Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 18P

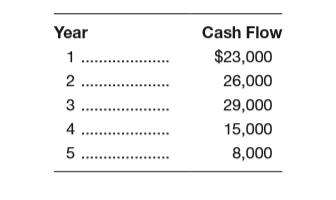

The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is

a. If the cost of capital is 13 percent, what is the

b. What is the

c. Should the project be accepted? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Project Mean Green has an initial after-tax cost of $500,000. The project is expected to produceafter-tax CFs of $100,000 at the end of each year for the next five years and has a WACC of10%.There’s a 20% probability that the project’s growth opportunities will have an NPV of $3million at t=5, and a 80% probability that the NPV will be -1.2 million at t=5.Is it feasible for the company to expand the project after 5 years?

plase show work

Project panther has an initial after-tax cost of $150,000 at t=0. The project is expected toproduce after-tax cash flows of $60,000 for the next three years. The project’s WACC is 12%.The project’s CFs depend critically upon customer’s acceptance of the product. There’s a 50%probability that the product will be successful and generate annual after-tax CFs of $100,000,and a 50% probability that it will not be successful and hence produce annual after-tax CFs of-$10,000.Should the company abandon the project after a year?

a. A semi-annual bond with a face value of $1,000 has an annual coupon rate of 8%. If 23days have passed since the last coupon payment, how much will be the accrued interest onthe bond? What will be invoice price if the bond is selling at its par value?b. What will be the invoice price if the bond is a discount bond with a yield to maturity(YTM) of 9% and a maturity of 7 years?

please show work.

Chapter 12 Solutions

Foundations of Financial Management

Ch. 12 - Prob. 1DQCh. 12 - Why does capital budgeting rely on analysis of...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - What does the term mutually exclusive investments...Ch. 12 - Prob. 6DQCh. 12 - If a corporation has projects that will earn more...Ch. 12 - What is the net present value profile? What three...Ch. 12 - How does an asset’s ADR (asset depreciation...Ch. 12 - Prob. 1P

Ch. 12 - Prob. 2PCh. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Al Quick, the president of a New York Stock...Ch. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Assume a 90,000 investment and the following cash...Ch. 12 - Prob. 9PCh. 12 - X-treme Vitamin Company is considering two...Ch. 12 - You buy a new piece of equipment for 16,230, and...Ch. 12 - Prob. 12PCh. 12 - Home Security Systems is analyzing the purchase of...Ch. 12 - Aerospace Dynamics will invest 110,000 in a...Ch. 12 - The Horizon Company will invest 60,000 in a...Ch. 12 - Skyline Corp. will invest 130,000 in a project...Ch. 12 - The Hudson Corporation makes an investment of ...Ch. 12 - The Pan American Bottling Co. is considering the...Ch. 12 - You are asked to evaluate the following two...Ch. 12 - Turner Video will invest 76,344 in a project. The...Ch. 12 - The Suboptimal Glass Company uses a process of...Ch. 12 - Keller Construction is considering two new...Ch. 12 - Davis Chili Company is considering an investment...Ch. 12 - Prob. 25PCh. 12 - Assume 65,000 is going to be invested in each of...Ch. 12 - The Summit Petroleum Corporation will purchase an...Ch. 12 - Oregon Forest Products will acquire new equipment...Ch. 12 - Prob. 29PCh. 12 - Prob. 30PCh. 12 - Prob. 31PCh. 12 - Prob. 32PCh. 12 - Prob. 33PCh. 12 - Prob. 2WECh. 12 - Returning to TXN’s summary page, record the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- a. Krannert Inc. issues a bond with a coupon rate of 7% and a YTM of 10%. If the bond isselling for $815.66, what is the maturity of the bond?b. How much would the bond be selling for if it was a quarterly bond with a maturity of 6years?arrow_forwardTravis just won a lottery which gives him a choice between the following two paymentoptions:a. He will receive a one-time payment of $100,000 right now, ORb. He will receive $10,000 every year for the next 20 years.Which option Travis should go for? Suppose the interest rate is 5%. please show work.arrow_forwardProject Falcon has an upfront after-tax cost of $100,000. The project is expected to produceafter-tax cash flows of $35,000 at the end of each of the next four years. The project has aWACC of 11%.However, if the company waits a year, they will find out more information about marketcondition and its effect on the project’s expected after-tax cash flows. If they wait a year,• There’s a 60% chance that the market will be strong and the expected after-tax CFs willbe $45,000 a year for four years.• There’s a 40% chance that the market will be weak and the expected after-tax CFs willbe $25,000 a year for four years.• Project’s initial after-tax cost (at t=1) will still be $100,000.Should the company go ahead with the project today or wait for one more year? please show work.arrow_forward

- Make a report on Human Resource Development Practices in Nepalese Private Sector Business Industries.arrow_forwardEccles Inc., a zero-growth firm, has an expected EBIT of $100.000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. If the effective personal tax rates on debt income and stock income are Td = 25% and TS = 20% respectively, what is the value of the firm according to the Miller model (Based on the same unlevered firm value in the earlier question)? a. $475,875 b. $536,921 c. $587,750 d. $623,050 e. $564,167arrow_forwardRefer to the data for Eccles Inc. earlier. If the effective personal tax rates on debt income and stock income are Td = 25% and TS = 20% respectively, what is the value of the firm according to the Miller model (Based on the same unlevered firm value in the earlier question)? a. $475,875 b. $536,921 c. $587,750 d. $623,050 O $564,167arrow_forward

- Warren Supply Inc. wants to use debt and common equity for its capital budget of $800,000 in the coming year, but it will not issue any new common stock. It is forecasting an EPS of $3.00 on its 500,000 outstanding shares of stock and is committed to maintaining a $2.00 dividend per share. Given these constraints, what percentage of the capital budget must be financed with debt? a. 33.84% b. 37.50% c. 32.15% d. 30.54% e. 35.63%arrow_forwardEccles Inc., a zero-growth firm, has an expected EBIT of $100.000 and a corporate tax rate of 30%. Eccles uses $500,000 of 12.0% debt, and the cost of equity to an unlevered firm in the same risk class is 16.0%. What is the firm's cost of equity according to MM with corporate taxes? Ο 32.0% Ο 25.9% Ο 21.0% Ο 28.8% Ο 23.3%arrow_forwardP&L Corporation wants to sell some 20-year, annual interest, $1,000 par value bonds. Its stock sells for $42 per share, and each bond would have 75 warrants attached to it each exercisable into one share of stock at an exercise price of $47. The firm's straight bonds yield 10%. Each warrant is expected to have a market value of $2.00 given that the stock sells for $42. What coupon interest rate must the company set on the bonds in order to sell the bonds with-warrants at par? a. 9.54% b. 8.65% c. 9.08% d. 8.24% e. 83%arrow_forward

- Potter & Lopez Inc. just sold a bond with 50 warrants attached. The bonds have a 20-year maturity and an annual coupon of 12%, and they were issued at their $1,000 par value. The current yield on similar straight bonds is 15%. What is the implied value of each warrant? Ο $4.35 O $3.76 O $4.56 O $4.14 O $3.94arrow_forwardIf a firm adheres strictly to the residual dividend policy, the issuance of new common stock would suggest that The dividend payout ratio is decreasing. The dividend payout ratio has remained constant. The dollar amount of investments has decreased. No dividends were paid during the year. the dividend payout ratio is increasing.arrow_forwardq6) Which of the following statements is CORRECT? If Congress increases taxes on capital gains but leaves tax rates on dividends unchanged, this will motivate companies to increase stock repurchases. The clientele effect explains why firms change their dividend policies so often.. One advantage of the residual dividend policy is that it helps corporations to develop a specific and well-identified dividend clientele. If a firm splits its stock 2-for-1, then its stock price will be doubled. If a firm follows the residual dividend policy, then a sudden increase in the number of profitable projects is likely to reduce the firm's dividend payout.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License