Engineering Economy, Student Value Edition (17th Edition)

17th Edition

ISBN: 9780134838137

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 3P

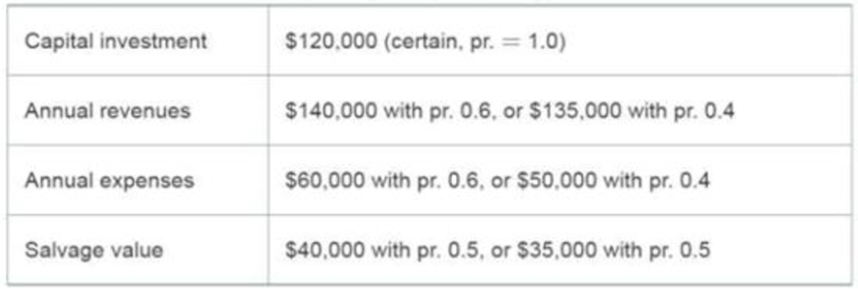

A new snow making machine utilizes technology that permits snow to be produced in ambient temperature of 70 degrees Fahrenheit or below. The estimated cash flows for the ski resort contemplating this investment are uncertain as shown below (note: pr. = probability).

The machine is expected to have a useful life of 12 years, and the MARR of the ski resort is 8% per year. What is the expected present worth of this investment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Asap please

not use ai plesea

Question 20

Economic value added is used to

O measure the company's profits

None of the above

measure the company's sales

measure the company's expenses

D Question 21

Chapter 12 Solutions

Engineering Economy, Student Value Edition (17th Edition)

Ch. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - A new snow making machine utilizes technology that...Ch. 12 - Prob. 4PCh. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Prob. 8PCh. 12 - Prob. 9PCh. 12 - Prob. 10P

Ch. 12 - Prob. 11PCh. 12 - Prob. 12PCh. 12 - Prob. 13PCh. 12 - Prob. 14PCh. 12 - Prob. 15PCh. 12 - Prob. 16PCh. 12 - Prob. 17PCh. 12 - Prob. 18PCh. 12 - Prob. 19PCh. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - If the interest rate is 8% per year, what decision...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26SE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- and u (C1, C2) = 1/2 = f) Derive analytically and show graphically the solution under other util- ity functions such as u (C1, C2) ac₁+bc2 where a, b > 0, u (C1, C2) = ac₁+bc1/2 acbc2 (assume that the agent is sufficiently rich to avoid the corner solution). What of these utility functions reflects best your own preferences (or indicate other utility function that represent your pref- erences).arrow_forwardnot use ai please don'tarrow_forwardnot use ai pleasearrow_forward

- Please give me true answer this financial accounting questionarrow_forwardnot use aiarrow_forwardExplain if any states are not a “friendly” place for tax preparers, payday lenders, title pawn lenders, and “credit approved” used car dealers to operate in and what they have done, regulation-wise.arrow_forward

- Explain the regulation or lack of regulation of payday lenders, title pawn lenders, and “credit-approved” used car dealers in Alabama.arrow_forwardExplain why people should avoid the business model of payday lenders, title pawn lenders, and “credit approved” used car dealers.arrow_forwardExplain why people fall prey to payday lenders, title pawn lenders, and “credit-approved” used car dealers.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License