Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 13E

Payback Period and Simple

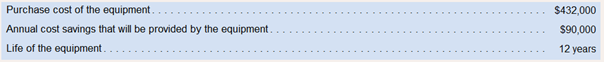

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd, could use to reduce costs in one of its plants in Japan Relevant data relating to the equipment follow:

Required:

1. What is the pevb.ck period for the equipment? If the company requires a prb.ck period of four years or less, would the equipment be purchased?

2. What is the simple rate of return on the equipment? Use straight-line

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Limited, could use to reduce costs in one of

its plants in Japan. Relevant data relating to the equipment follow:

Purchase cost of the equipment

Annual cost savings that will be

provided by the equipment

Life of the equipment

Required:

1a. Compute the payback period for the equipment.

1b. If the company requires a payback period of four years or less, would the equipment be purchased?

2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful life.

2b. Would the equipment be purchased if the company's required rate of return is 16%?

Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

$ 378,000

$ 70,000

12 years

Req 2A

Years

Req 2B

Compute the payback period for the equipment. (Round your answer to 1 decimal place.)

Payback Period

A piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Limited, could use to reduce

costs in one of its plants in Japan. Relevant data relating to the equipment follow:

Purchase cost of the equipment

Annual cost savings that will be

provided by the equipment

Life of the equipment

$ 600,000

$ 100,000

12 years

Required:

1a. Compute the payback period for the equipment.

1b. If the company requires a payback period of four years or less, would the equipment be purchased?

2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful

life.

2b. Would the equipment be purchased if the company's required rate of return is 12%?

Complete this question by entering your answers in the tabs below.

ces

Reg 1A

Reg 18

Req 2A

Req 28

Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment's useful

life. (Round your answer to 1 decimal place i.e. 0.123 should be…

A3

Chapter 12 Solutions

Introduction To Managerial Accounting

Ch. 12.A - Basic Present Value Concepts Annual cash inflows...Ch. 12.A - Basic Present value Concepts Julie has just...Ch. 12.A - Prob. 3ECh. 12.A - Prob. 4ECh. 12.A - Basic Present Value Concepts The Atlantic Medical...Ch. 12.A - Prob. 6ECh. 12 - What is the difference between capital budgeting...Ch. 12 - Prob. 2QCh. 12 - Prob. 3QCh. 12 - Prob. 4Q

Ch. 12 - Why are discounted cash flow methods of making...Ch. 12 - Prob. 6QCh. 12 - Identify two simplifying assumptions associated...Ch. 12 - Prob. 8QCh. 12 - Prob. 9QCh. 12 - Prob. 10QCh. 12 - Prob. 11QCh. 12 - Prob. 12QCh. 12 - How is the project profitability index computed,...Ch. 12 - Prob. 14QCh. 12 - Prob. 15QCh. 12 - Prob. 1AECh. 12 - The Excel worksheet form that appears below is to...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 3F15Ch. 12 - Prob. 4F15Ch. 12 - Prob. 5F15Ch. 12 - Prob. 6F15Ch. 12 - Prob. 7F15Ch. 12 - Prob. 8F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 11F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Prob. 13F15Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Cardinal Company is considering a five-year...Ch. 12 - Payback Method The management of Unter...Ch. 12 - Net Present Value Analysis The management of...Ch. 12 - Internal Rate of Return Wendell’s Donut Shoppe is...Ch. 12 - Uncertain Future Cash Flows Lukow Products is...Ch. 12 - Prob. 5ECh. 12 - Simple Rate of Return Method The management of...Ch. 12 - Prob. 7ECh. 12 - Payback Period and Simple Rate of Return Nicks...Ch. 12 - Prob. 9ECh. 12 - Prob. 10ECh. 12 - Preference Ranking of Investment Projects Oxford...Ch. 12 - Prob. 12ECh. 12 - Payback Period and Simple Rate of Return...Ch. 12 - Comparison of Projects Using Net Present Value...Ch. 12 - Internal Rate of Return and Net Present Value...Ch. 12 - Net Present Value Analysis Windhoek Mines, Ltd.,...Ch. 12 - Net Present Value Analysis; Internal Rate of...Ch. 12 - Net Present Value Analysis Oakmont Company has an...Ch. 12 - Simple Rate of Return; Payback Period Paul Swanson...Ch. 12 - Prob. 20PCh. 12 - Prob. 21PCh. 12 - Prob. 22PCh. 12 - Comprehensive Problem - Lou Barlow, a divisional...Ch. 12 - Prob. 24PCh. 12 - Prob. 25PCh. 12 - Prob. 26PCh. 12 - Net Present Value Analysis In five years, Kent...Ch. 12 - Prob. 28PCh. 12 - Prob. 29P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ssarrow_forwardREQUIRED Study the information given below and calculate the following: Payback period (in years, months and days) Net Present Value Internal Rate of Return (expressed to two decimal places). (Note: Your answer must include the interpolation.) information Eva Limited is considering the purchase of a machine. The company desires a minimum required rate of return of 12%. The machine will cost R2 200 000 plus installation costs of R200 000 and is expected to have a useful life of six years. It is anticipated that the machine will have a salvage value of R100 000. The machine is expected to increase revenues by R800 000 per year but will require the employment of two new machine operators at R100 000 per year for each operator, and it will also require maintenance and repairs averaging R50 000 per year. Depreciation is estimated to be R400 000 per year.arrow_forward6. A lamp socket die-cutting company has two alternatives to purchase a new die-cutting machine, where the initial investment (in US dollars) and the projected net income stream for each alternative is shown in the following tables; the number of periods corresponds to the number of years of service life. If the company's purchasing committee considers a capital cost of 12.50% for internal financing, which machine should be purchased?arrow_forward

- Payback, Accounting Rate of Return, Net Present Value, Internal Rate of Return Follow the format shown in Exhibit 12B.1 and Exhibit 12B.2 as you complete the requirement below. Blaylock Company wants to buy a numerically controlled (NC) machine to be used in producing specially machined parts for manufacturers of trenching machines. The outlay required is $730,671. The NC equipment will last five years with no expected salvage value. The expected after-tax cash flows associated with the project follow: Year Cash Revenues Cash Expenses 1 $1,300,000 $1,000,000 1,300,000 1,000,000 1,000,000 1,000,000 1,000,000 2 3 4 5 1,300,000 1,300,000 1,300,000 Required: Compute the Investment's Internal Rate of return. Enter as a percent. If required, round your answer to the nearest whole percent. IRR = %arrow_forwardA piece of labor-saving equipment has just come onto the market that Mitsui Electronics, Ltd., could use to reduce costs in one of its plants in Japan. Relevant data relating to the equipment follow: Purchase cost of the equipment $ 432,000 Annual cost savings that will beprovided by the equipment $ 90,000 Life of the equipment 12 years Required: 1a. Compute the payback period for the equipment. 1b. If the company requires a payback period of four years or less, would the equipment be purchased? 2a. Compute the simple rate of return on the equipment. Use straight-line depreciation based on the equipment’s useful life. 2b. Would the equipment be purchased if the company’s required rate of return is 14%?arrow_forwardrarrow_forward

- 1. Should SS upgrade its production line or replace it? Show your calculations 2. Suppose the one-time equipment cost to replace the production equipment is negotiable.All other data are as given previously. What is the maximum one-time equipment cost that SSwould be willing to pay to replace the old equipment rather than upgrade it?arrow_forward6arrow_forwardProblem 3. Calculate the PW and IRR of this transaction. At the given MARR is this a good purchase? Please workout in excel spreadsheet.arrow_forward

- I need help solving this questionarrow_forwardI need assistance with this problem. Thank youarrow_forwardTwo alternative machines will produce the same product, but one is capable of higher-quality work, which can be expected to return greater revenue. The following are relevant data. Determine which is the better alternative, assuming repeatability and using SL depreciation, an income-tax rate of 27%, and an after-tax MARR of 11%. Capital investment Life Calculate the AW value for the Machine A. Machine A $23,000 12 years $4,000 Terminal BV (and MV) Annual receipts Annual expenses Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11%er year. AWA (11%) = $ (Round to the nearest dollar.) Machine B $33,000 6 years $1,500 $197,000 $176,000 $152,000 $130,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License