Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 12, Problem 17E

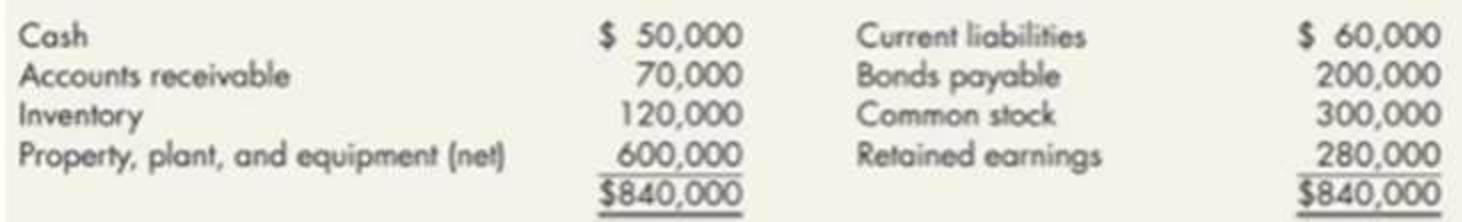

Company is considering purchasing EKC Company. EKC’s

At December 31, 2019, Elm discovered the following about EKC:

- a. No allowance for uncollectible accounts has been established. An allowance of $5,000 is considered appropriate.

- b. The LIFO inventory method has been used. The FIFO inventory method would be used if EKC were purchased by Elm. The FIFO inventors-valuation of the December 31, 2019, ending inventors-would be $180,000.

- c. The fair value of the property, plant, and equipment (net) is $730,000.

- d. The company has an unrecorded patent that is worth $120,000.

- e. The book values of the current liabilities and bonds payable are the same as their market values.

Required:

1. Compute the value of the

2. Next Level Why would the book value of a company’s identifiable net assets differ from its market value?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

On July 1, Archer Ltd. has retained earnings of $45,320. Revenues for July were $8,250. Expenses for July were $3,140. In July, the company paid out a total of $1,120 in dividends to its shareholders. What is the value of retained earnings on July 31?

Which inventory costing method is

prohibited under IFRS?

a) FIFO

b) Weighted average

c) LIFO

d) Specific identification

General Accounting

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 12 - Prob. 1GICh. 12 - Prob. 2GICh. 12 - Prob. 3GICh. 12 - Prob. 4GICh. 12 - Prob. 5GICh. 12 - Prob. 6GICh. 12 - Prob. 7GICh. 12 - What activities are included in RD? Which are...Ch. 12 - What elements of RD activities does a company...Ch. 12 - How does a company record a patent worth 100,000...

Ch. 12 - Prob. 11GICh. 12 - Prob. 12GICh. 12 - Over how many years are patents amortized?...Ch. 12 - Prob. 14GICh. 12 - Prob. 15GICh. 12 - Prob. 16GICh. 12 - Prob. 17GICh. 12 - Prob. 18GICh. 12 - Prob. 19GICh. 12 - Prob. 20GICh. 12 - What is the proper time or time period over which...Ch. 12 - Prob. 2MCCh. 12 - Prob. 3MCCh. 12 - Which of the following assets typically are...Ch. 12 - Prob. 5MCCh. 12 - Prob. 6MCCh. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - Steel Magnolia Incorporated purchased a trademark...Ch. 12 - Match the following items with correct accounting...Ch. 12 - Notting Hill Company incurred the following costs...Ch. 12 - Hook Corp. incurred the following start-up costs,...Ch. 12 - Mystic Pizza Company purchased a patent from Prime...Ch. 12 - Mystic Pizza Company purchases a franchise from NY...Ch. 12 - Prob. 7RECh. 12 - Prob. 8RECh. 12 - Prob. 9RECh. 12 - Prob. 10RECh. 12 - Prob. 1ECh. 12 - On January 4, 2019, Franc Company purchased for...Ch. 12 - On January 11, 2019, Hughes Company applied for a...Ch. 12 - Gansac Publishing Company signed a contract with...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - KLK Clothing Company manufactures professional...Ch. 12 - Cressman Company incurred RD costs for various...Ch. 12 - In 2019, Lalli Corporation incurred RD costs as...Ch. 12 - Kling Company was organized in late 2019 and began...Ch. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Company is considering purchasing EKC Company....Ch. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - Prob. 3PCh. 12 - Halpern Companys controller prepared the following...Ch. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Hamilton Companys balance sheet on January 1,...Ch. 12 - Prob. 8PCh. 12 - Lee Manufacturing Corporation was incorporated on...Ch. 12 - Information concerning Tully Corporations...Ch. 12 - Prob. 11PCh. 12 - In examining Samson Manufacturing Companys books,...Ch. 12 - Prob. 2CCh. 12 - Prob. 3CCh. 12 - Prob. 4CCh. 12 - On June 30, 2019, your client, Sprauge...Ch. 12 - Prob. 6CCh. 12 - NBC paid 401 million for the rights to televise...Ch. 12 - Prob. 8C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company sold office furniture costing $12,700 with accumulated depreciation of $10,150 for $2,200 cash. The entry to record the sale would include a gain or loss of what amount?arrow_forwardLattimer enterprises reported the following information for the year please answer the general accounting questionarrow_forwardWhat will be the ending retained earning balance?arrow_forward

- What would be the effect on income from operations?arrow_forwardHello tutor answer these general accounting questionarrow_forwardAlam Store recorded the following: cash sales $52,000, credit sales $78,000, sales return $6,000, sales allowances $4,300, and early payment discount taken by customers $3,600. Calculate the net sales.arrow_forward

- What is the production cost per unit?arrow_forwardAegis Corp. has assets of $215,630 and liabilities of $97,425. Then the firm receives $30,215 from an investor in exchange for new stock, which the firm issues to the investor. What is the value of stockholders' equity after the investment?helparrow_forwardCalculate the inventory turnover ratio of this financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License