Concept explainers

Exercise 4-5A Allocating

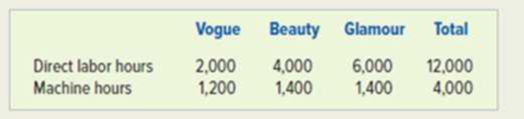

Tyson Hats Corporation manufactures three different models of hats: Vogue. Beauty, and Glamour. Tyson expects to incur $480,000 of overhead cost during the next fiscal year. Other budget information follows:

Required

a. Use direct labor hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

b. Use machine hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

c. Describe a set of circumstances where it would be more appropriate to use direct labor hours as the allocation base.

d. Describe a set of circumstances where it would be more appropriate to use machine hours as the allocation base.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Survey Of Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning