Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781337517386

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.2.2P

Differential analysis report for machine replacement proposal

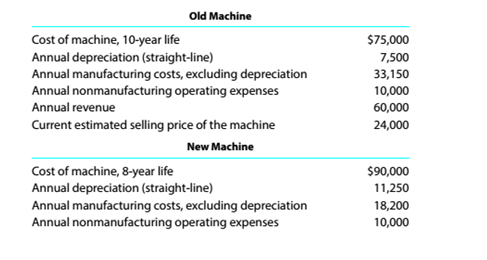

Catalina Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by the purchase of the new machine.

Instructions

List other factors that should be considered before a final decision is reached.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Which of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stock

Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recorded

What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

Chapter 12 Solutions

Survey of Accounting (Accounting I)

Ch. 12 - Mario Company is considering discontinuing a...Ch. 12 - Victor Company is considering disposing of...Ch. 12 - Prob. 3SEQCh. 12 - For which cost concept used in applying (he...Ch. 12 - Prob. 5SEQCh. 12 - Prob. 1CDQCh. 12 - Prob. 2CDQCh. 12 - A company could sell a building for $650,000 or...Ch. 12 - Prob. 4CDQCh. 12 - Prob. 5CDQ

Ch. 12 - A company fabricates a component at a cost of...Ch. 12 - Prob. 7CDQCh. 12 - Prob. 8CDQCh. 12 - Prob. 9CDQCh. 12 - Prob. 10CDQCh. 12 - Prob. 11CDQCh. 12 - Prob. 12CDQCh. 12 - Lease or sell decision Orwell Industries is...Ch. 12 - Prob. 12.2ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4ECh. 12 - Prob. 12.5ECh. 12 - Make-or-buy decision Watts Technologies Company...Ch. 12 - Make-or-buy decision Wisconsin Arts of Milwaukee...Ch. 12 - Machine replacement decision Creekside Products...Ch. 12 - Differential analysis report for machine...Ch. 12 - Sell or process further St. Paul Lumber Company...Ch. 12 - Prob. 12.11ECh. 12 - Decision on accepting additional business Madison...Ch. 12 - Accepting business at a special price Palomar...Ch. 12 - Prob. 12.14ECh. 12 - Total cost concept of product costing Willis...Ch. 12 - Product cost concept of product pricing Based on...Ch. 12 - Variable cost concept of product pricing Based on...Ch. 12 - Target costing Toyota Motor Corporation (TM) uses...Ch. 12 - Differential analysis report involving opportunity...Ch. 12 - Prob. 12.1.2PCh. 12 - Prob. 12.1.3PCh. 12 - Differential analysis report for machine...Ch. 12 - Differential analysis report for machine...Ch. 12 - Differential analysis report for sales promotion...Ch. 12 - Differential analysis report for sales promotion...Ch. 12 - Differential analysis report for further...Ch. 12 - Prob. 12.4.2PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.5.2PCh. 12 - Prob. 12.5.3PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.5.5PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.1MBACh. 12 - Prob. 12.2MBACh. 12 - Prob. 12.3.1MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.3.3MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.4.2MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.5.1MBACh. 12 - Prob. 12.5.2MBACh. 12 - Prob. 12.5.3MBACh. 12 - Product pricing Bev Frazier is a cost accountant...Ch. 12 - Prob. 12.2CCh. 12 - Prob. 12.3CCh. 12 - Cost-plus and target costing concepts The...Ch. 12 - Cost-plus and target costing concepts The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License