Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 15F15

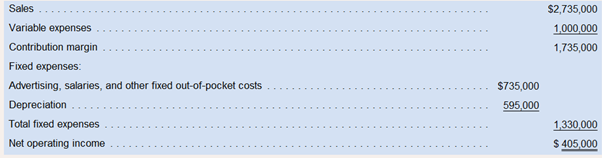

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company’s discount rate is 14%. The project would provide net operating income in each of five wars as follows:

Required:

(Answer each question by referring to the original data unless instructed otherwise.)

15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the projects actual simple

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company’s discount rate is 14%. The project would provide net operating income in each of five years as follows:

Required:

(Answer each question by referring 10 the original data unless instructed otherwise.)

1. Which item(s) in the income statement shown above will not affect cash flows?

2. What are the project’s annual net cash inflows?

3. What is the present value of the project’s annual net cash inflows?

4. What is the project’s net present value?

5. What is the project profitability index for this project? (Round your answer to the nearest whole percent.)

6. What is the project’s internal rate of return to the nearest whole percent?

7. What is the project’s payback period?

8. What is the project’s simple rate of return for each of the five years?

9. If the company’s discount rate was 16% instead of 14%, would you…

Mountain Frost is considering a new project with an initial cost of $295,000. The equipment will

be depreciated on a straight-line basis to a zero book value over the four-year life of the project.

The projected net income for each year is $21,800, $22,700, $24,600, and $18,700, respectively.

What is the average accounting return?

Multiple Choice

O 13.64%

O 14.88%

7.44%

O 11.16%

15.94%

Mountain Frost is considering a new project with an initial cost of $205,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $20,000, $20,900, $24,600, and $16,900, respectively. What is the average accounting return? Please make sure its correct

Chapter 12 Solutions

Introduction To Managerial Accounting

Ch. 12.A - Basic Present Value Concepts Annual cash inflows...Ch. 12.A - Basic Present value Concepts Julie has just...Ch. 12.A - Prob. 3ECh. 12.A - Prob. 4ECh. 12.A - Basic Present Value Concepts The Atlantic Medical...Ch. 12.A - Prob. 6ECh. 12 - What is the difference between capital budgeting...Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4Q

Ch. 12 - Why are discounted cash flow methods of making...Ch. 12 - Prob. 6QCh. 12 - Identify two simplifying assumptions associated...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10QCh. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - How is the project profitability index computed,...Ch. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1AECh. 12 - The Excel worksheet form that appears below is to...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - Prob. 6F15Ch. 12 - Prob. 7F15Ch. 12 - Prob. 8F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 11F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 13F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Payback Method The management of Unter...Ch. 12 - Net Present Value Analysis The management of...Ch. 12 - Internal Rate of Return Wendell’s Donut Shoppe is...Ch. 12 - Uncertain Future Cash Flows Lukow Products is...Ch. 12 - Prob. 5ECh. 12 - Simple Rate of Return Method The management of...Ch. 12 - Prob. 7ECh. 12 - Payback Period and Simple Rate of Return Nicks...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Preference Ranking of Investment Projects Oxford...Ch. 12 - Prob. 12ECh. 12 - Payback Period and Simple Rate of Return...Ch. 12 - Comparison of Projects Using Net Present Value...Ch. 12 - Internal Rate of Return and Net Present Value...Ch. 12 - Net Present Value Analysis Windhoek Mines, Ltd.,...Ch. 12 - Net Present Value Analysis; Internal Rate of...Ch. 12 - Net Present Value Analysis Oakmont Company has an...Ch. 12 - Simple Rate of Return; Payback Period Paul Swanson...Ch. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Comprehensive Problem - Lou Barlow, a divisional...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Net Present Value Analysis In five years, Kent...Ch. 12 - Prob. 28PCh. 12 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Isle Royale Solutions is considering a project that would have a eight-year life and would require a $2,904,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Use the documents provided in the instructions to determine the appropriate discount factor(s). All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%. Compute the project's net present value. Compute the project's internal rate of return. Compute the project's simple rate of return. Compute the project's payback period. Isle Royale Solutions is considering a project that would have a eight-year life and would require a $2,904,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income…arrow_forwardA company is considering purchasing an equipment for $136,840. Shipping and installation costs would cost another $6,599. The project would require an initial investment in net working capital of $21,243 which would be recouped at the end of the project. What is the project's initial outlay? Do not enter $ or comma in the answer answer. Enter your final answer of initial outlay as an absolute number (that means, enter it as a positive number).arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- Cardinal Company is considering a five-year project that would require a $2,915,000 investment in equipment with a useful life of five years and no salvage value. The company's discount rate is 16%. The project would provide net operating income in each of five years as follows: Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $ 2,863, 000 1,014,000 1,849,000 $ 781,000 583, 000 1,364, 000 $ 485,000 Net operating incone Click here to view Exhibit 148-1 ond Exhibit 148-2, to determine the appropriate discount factor(s) using table. 15. Assume a postaudit showed that all estimates (including total sales) were exactly correct except for the variable expense ratio, which actually turned out to be 45%. What was the project's actual simple rate of return? (Round your answer to 2 decimal places.) Simple rate of returnarrow_forwardMountain Frost is considering a new project with an initial cost of $180,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $19,500, $20,400, $24,600, and $16,400, respectively. What is the average accounting return?arrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $560,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $28; variable costs = $20; fixed costs = $200,000; quantity sold = 86,000 units; tax rate = 35 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places,arrow_forward

- [The following information applies to the questions displayed below.] Project Y requires a $306,000 investment for new machinery with a five-year life and no salvage value. The project yields the following annual results. Cash flows occur evenly within each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Project Y $ 390,000 174,720 61,200 28,000 $ 126,080 2. Determine Project Y's payback period. Project Y Payback Period Numerator: 1 Denominator: = = Payback Period 0arrow_forwardMansukharrow_forwardA project has an initial cost of $34051 and a three-year life. The company uses straight-line depreciation to a book value of zero over the life of the project. The projected net income from the project is $1,700, $2,000, and $2330 a year for the next three years, respectively. What is the average accounting return?arrow_forward

- Consider a four-year project with the following information: Initial fixed asset investment = $635,000; straight-line depreciation to zero over the four-year life; zero salvage value; price $53; variable costs = $44; fixed costs $310,000; quantity sold = 127,000 units; tax rate 25 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) AOCF/AQarrow_forwardConsider a project with the following information: Initial fixed asset investment = $550,000; straight-line depreciation to zero over the 4-year life; zero salvage value; price $54; variable costs = $35; fixed costs = $228,000, quantity sold = 116,000 units; tax rate = 23 percent. How sensitive is OCF to changes in quantity sold? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) AOCFIAQ 9.24arrow_forwardThe data below are estimated for the project for the project study of a certain businessinvestment. IF money is worth 15% which of the project is more desirable, using PresentWorth Method and determine the difference in profit from each project study.For A, the initial investment is P5,000, with annual revenue of P2000. Annualdisbursement amounts to P650 with no salvage value at the end of its life which is 4years.For B, the initial investment is P8,000, with annual revenue of P3000. Annualdisbursement is P1500 with no salvage value at the end of its life which is 8 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License