Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 10E

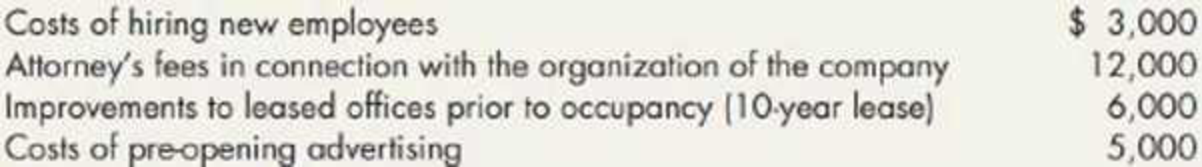

Kling Company was organized in late 2019 and began operations on January 2, 2020. Prior to the start of operations, it incurred the following costs:

Required:

- 1. What amount should the company expense in 2019? In 2020?

- 2. Next Level What is the justification of the accounting treatment of these costs?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Accurate answer

What is your estimate of an appropriate stock price?

I need correct answer general accounting question

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 12 - Prob. 1GICh. 12 - Prob. 2GICh. 12 - Prob. 3GICh. 12 - Prob. 4GICh. 12 - Prob. 5GICh. 12 - Prob. 6GICh. 12 - Prob. 7GICh. 12 - What activities are included in RD? Which are...Ch. 12 - What elements of RD activities does a company...Ch. 12 - How does a company record a patent worth 100,000...

Ch. 12 - Prob. 11GICh. 12 - Prob. 12GICh. 12 - Over how many years are patents amortized?...Ch. 12 - Prob. 14GICh. 12 - Prob. 15GICh. 12 - Prob. 16GICh. 12 - Prob. 17GICh. 12 - Prob. 18GICh. 12 - Prob. 19GICh. 12 - Prob. 20GICh. 12 - What is the proper time or time period over which...Ch. 12 - Prob. 2MCCh. 12 - Prob. 3MCCh. 12 - Which of the following assets typically are...Ch. 12 - Prob. 5MCCh. 12 - Prob. 6MCCh. 12 - Prob. 7MCCh. 12 - Prob. 8MCCh. 12 - Prob. 9MCCh. 12 - Prob. 10MCCh. 12 - Steel Magnolia Incorporated purchased a trademark...Ch. 12 - Match the following items with correct accounting...Ch. 12 - Notting Hill Company incurred the following costs...Ch. 12 - Hook Corp. incurred the following start-up costs,...Ch. 12 - Mystic Pizza Company purchased a patent from Prime...Ch. 12 - Mystic Pizza Company purchases a franchise from NY...Ch. 12 - Prob. 7RECh. 12 - Prob. 8RECh. 12 - Prob. 9RECh. 12 - Prob. 10RECh. 12 - Prob. 1ECh. 12 - On January 4, 2019, Franc Company purchased for...Ch. 12 - On January 11, 2019, Hughes Company applied for a...Ch. 12 - Gansac Publishing Company signed a contract with...Ch. 12 - Prob. 5ECh. 12 - Prob. 6ECh. 12 - KLK Clothing Company manufactures professional...Ch. 12 - Cressman Company incurred RD costs for various...Ch. 12 - In 2019, Lalli Corporation incurred RD costs as...Ch. 12 - Kling Company was organized in late 2019 and began...Ch. 12 - Prob. 11ECh. 12 - Prob. 12ECh. 12 - Prob. 13ECh. 12 - Prob. 14ECh. 12 - Prob. 15ECh. 12 - Prob. 16ECh. 12 - Company is considering purchasing EKC Company....Ch. 12 - Prob. 18ECh. 12 - Prob. 19ECh. 12 - Prob. 20ECh. 12 - Prob. 1PCh. 12 - Prob. 2PCh. 12 - Prob. 3PCh. 12 - Halpern Companys controller prepared the following...Ch. 12 - Prob. 5PCh. 12 - Prob. 6PCh. 12 - Hamilton Companys balance sheet on January 1,...Ch. 12 - Prob. 8PCh. 12 - Lee Manufacturing Corporation was incorporated on...Ch. 12 - Information concerning Tully Corporations...Ch. 12 - Prob. 11PCh. 12 - In examining Samson Manufacturing Companys books,...Ch. 12 - Prob. 2CCh. 12 - Prob. 3CCh. 12 - Prob. 4CCh. 12 - On June 30, 2019, your client, Sprauge...Ch. 12 - Prob. 6CCh. 12 - NBC paid 401 million for the rights to televise...Ch. 12 - Prob. 8C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Accounting for Derivatives_1.mp4; Author: DVRamanaXIMB;https://www.youtube.com/watch?v=kZky1jIiCN0;License: Standard Youtube License

Depreciation|(Concept and Methods); Author: easyCBSE commerce lectures;https://www.youtube.com/watch?v=w4lScJke6CA;License: Standard YouTube License, CC-BY