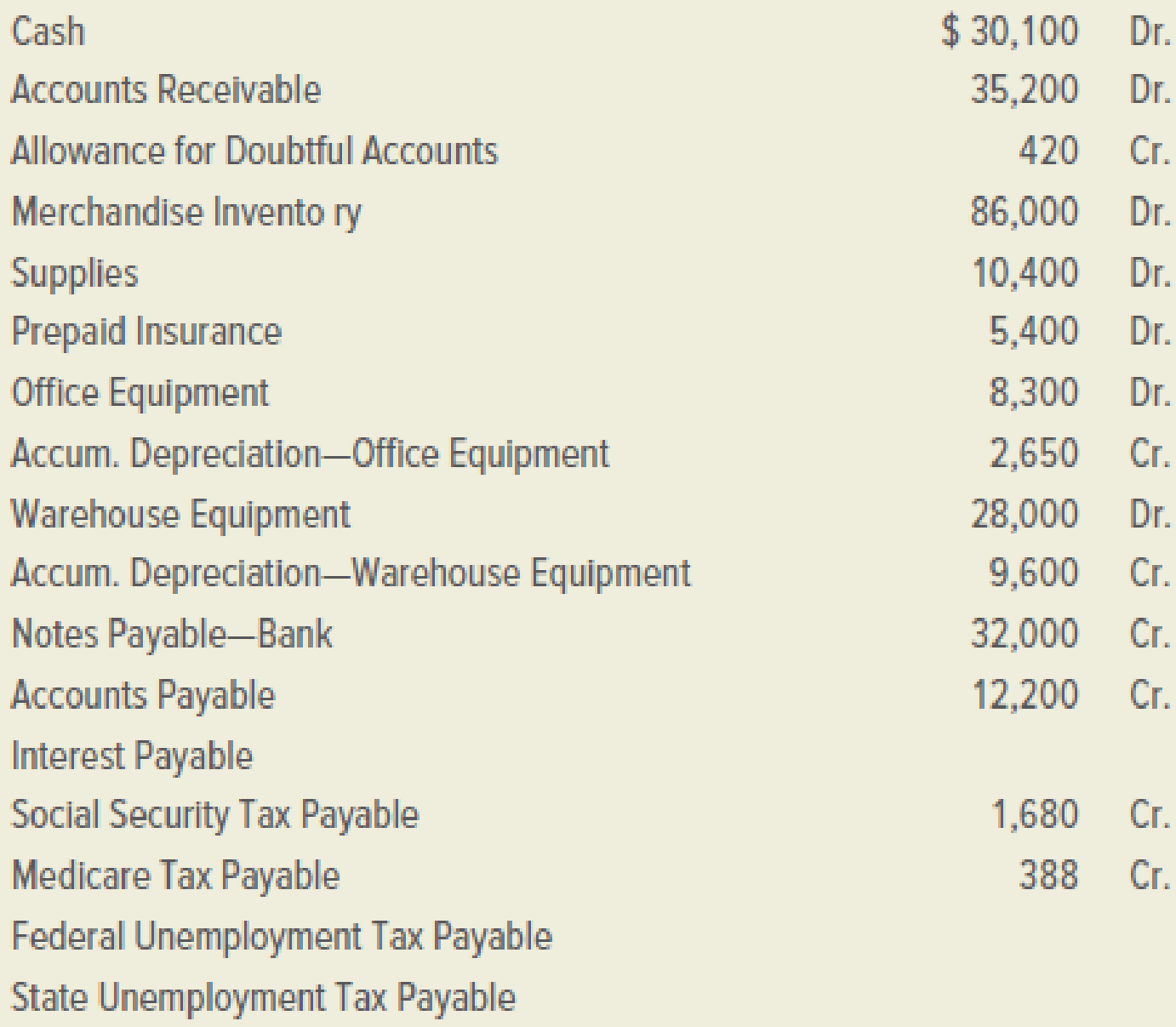

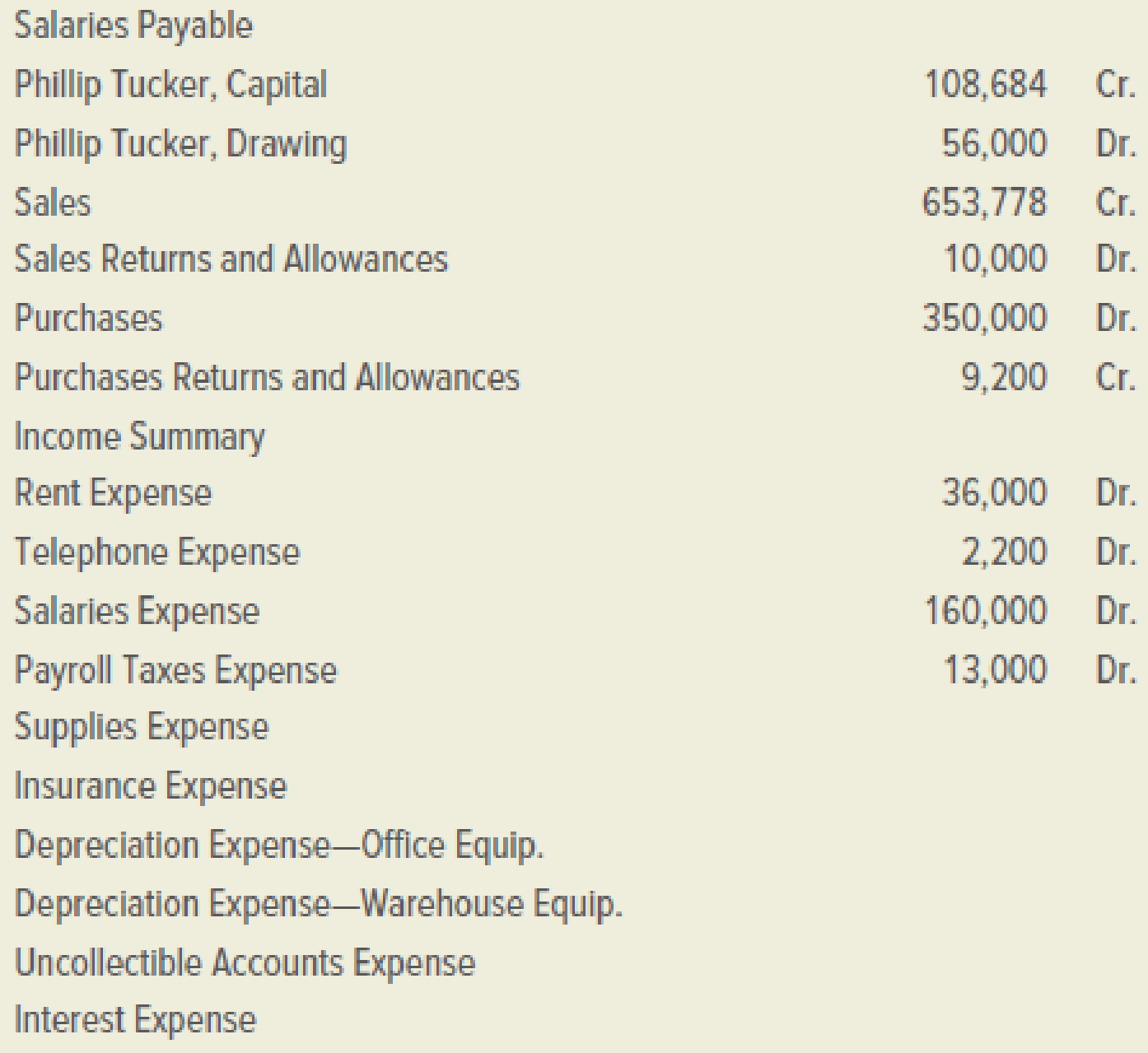

Healthy Eating Foods Company is a distributor of nutritious snack foods such as granola bars. On December 31, 2019, the firm’s general ledger contained the accounts and balances that follow.

INSTRUCTIONS

- 1. Prepare the

Trial Balance section of a 10-column worksheet. The worksheet covers the year ended December 31, 2019. - 2. Enter the adjustments in the Adjustments section of the worksheet. Identify each adjustment with the appropriate letter.

- 3. Complete the worksheet.

Note: This problem will be required to complete Problem 13.4A in Chapter 13.

ACCOUNTS AND BALANCES

ADJUSTMENTS

a.–b. Merchandise inventory on December 31, 2019, is $78,000.

c. During 2019, the firm had net credit sales of $560,000; past experience indicates that 0.5 percent of these sales should result in uncollectible accounts.

d. On December 31, 2019, an inventory of supplies showed that items costing $1,180 were on hand.

e. On May 1, 2019, the firm purchased a one-year insurance policy for $5,400.

f. On January 2, 2017, the firm purchased office equipment for $8,300. At that time, the equipment was estimated to have a useful life of six years and a salvage value of $350.

g. On January 2, 2017, the firm purchased warehouse equipment for $28,000. At that time, the equipment was estimated to have a useful life of five years and a salvage value of $4,000.

h. On November 1, 2019, the firm issued a four-month, 12 percent note for $32,000.

i. On December 31, 2019, the firm owed salaries of $5,000 that will not be paid until 2020.

j. On December 31, 2019, the firm owed the employer’s social security tax (assume 6.2 percent) and Medicare tax (assume 1.45 percent) on the entire $5,000 of accrued wages.

k. On December 31, 2019, the firm owed the federal

Analyze: When the financial statements for Healthy Eating Foods Company are prepared, what net income will be reported for the period ended December 31, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

GEN COMBO COLLEGE ACCOUNTING; CONNECT ACCESS CARD

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT