Concept explainers

NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFat’s controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)—a toxic waste cleanup company—offered to buy 10,000 pounds of olestra from NoFat during December for a price of $2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that “This is another way to use our expensive olestra plant!”

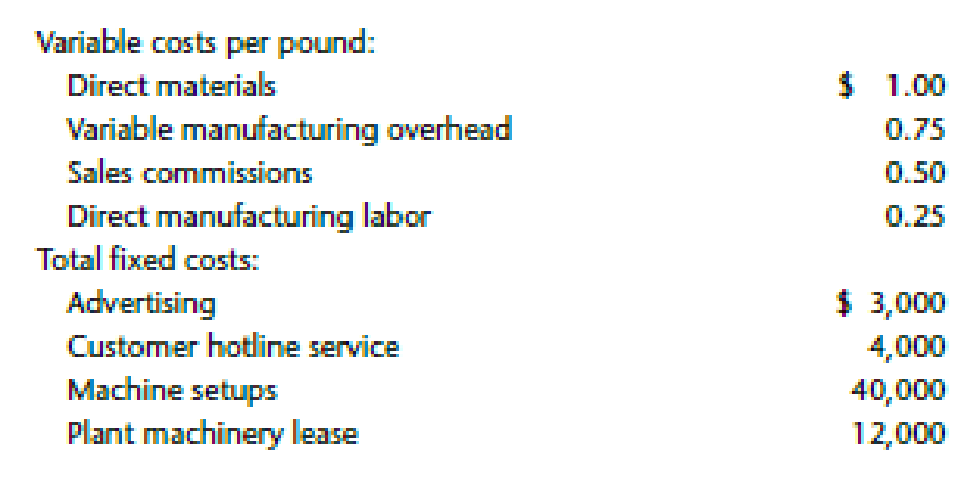

The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows:

In addition, Allyson met with several of NoFat’s key production managers and discovered the following information:

- The special order could be produced without incurring any additional marketing or customer service costs.

- NoFat owns the aging plant facility that it uses to manufacture olestra.

- NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year.

- NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra.

- PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the $1,000 cost of the inspection team.

Assume for this question that NoFat rejected PU’s special sales offer because the $2.20 price suggested by PU was too low. In response to the rejection, PU asked NoFat to determine the price at which it would be willing to accept the special sales offer. For its regular sales, NoFat sets prices by marking up variable costs by 10%.

If Allyson decides to use NoFat’s 10% markup pricing method to set the price for PU’s special sales offer,

- a. Calculate the price that NoFat would charge PU for each pound of olestra.

- b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its markup pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.)

- c. Explain why NoFat should accept or reject the special sales offer if it uses its markup pricing method to set the special sales price.

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Hi expertarrow_forwardA gourmet coffee shop currently sells 25,000 premium coffee cups annually at an average price of $5 each. It is considering adding a budget-friendly coffee option that sells for $3 each. The shop estimates it can sell 10,000 cups of the budget-friendly coffee, but by doing so, it will sell 4,000 fewer cups of the premium coffee. What is the total sales revenue that should be used when evaluating the addition of the budget-friendly coffee? A) $139,000 B) $142,000 C) $131,000 D) $135,000 E) $148,000arrow_forward??!arrow_forward

- Tokyo's Juice Bar operates a fresh juice stand at a local shopping center. Each juice requires 3/4 pound of mixed fruits, which are expected to cost $4 per pound during the summer months. Shop employees are paid $8 per hour. Variable overhead consists of utilities and supplies, and the variable overhead rate is $0.09 per minute of direct labor (DL) time. Each juice should require 4 minutes of direct labor time. 1. What is the standard cost of direct materials for each juice? 2. What is the standard cost of direct labor for each juice? 3. What is the standard cost of variable overhead for each juice?arrow_forwardNeed answerarrow_forwardRina's Trikes, Inc. reported a debt-to-equity ratio of 1.81 times at the end of 2022. If the firm's total debt at year-end was $9.00 million, how much equity does Rina's Trikes have?{Financial Accounting 5 PTS} A. $16.29 million B. $4.97 million C. $9.00 million D. $1.81 millionarrow_forward

- In 2019, a company reported sales revenue of Landon Manufacturing Company produced 2,000 units of inventory in March 2023. It expects to produce an additional 18,000 units during the remaining nine months of the year, resulting in an estimated total production of 20,000 units for 2023. The direct materials and direct labor costs per unit are $72 and $60, respectively. The company expects to incur the following manufacturing overhead costs for the 2023 accounting period: ⚫ Production supplies: $12,000 • Supervisor salary: $200,000 Depreciation on equipment: $80,000 ⚫ Utilities: $25,000 . Rental fee on manufacturing facilities: $55,000 a. Combine the individual overhead costs into a cost pool and calculate a predetermined overhead rate assuming the cost driver is the number of units. b. Determine the total cost of the 2,000 units produced in March.arrow_forwardGeneral accounting questionarrow_forwardwhat is the equity at the end of the year?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning