Concept explainers

Harvey Company produces two models of blenders: the “Super Model” (priced at $400) and the “Special Model” (priced at $200). Recently, Harvey has been losing market share with its Special Model because of competitors offering blenders with the same quality and features but at a lower price. A careful market study revealed that if Harvey could reduce the price of its Special Model to $180, it would regain its former share of the market. Management, however, is convinced that any price reduction must be accompanied by a cost reduction of the same amount so that per-unit profitability is not affected. Earl Wise, company controller, has indicated that poor

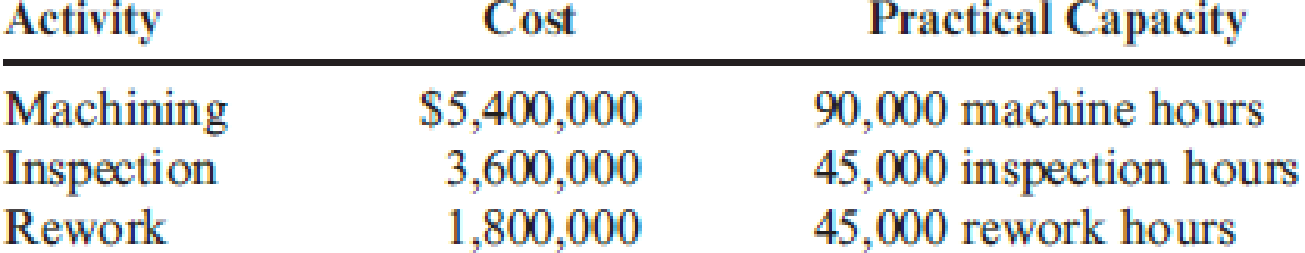

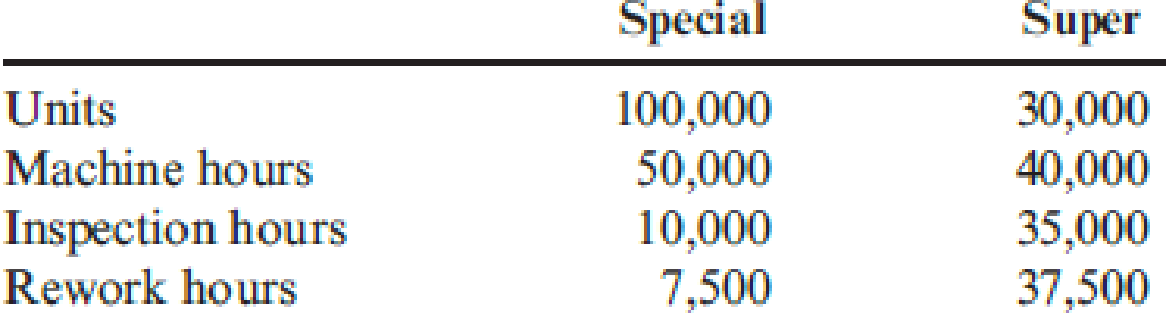

The consumption patterns of the two products are as follows:

Harvey assigns overhead costs to the two products using a plantwide rate based on machine hours.

Required:

- 1. Calculate the unit overhead cost of the Special Model using machine hours to assign overhead costs. Now, repeat the calculation using ABC to assign overhead costs. Did improving the accuracy of cost assignments solve Harvey’s competitive problem? What did it reveal?

- 2. Now, assume that in addition to improving the accuracy of cost assignments, Earl observes that defective supplier components are the root cause of both the inspection and rework activities. Suppose further that Harvey has found a new supplier that provides higher-quality components such that inspection and rework costs are reduced by 50 percent. Now, calculate the cost of the Special Model (assuming that inspection and rework times are also reduced by 50 percent) using ABC. The relative consumption patterns also remain the same. Comment on the difference between ABC and ABM.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Get correct answer general accounting questionsarrow_forwardWhat is tikki's ROE for 2008 ?arrow_forward1. I want to know how to solve these 2 questions and what the answers are 1. Solar industries has a debt-to-equity ratio of 1.25. Its WACC is 7.8%, and its cost of debt is 4.7%. The corporate tax rate is 21%. a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c. What would be the cost of equity if the D/E ratio were 2? What if it were 1? 2. Therap software company is trying to determine its optimal capital structure. The company’s current capital structure consists of 35% debt and 65% common equity; however, the treasurer believes that the firm should use more debt. Currently, the company’s cost of equity capital is 9%, which is determined by CAPM. What would be Therap’s estimated cost of equity capital if they change their capital structure to 50% debt? Risk-free rate is 3%, market index returns 11%, and the Therap’s tax rate is 25%.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning