Concept explainers

a.

To calculate: The book value of the old equipment.

Introduction:

Book value:

It refers to the total worth of the company if it liquidates all its assets and pays off all the liabilities. It can also refer to the price of an asset as recorded in the

MACRS

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

a.

Answer to Problem 33P

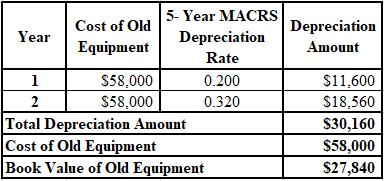

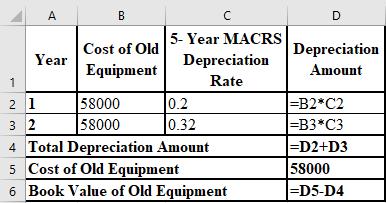

The calculation of the old equipment’s book value is shown below:

Hence, the book value of the old equipment is $27,480

Explanation of Solution

The formulae used for calculation of old equipment’s book value are shown below:

b.

To calculate: The tax loss that will be incurred on the sale of the old equipment.

Introduction:

Tax loss:

It is that loss incurred when the total deduction that can be claimed in a financial year exceeds the total assessable income of that year.

b.

Answer to Problem 33P

The tax loss that will be incurred on the sale of the old equipment is $3,040.

Explanation of Solution

The calculation of the tax loss on the sale of the old equipment is shown below.

c.

To calculate: The tax benefit from the sale of the old equipment.

Introduction:

Tax benefit:

It refers to the allowable deductions on the assessable income of the taxpayer with the intent of reducing their tax liability and burden.

c.

Answer to Problem 33P

The tax benefit from the sale of the old equipment is $1,064.

Explanation of Solution

The calculation of the tax benefit from the sale of the old equipment is shown below.

d.

To calculate: The

Introduction:

Cash inflow:

It is the money received by the firm as the result of its operating, investing and financing activities and is recorded in the cash flow statement.

d.

Answer to Problem 33P

The cash inflow from the old equipment’s sale is $25,864.

Explanation of Solution

The calculation of the cash inflow from the old equipment’s sale is shown below.

e.

To calculate: The new equipment’s net cost.

Introduction:

Net cost:

The cost computed by deducting all the benefits related to an object from its gross cost is termed as the net cost.

e.

Answer to Problem 33P

The net cost of the new equipment is $122,136.

Explanation of Solution

The calculation of the net cost of the new equipment is shown below.

f.

To prepare: The depreciation schedule of new equipment.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

f.

Answer to Problem 33P

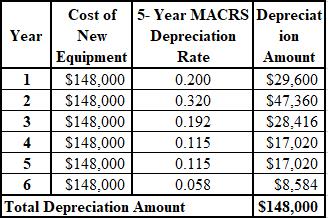

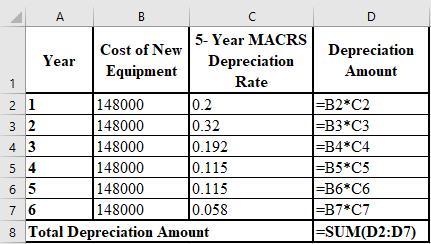

The depreciation schedule of new equipment is shown below.

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of the new equipment are shown below.

g.

To prepare: The depreciation schedule for the old equipment of its remaining years.

Introduction:

Depreciation schedule:

A table that shows the amount of depreciation of a particular asset over the years of its usage is termed as depreciation schedule.

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

g.

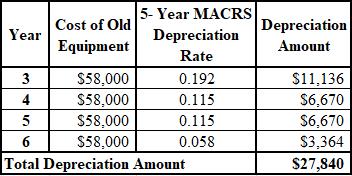

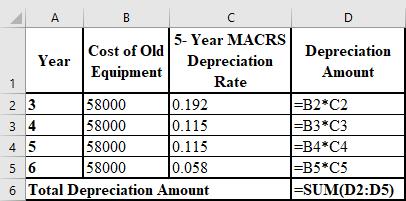

Answer to Problem 33P

The depreciation schedule for the old equipment of its remaining years is shown below:

Explanation of Solution

The formulae used for the preparation of the depreciation schedule of the residual years of the old equipment are shown below.

h.

To calculate: The incremental depreciation with respect to the old and the new equipment and the depreciation tax shield benefit.

Introduction:

MACRS depreciation method:

Modified Accelerated Cost Recovery System (MACRS) is a tool of depreciation used in the U.S. for tax purposes. This system places all the assets into categories with predetermined depreciation periods.

Depreciation tax shield:

It is a particular kind of a tax shield provided to an individual or corporation in which depreciation as an expense is deducted from taxable income.

h.

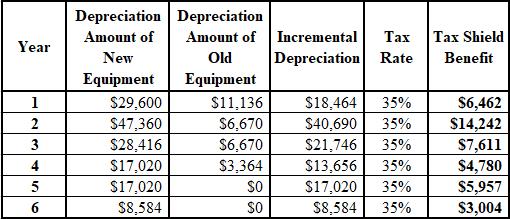

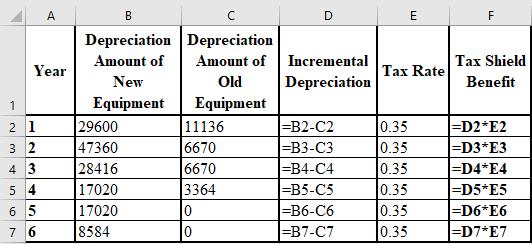

Answer to Problem 33P

The calculation of the incremental depreciation of the old and new equipment and the tax shield benefit are shown below.

Explanation of Solution

The formulae used for the calculation of the incremental depreciation of the old and new equipment and the tax shield benefit are shown below.

i.

To calculate: The after-tax benefits of cost savings.

Introduction:

After-tax benefits:

After-tax benefits are deductions that individuals are eligible for after the calculation of income tax calculated.

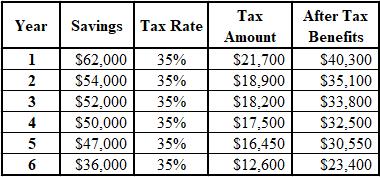

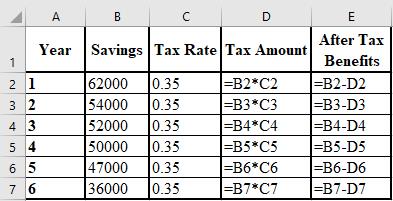

i.

Answer to Problem 33P

The calculation of the after-tax benefits of cost savings is shown below.

Explanation of Solution

The formulae used for the calculation of the after-tax benefits of cost savings are shown below.

j.

To calculate: The PV of the total cash inflow (sum of depreciation tax shield and after tax benefits).

Introduction:

The current value of an investment or asset is termed as its present value. It is calculated by discounting the

Cash inflow:

It is the money received by the firm as the result of its operating, investing and financing activities and is recorded in the cash flow statement.

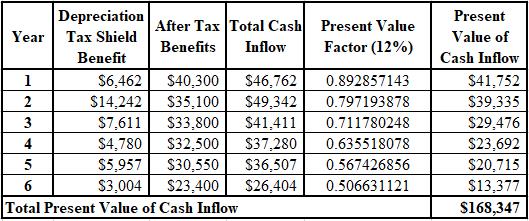

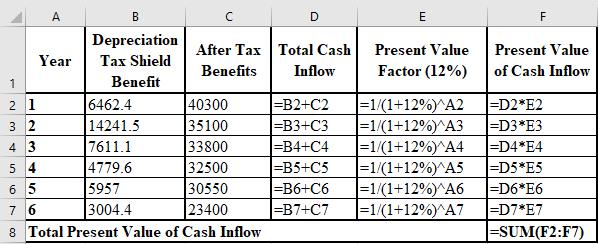

j.

Answer to Problem 33P

The calculation of the PV of the total cash inflow is shown below.

Explanation of Solution

The formulae used for the calculation of the present value of the total cash inflow are shown below.

k.

To determine: Whether the replacement should be done or not.

Introduction:

It is the difference between the PV (present value) of cash inflows and that of

k.

Answer to Problem 33P

The replacement should be done because the NPV of the project is $46,211, and a positive NPV indicates that the replacement is beneficial for the corporation.

Explanation of Solution

The calculation of the NPV of the replacement is as follows.

Want to see more full solutions like this?

Chapter 12 Solutions

Foundations of Financial Management

- Need soln for thisarrow_forwardMuskoka Tourism has announced a rights offer to raise $30 million for a new magazine, titled ‘Discover Muskoka’. The magazine will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells for $52 per share and there are 3.9 million shares outstanding. Required What is the maximum possible subscription price? What is the minimum? If the subscription price is set at $46 per share, how many shares must be sold? How many rights will it take to buy one share? What is the ex-rights price? What is the value of a right?arrow_forwardNorthern Escapes Inc. has 225,000 shares of stock outstanding. Each share is worth $73, so the company’s market value of equity is $16,425,000. Suppose the firm issues 30,000 new shares at the following prices: $73, $69, and $60. What will the effect be of each of these alternative offering prices on the existing price per share?arrow_forward

- Need answer correctly.arrow_forwardMuskoka Tourism has announced a rights offer to raise $30 million for a new magazine, titled ‘Discover Muskoka’. The magazine will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells for $52 per share and there are 3.9 million shares outstanding.arrow_forwardSs stores probarrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College