Concept explainers

NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFat’s controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)—a toxic waste cleanup company—offered to buy 10,000 pounds of olestra from NoFat during December for a price of $2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that “This is another way to use our expensive olestra plant!”

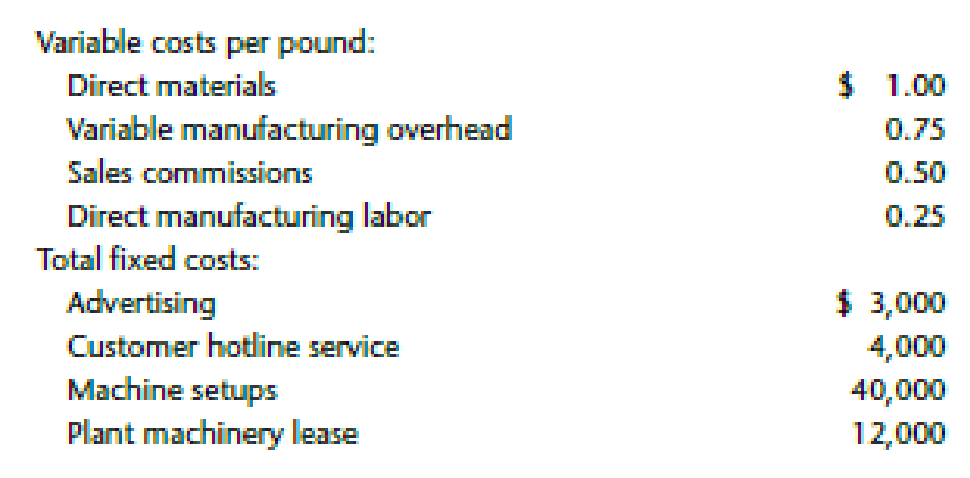

The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows:

In addition, Allyson met with several of NoFat’s key production managers and discovered the following information:

- The special order could be produced without incurring any additional marketing or customer service costs.

- NoFat owns the aging plant facility that it uses to manufacture olestra.

- NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year.

- NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra.

- PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the $1,000 cost of the inspection team.

Assume for this question that Allyson’s relevant analysis reveals that NoFat would earn a positive relevant profit of $10,000 from the special sale (i.e., the special sales alternative). However, after conducting this traditional, short-term relevant analysis, Allyson wonders whether it might be more profitable over the long term to downsize the company by reducing its manufacturing capacity (i.e., its plant machinery and plant facility). She is aware that downsizing requires a multiyear time horizon because companies usually cannot increase or decrease fixed plant assets every year. Therefore, Allyson has decided to use a 5-year time horizon in her long-term decision analysis. She has identified the following information regarding capacity downsizing (i.e., the downsizing alternative):

- The plant facility consists of several buildings. If it chooses to downsize its capacity, NoFat can immediately sell one of the buildings to an adjacent business for $30,000.

- If it chooses to downsize its capacity, NoFat’s annual lease cost for plant machinery will decrease to $9,000.

Therefore, Allyson must choose between these two alternatives: Accept the special sales offer each year and earn a $10,000 relevant profit for each of the next 5 years or reject the special sales offer and downsize as described above.

Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all

- a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of $10,000 per year (i.e., the special sales alternative).

- b. Calculate the NPV of downsizing capacity as previously described (i.e., the downsizing alternative).

- c. Based on the NPV of Requirements 5a and 5b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- need help this ouestionarrow_forwardAns plzarrow_forwardPROBLEM A Sabio, as her original investment in the firm of Sabio and Mariano, contributed equipment that had been recorded in the books of her own business as costing P900,000, with accumulated depreciation of P620,000. The partners agreed on a valuation of P400,000. They also agreed to accept Sabio's accounts receivable of P360,000, realizable or collectible to the extent of 85%. Required: 1. Prepare the journal entry: a. To adjust Sabio's assets b. To close Sabio's books c. To record Sabio's investment to the partnership PROBLEM B On March 1, 2025, Gogola and Paglinawan formed a partnership. Gogola contributed cash of P1,260,000 and computer equipment that cost P540,000. The fair value of the computer is P360,000. Gogola has notes payable on the computer of P120,000 to be assumed by the partnership. Gogola is to have 60% capital interest in the partnership. Paglinawan contributed cash amounting to P900,000. The partners agreed to share profit and loss equally. Required: 1. Prepare…arrow_forward

- York Manufacturing uses a standard cost system. • • Standard direct labor requirement: 1.8 direct labor hours per unit Standard labor rate: $12 per hour Actual production: 15,000 units during the year Direct labor costs incurred: $322,200 for 28,600 hours Compute the Direct Labor Efficiency Variance.arrow_forwardHello tutor solve this question accountingarrow_forwardGeM Industries' common stock is currently selling for $72.15 per share. Last year, the company paid dividends of $1.25 per share. The projected growth rate of dividends for this stock is 4.85%. What rate of return does an investor expect to receive on this stock if it is purchased today?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning