MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

12th Edition

ISBN: 9780134727677

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.6S

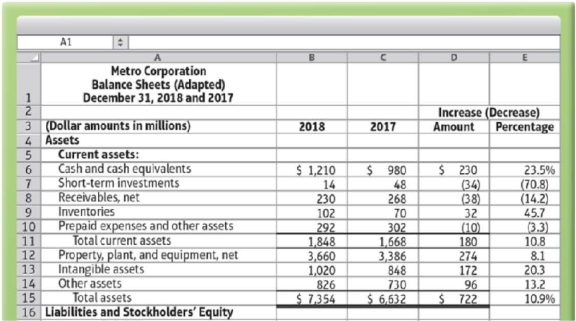

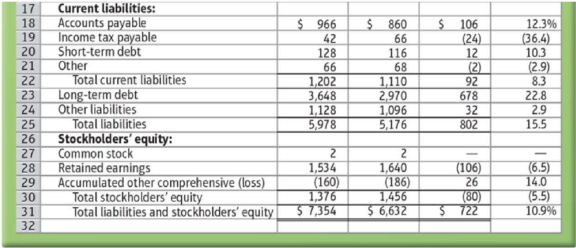

(Learning Objective 4: Evaluate a company’s quick ratio) To follow are the

| Company | Quick (acid-test) Ratio |

| Orleans Electric, Inc. (Utility)……………. | 0.74 |

| O’Neil Company (Department store)………….. | 0.63 |

| Lavallee Foods Corporation (Grocery store)……… | 0.66 |

Use the data to answer the following questions.

1. Calculate Metro’s quick (acid-test) ratio at December 31, 2018, and 2017.

2. Use the comparative information from the table given for Orleans Electric, Inc., O’Neil Company, and Lavallee Foods Corporation. Is Metro’s quick (acid-test) ratio for 2018 and 2017 strong, average, or weak in comparison?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Sales revenue for the year

Give me true answer this general accounting question

Carry Manufacturing Inc. had a variable costing operating income of $95,200 in 2018. Ending inventory decreased during 2018 from 50,000 units to 47,000 units. During both 2017 and 2018, fixed manufacturing overhead was $900,000, and 120,000 units were produced. Determine the absorption costing operating income for 2018.

Chapter 12 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License