Concept explainers

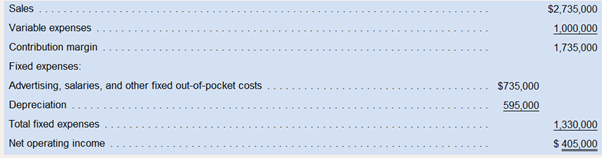

Cardinal Company is considering a five-year project that would require a $2,975,000 investment in equipment with a useful life of five years and no salvage value. The company’s discount rate is 14%. The project would provide net operating income in each of five wars as follows:

Required:

(Answer each question by referring to the original data unless instructed otherwise.)

10. If the equipment had a salvage i1ue of $300000 at the end of five yes, would von expect the project’s pa1ack period to be higher than, lower than, or the same as vow answer to requirement 7? No computations are necessary.

If the equipment had a salvage i1ue of $300000 at the end of five yes, would von expect the project’s pa1ack period to be higher than, lower than, or the same as vow answer to requirement 7? No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

INTRO MGRL ACCT LL W CONNECT

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning