Concept explainers

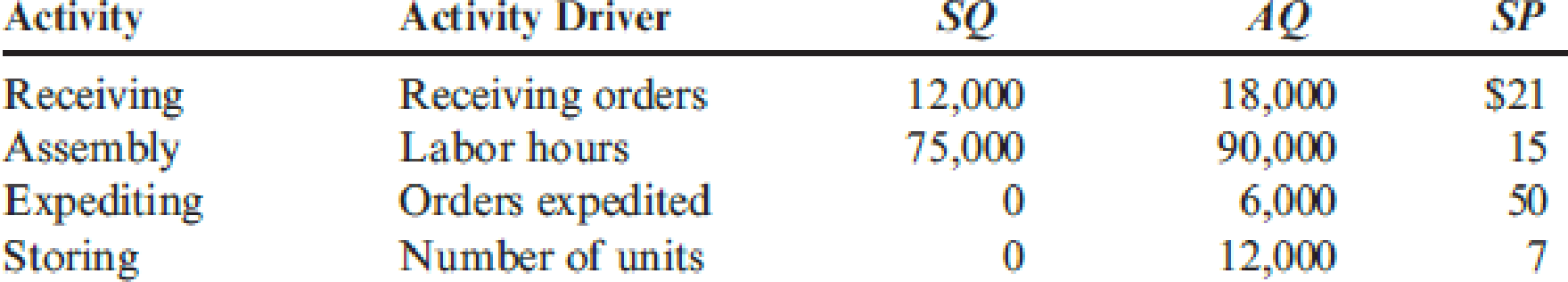

Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price):

Required:

- 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity.

- 2. Explain why expediting products and storing goods are non-value-added activities.

- 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?

1.

Construct a cost report for C Company showing the value-added, non-value cost and total cost of each activity.

Explanation of Solution

Value-added cost: A value added cost is the cost incurred by the business to perform the value added activities in order to achieve optimum efficiency in their operations. Value-added costs are calculated using the following formula.

Non-value added cost: A non-value added cost is the cost incurred by a business on non-value added activities that adds to the total cost of the business but does not contribute to the required efficiency. Non-value-added costs are calculated using the following formula.

Prepare a cost report of C Company showing the value-added, non-value added and total cost of each activity of C Company.

| Value and non-value added | |||

| Cost report of C Company | |||

| Activity |

Value-Added cost ($) |

Non-value Added cost ($) |

Total Cost ($) |

| Receiving | 252,000 (1) | 126,000(3) | 378,000(7) |

| Assembly | 1,125,000(2) | 225,000(4) | 1,350,000(8) |

| Expediting | 0 | 300,000(5) | 300,000(9) |

| Storing | 0 | 84,000(6) | 84,000(10) |

| Total | 1,377,000 | 735,000 | 2,112,000 |

Table (1)

Working notes:

(1) Compute the value-added cost of receiving activity of C Company.

(2) Compute the value-added cost of assembly activity of C Company.

(3) Compute the non-value-added cost of receiving activity of C Company.

(4) Compute the non-value-added cost of assembling activity of C Company.

(5) Compute the non-value-added cost of expediting activity of C Company.

(6) Compute the non-value-added cost of storing activity of C Company.

(7) Compute the total cost of receiving activity of C Company.

(8) Compute the total cost of assembling activity of C Company.

(9) Compute the total cost of expediting activity of C Company.

(10) Compute the total cost of storing activity of C Company.

2.

Give reasons for the activity of expediting products and storing goods being catagorized as non-value added activities.

Explanation of Solution

Both expediting aand storing activities are actually unnecessary activities that consume resource without influencing any change in the quality and customer perspective of the product.

3.

Explain the implications for reducing the cost of waste for reach activity assuming receiving cost is a step-fixed cost with each step being 1,500 orders and assembly cost is a variable cost.

Explanation of Solution

For receiving activities, cost reduction can only be made when the actual demand for receiving orders is reduced by each block of 1,500 orders. In the case of assembly activities, each hour that is saved produce a saving of $15. As a result, reduction in spending can benefit better for assembly activity than for receiving activity.

Want to see more full solutions like this?

Chapter 12 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Jiminy Cricket Co. has a five-day workweek (Monday through Friday). Employees earn $1,420 per day. If the month ends on Wednesday, with wages paid on Friday, how much wage expense should be accrued on Wednesday? a. $1,500 b. $1,560 c. $2,530 d. $1,050 e. $4,260arrow_forwardMy Company has a predetermined overhead rate of 179% of direct labor cost. Estimated overhead for the period was $300,000. The actual cost for direct labor was $268,000 and the actual overhead was $309,000. How much overhead was applied? How much was over-or under-applied overhead?arrow_forwardJiminy Cricket Co. has a five-day workweek (Monday through Friday). Employees earn $1,420 per day. If the month ends on Wednesday, with wages paid on Friday, how much wage expense should be accrued on Wednesday? a. $1,500 b. $1,560 c. $2,530 d. $1,050 e. $4,260need answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub