Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 8P

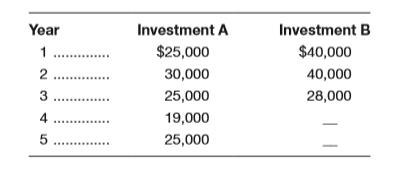

Assume a

a. Calculate the payback for investments A and B.

b. If the inflow in the fifth year for Investment A was

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help with financial accounting question

Need help with the Correct answer of this Financial Accounting Question

: A project costs $100,000 and is expected to generate cash flows of $30,000 annually for 5 years. If the discount rate is 8%, should the project be accepted based on Net Present Value (NPV)?

Chapter 12 Solutions

Foundations of Financial Management

Ch. 12 - Prob. 1DQCh. 12 - Why does capital budgeting rely on analysis of...Ch. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - What does the term mutually exclusive investments...Ch. 12 - Prob. 6DQCh. 12 - If a corporation has projects that will earn more...Ch. 12 - What is the net present value profile? What three...Ch. 12 - How does an asset’s ADR (asset depreciation...Ch. 12 - Prob. 1P

Ch. 12 - Prob. 2PCh. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Assume a firm has earnings before depreciation and...Ch. 12 - Al Quick, the president of a New York Stock...Ch. 12 - Prob. 6PCh. 12 - Prob. 7PCh. 12 - Assume a 90,000 investment and the following cash...Ch. 12 - Prob. 9PCh. 12 - X-treme Vitamin Company is considering two...Ch. 12 - You buy a new piece of equipment for 16,230, and...Ch. 12 - Prob. 12PCh. 12 - Home Security Systems is analyzing the purchase of...Ch. 12 - Aerospace Dynamics will invest 110,000 in a...Ch. 12 - The Horizon Company will invest 60,000 in a...Ch. 12 - Skyline Corp. will invest 130,000 in a project...Ch. 12 - The Hudson Corporation makes an investment of ...Ch. 12 - The Pan American Bottling Co. is considering the...Ch. 12 - You are asked to evaluate the following two...Ch. 12 - Turner Video will invest 76,344 in a project. The...Ch. 12 - The Suboptimal Glass Company uses a process of...Ch. 12 - Keller Construction is considering two new...Ch. 12 - Davis Chili Company is considering an investment...Ch. 12 - Prob. 25PCh. 12 - Assume 65,000 is going to be invested in each of...Ch. 12 - The Summit Petroleum Corporation will purchase an...Ch. 12 - Oregon Forest Products will acquire new equipment...Ch. 12 - Prob. 29PCh. 12 - Prob. 30PCh. 12 - Prob. 31PCh. 12 - Prob. 32PCh. 12 - Prob. 33PCh. 12 - Prob. 2WECh. 12 - Returning to TXN’s summary page, record the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are considering a project in Poland, which has an initial cost of 250,000PLN. The project is expected to return a one-time payment of 400,000PLN 5 years from now. The risk-free rate of return is 3% in Canada and 4% in Poland. The inflation rate is 2% in Canada and 5% in Poland. Currently, you can buy 375PLN for $100. How much will the payment 5 years from now be worth in dollars? Question 6 options: $1,576,515 $1,489,025 $101,490 $1,462,350 $142,060arrow_forward: A project costs $100,000 and is expected to generate cash flows of $30,000 annually for 5 years. If the discount rate is 8%, should the project be accepted based on Net Present Value (NPV)? i need hellarrow_forwardYou invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio? helparrow_forward

- Importers and exporters are key players in the foreign exchange market. Question 10 options: True Falsearrow_forwardTriangle arbitrage helps keep the currency market in equilibrium. Question 9 options: True Falsearrow_forwardThe use of dividends is a method by which a foreign subsidiary can remit cash to its parent company. Question 8 options: True False\arrow_forward

- The notion that exchange rates adjust to keep the purchasing power of a currency constant across countries is called: Question 7 options: Interest rate parity. The unbiased forward rates condition. Uncovered interest rate parity. Purchasing power parity. The international Fisher effect.arrow_forwardThe notion that exchange rates adjust to keep the purchasing power of a currency constant across countries is called: Question 7 options: Interest rate parity. The unbiased forward rates condition. Uncovered interest rate parity. Purchasing power parity. The international Fisher effect.arrow_forwardSuppose the direct exchange rate for the Canadian dollar and U.S. dollar is 1.11, this means that you can buy $1 U.S. for $1.11 Canadian. Question 5 options: True Falsearrow_forward

- The 60-day forward rate for Japanese Yen is x108.02 per $1. The spot rate is x103.09 per $1. In 60 days you expect to receive x1,500,000. If you agree to a forward contract, how many dollars will you receive in 60 days? Question 4 options: $154.635 million $15,312 million $13,886 million $14,550 millionarrow_forwardPlease provide correct solution with financial accounting questionarrow_forwardSolve this question and financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License