MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

12th Edition

ISBN: 9780134727677

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.65BP

LO 4

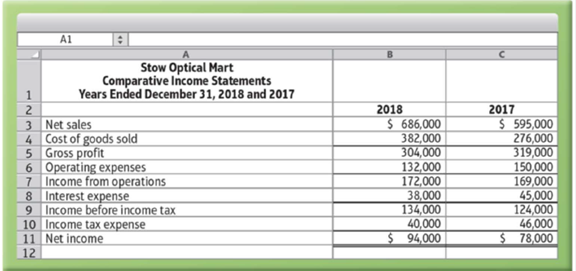

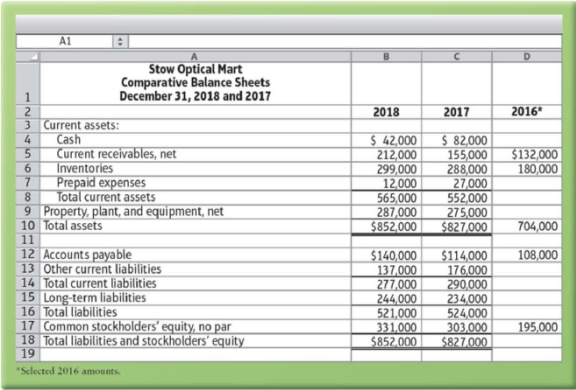

(Learning Objective 4: Use ratios to evaluate a stock investment) Comparative financial statement data of Stow Optical Mart follow:

Other information:

- 1. Market price of Stow Optical Mart common stock: $122.91 at December 31 , 2018, and $165.75 at December 31, 2017

- 2. Common shares outstanding: 13,000 during 2018 and 8,000 during 2017

- 3. All sales on credit

- 4. Cash dividends paid per share: $2.75 per share in 2018 and $4.00 in 2017

Requirements

1. Calculate the following ratios for 2018 and 2017:

- a.

Current ratio - b. Quick (acid-test) ratio

- c. Receivables turnover and days’ sales outstanding (DSO)-round to the nearest whole day

- d. Inventory turnover and days’ inventory outstanding (DIO)-round to the nearest whole day

- e. Accounts payable turnover and days’ payable outstanding (DPO)-use cost of goods sold in the turnover ratio and round DPO to the nearest whole day

- f. Cash conversion cycle (in days)

- g. Times-interest-earned ratio

- h. Return on assets-use DuPont Analysis

- i. Return on common stockholders’ equity-use DuPont Analysis

- j. Earnings per share of common stock

- k. Price-earnings ratio

2. Decide whether (a) Stow Optical Mart’s financial position improved or deteriorated during 2018 and (b) whether the investment attractiveness of the company’s common stock appears to have increased or decreased from 2017 to 2018.

3. How will what you learned in this problem help you evaluate an investment?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need answer the financial accounting question

Get correct solution this financial accounting question

Financial Accounting Question please answer

Chapter 12 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How much of every retail sales dollar is made up of merchandise cost on these general accounting question?arrow_forwardThe company where Daniel works produces skateboards locally but sells them globally for $60 each. Daniel is one of the production managers in a meeting to discuss preliminary results from the year just ended. Here is the information they had in front of them: Standard Quantity per Unit Standard Price Wood 2.50 feet $4.00 per foot Wheels 5.00 wheels $0.50 per wheel Direct labor 0.30 hours $14.00 per hour Actual results: . • Quantity of wood purchased, 225,000 feet; quantity of wood used, 220,000 feet. Quantity of wheels purchased, 418,800 wheels; quantity of wheels used, 400,800 wheels. Actual cost of the wood, $4.20 per foot. Actual cost of the wheels, $0.55 per wheel. • Quantity of DL hours used, 26,400 hours; actual cost of DL hours, $15.20 per hour. Actual units produced, 80,000 skateboards. (a) Complete a variance analysis for DM (both wood and wheels) and DL, determining the price and efficiency variances for each; be sure to specify the amount and sign of each variance. DM- Wood…arrow_forwardNeed help with this financial accounting questionarrow_forward

- Please provide answer this financial accounting questionarrow_forwardWhat is the denominator in computing the annual rate of return on these financial accounting question?arrow_forwardCustom Cabinetry has one job in process (Job 120) as of June 30; at that time, its job cost sheet reports direct materials of $7,000, direct labor of $3,400, and applied overhead of $2,890. Custom Cabinetry applies overhead at the rate of 85% of direct labor cost. During July, Job 120 is sold (on credit) for $26,000, Job 121 is started and completed, and Job 122 is started and still in process at the end of July. Custom Cabinetry incurs the following costs during July. Job 120 Direct materials used Direct labor used $ 2,300 3,400 Job 121 $ 7,100 4,700 Job 122 $ 2,600 3,700 1. Prepare journal entries for the following July transactions and events a through e. a. Direct materials used. b. Direct labor used. c. Overhead applied. d. Sale of Job 120. e. Cost of goods sold for Job 120. Hint. Job 120 has costs from June and July. 2. Compute the July 31 balances of the Work in Process Inventory and the Finished Goods Inventory accounts. (There were no jobs in Finished Goods Inventory at June…arrow_forward

- In 2014, LL Bean sold 450,000 pairs of boots. At one point in 2014, it had a back order of 100,000. In 2015, LL Bean expects to sell 500,000 pairs of boots. As of late November 2015, it has a back order of 50,000.Question: When would LL Bean see sales revenue from the sale of its back order on the boots?arrow_forwardHelp me to solve this questionsarrow_forwardcorrect answer pleasearrow_forward

- Give this question financial accountingarrow_forward1.3 1.2.5 za When using a computerised accounting system, the paper work will be reduced in the organisation. Calculate the omitting figures: Enter only the answer next to the question number (1.3.1-1.3.5) in the NOTE. Round off to TWO decimals. VAT report of Comfy shoes as at 30 April 2021 OUTPUT TAX INPUT TAX NETT TAX Tax Gross Tax(15%) Gross (15%) Standard 75 614,04 1.3.1 Capital 1.3.2 9 893,36 94 924,94 Tax (15%) 1.3.3 Gross 484 782,70 75 849,08 -9 893,36 -75 849,08 Bad Debts TOTAL 1.3.4 4 400,00 1 922,27 14 737,42 -1 348,36 1.3.5 (5 x 2) (10arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License