Concept explainers

NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFat’s controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)—a toxic waste cleanup company—offered to buy 10,000 pounds of olestra from NoFat during December for a price of $2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that “This is another way to use our expensive olestra plant!”

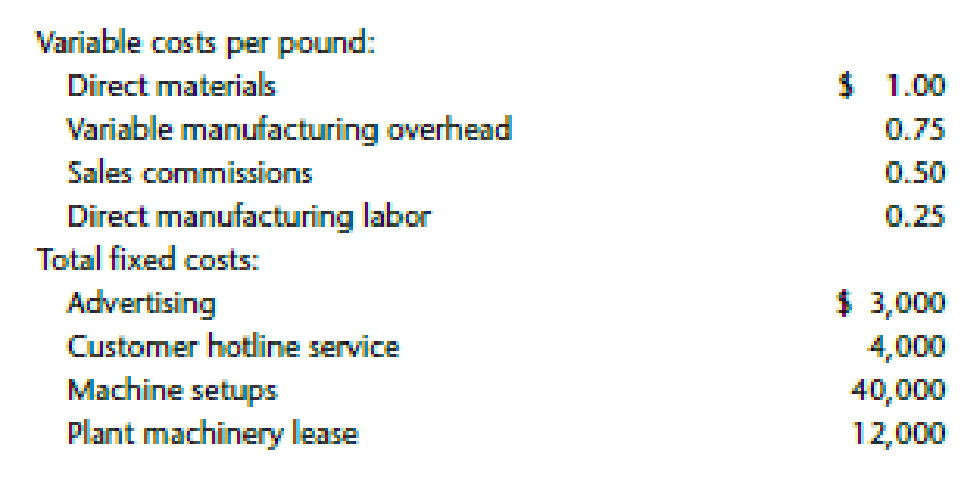

The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows:

In addition, Allyson met with several of NoFat’s key production managers and discovered the following information:

- The special order could be produced without incurring any additional marketing or customer service costs.

- NoFat owns the aging plant facility that it uses to manufacture olestra.

- NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year.

- NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra.

- PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the $1,000 cost of the inspection team.

Based solely on financial factors, explain why NoFat should accept or reject PU’s special sales offer.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Degregorio Corporation makes a product that uses a material with the following direct material standards: Standard quantity 2.7 kilos per unit Standard price $9 per kilo The company produced 5,700 units in November using 15,760 kilos of the material. During the month, the company purchased 17,830 kilos of direct material at a total cost of $156,904. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for November is: a. $3,330 F b. $3,236 F c. $3,330 U d. $3,236 Uarrow_forwardNonearrow_forwardGeneral Accountarrow_forward

- Financial accountingarrow_forwardSubject: Financial Accountingarrow_forwardThe blending department had the following data for the month of March: Units in BWIP Units completed 7,200 Units in EWIP (40% complete) 750 $27,000 Total manufacturing costs Required: 1. What is the output in equivalent units for March? 2. What is the unit manufacturing cost for March?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning