Concept explainers

Problem 4-18A Selecting an appropriate cost driver (What is the base?)

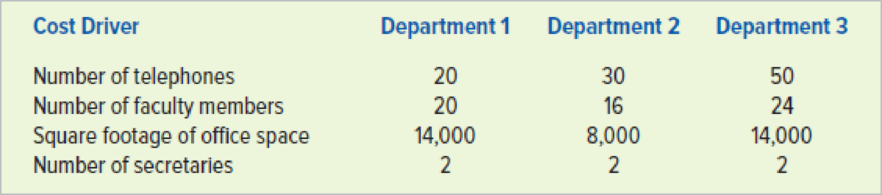

The Huffman School of Vocational Technology has organized the school training programs into three departments. Each department provides training in a different area as follows: nursing assistant, dental hygiene, and office technology. The school’s owner, Amy Huffman, wants to know how much it costs to operate each of the three departments. To accumulate the total cost for each department, the accountant has identified several indirect costs that must be allocated to each. These costs are $12,000 of phone expense, $21,000 of office supplies, $900,000 of office rent, $144,000 of janitorial services, and $150,000 of salary paid to the dean of students. To provide a reasonably accurate allocation of costs, the accountant has identified several possible cost drivers. These drivers and their association with each department follow:

Required

- a. Identify the appropriate cost objects.

- b. Identify the appropriate cost driver for each indirect cost and compute the allocation rate for assigning each indirect cost to the cost objects.

- c. Determine the amount of telephone expense that should be allocated to each of the three departments.

- d. Determine the amount of supplies expense that should be allocated to Department 3.

- e. Determine the amount of office rent that should be allocated to Department 2.

- f. Determine the amount of janitorial services cost that should be allocated to Department 1.

- g. Identify two cost drivers not listed here that could be used to allocate the cost of the dean’s salary to the three departments.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Survey Of Accounting

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardKFC Industries estimates direct labor costs and manufacturing overhead costs for the upcoming year to be $920,000 and $740,000, respectively. KFC allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 23,000 hours and 9,250 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) Help with this questionarrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardJeel Corporation projected current year sales of 45,000 units at a unit sale price of $32.00. Actual current year sales were 48,500 units at $34.50 per unit. Actual variable costs, budgeted at $22.50 per unit, totaled $21.75 per unit. Budgeted fixed costs totaled $375,000, while actual fixed costs amounted to $392,000. What is the sales volume variance for total revenue?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning