Concept explainers

Payback Period and Simple

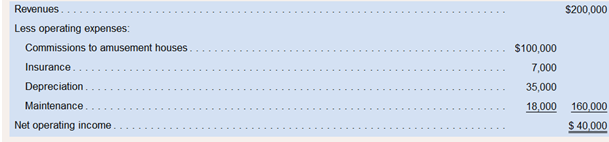

Nicks Novelties, Inc., is considering the purchase of Dew electronic games to place in its amusement houses. The games would cost a total of $300,000, have an eight-year useful life, and have a total salvage value of $20,000. The company estimates that annual revenues and expenses associated with the games would be as follows:

Required:

1. What is the payback period for the new electronic games? Assume that Nicks Novelties, Inc., il1 not purchase new games unless they provide a payback period of fire years or less. Would the company purchase the new games?

2. What is the simple rate of return promised by the games? If the company requires a simple rate of return of at least 12%, will the games be purchased?

Concept Introduction: When the Payback Period is computed after discounting the cash flows by a pre-determined rate (cut-off rate), it is called as the discounted payback period.

Concept of simple Rate of return:

Simple Rate of Return is also known as Accounting (or) Average rate of return (ARR) Means the average annual yield on the project. In this method, Profit After Tax (PAT) instead of (FAT) is used for evaluation.

1. Payback period for the new electronic games. 2. Simple rate of interest.

Explanation of Solution

Calculation of cash flows after Tax

Here, the payback period is 3 years 7 months. So, Neck’s Novelties, Inc., would purchase the new games.

2. Simple rate of return

Want to see more full solutions like this?

Chapter 12 Solutions

INTRO MGRL ACCT LL W CONNECT

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning  Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning