Concept explainers

Applying

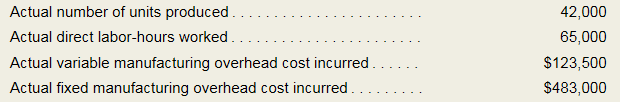

Lane Company manufactures a single product that requires a great deal of hand labor. Overhead cost is applied on the basis of standard direct labor-hours. The budgeted variable manufacturing overhead is $2 per direct labor-hour and the budgeted fixed manufacturing overhead is $480,000 per year.

The standard quantity of materials is 3 pounds per unit and the

Required:

- Compute the predetermined overhead rate for the year Break the rate down into variable and fixed elements.

- Prepare a standard cost card for the company’s product; show the details for all

manufacturing costs on your standard cost card. - Do the following:

- Compute the standard direct labor-hours allowed for the year’s production.

- Complete the following Manufacturing Overhead T-account for the year:

- Determine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead rate and efficiency variances and the fixed overhead budget and volume variances.

- Suppose the company had chosen 65,000 direct labor-hours as the denominator activity rather than 60,000 hours. State which, if any, of the variances computed in (4) above would have changed, and explain how the variance(s) would have changed. No computations are necessary.

1

The predetermined overhead rate for the year. Break the rate down into variable and fixed elements.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 11A.8P

Total direct labor cost is $10, variable overhead labor cost is $2, and Fixed overhead labor cost is $8.

Explanation of Solution

2

Prepare a standard cost card for the company’s product; show the details for all manufacturing cost on your standard cost card.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 11A.8P

Standard labor cost per unit is $54

Explanation of Solution

3

Compute the standard direct-labor allowed for the year’s production and complete manufacturing overhead T-account of the year.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 11A.8P

Standard direct labor hour is $63,000, under applied cost is $630,000, and over applied cost is $23,500

Explanation of Solution

Under applied cost is computed below:

Over applied cost is computed below:

4

The reason for any under applied and over applied overhead for the year.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 11A.8P

Variable overhead rate variance is $6,500, Variable overhead efficiency variance is $4,000, Budget variance is $3,000, and volume variance is $24,000.

Explanation of Solution

5

Direct-labor hours changed from 60,000 to 65,000 hours. Give explanation for change in variances.

Introduction: Overhead means the ongoing business expenses which are not directly incurred while producing product or service. Overhead is important while preparing budget but it is also used to determine the amount company must charge in order to incur profit.

Answer to Problem 11A.8P

Change in direct labor hours changed few cost and variances like variable overhead labor cost, fixed overhead budget variance and fixed overhead volume variance.

Explanation of Solution

If direct-labor hours would have been changed from 60,000 to 65,000 as denominators activity then following cost will be changed such as variable overhead labor cost, fixed overhead budget variance and fixed overhead volume variance.

Want to see more full solutions like this?

Chapter 11A Solutions

GEN COMBO MANAGERIAL ACCOUNTING FOR MANAGERS; CONNECT 1S ACCESS CARD

- ABC Inc. spent a total of $48,000 on factory overhead. Of this, $28,000 was fixed overhead. ABC Inc. had budgeted $27,000 for fixed overhead. Actual machine hours were 5.000. Standard hours for units made were 4,800. The standard variable overhead rate was $4.10. What is the variable overhead rate variance?arrow_forwardCalculating amount of factory overhead applied to work in process The overhead application rate for a company is 2.50 per unit, made up of 1.00 for fixed overhead and 1.50 for variable overhead. Normal capacity is 10,000 units. In one month, there was an unfavorable flexible budget variance of 200. Actual overhead for the month was 27,000. What was the amount of the budgeted overhead for the actual level of production?arrow_forwardRefer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forward

- Direct materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardCalculating factory overhead: two variances Munoz Manufacturing Co. normally produces 10,000 units of product X each month. Each unit requires 2 hours of direct labor, and factory overhead is applied on a direct labor hour basis. Fixed costs and variable costs in factory overhead at the normal capacity are 2.50 and 1.50 per direct labor hour, respectively. Cost and production data for May follow: a. Calculate the flexible-budget variance. b. Calculate the production-volume variance. c. Was the total factory overhead under- or overapplied? By what amount?arrow_forwardRefer to the data in Problem 9.34. Vet-Pro, Inc., also uses two different types of direct labor in producing the anti-anxiety mixture: mixing and drum-filling labor (the completed product is placed into 50-gallon drums). For each batch of 20,000 gallons of direct materials input, the following standards have been developed for direct labor: The actual direct labor hours used for the output produced in March are also provided: Required: 1. Compute the direct labor mix and yield variances. (Round standard price of yield to four significant digits.) 2. Compute the total direct labor efficiency variance. Show that the total direct labor efficiency variance is equal to the sum of the direct labor mix and yield variances. Vet-Pro, Inc., produces a veterinary grade anti-anxiety mixture for pets with behavioral problems. Two chemical solutions, Aranol and Lendyl, are mixed and heated to produce a chemical that is sold to companies that produce the anti-anxiety pills. The mixture is produced in batches and has the following standards: During March, the following actual production information was provided: Required: 1. Compute the direct materials mix and yield variances. 2. Compute the total direct materials usage variance for Aranol and Lendyl. Show that the total direct materials usage variance is equal to the sum of the direct materials mix and yield variances.arrow_forward

- Fitzgerald Company manufactures sewing machines, and they produced 2,500 this past month. The standard variable manufacturing overhead (M0H) rate used by the company is $6.75 per machine hour. Each sewing machine requires 13.5 machine hours. Actual machine hours used last month were 33,500, and the actual variable MOH rate last month was $7.00. Calculate the variable overhead rate variance and the variable overhead efficiency variance.arrow_forwardAt the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardProblem 2. Each of the following independent situations relates to direct labor. Fill in the blanks. A в C Units produced 4,000 1,900 3,000 Actual hours worked Standard hours for 8,400 2,000 6,000 production achieved Standard hours per unit Standard rate per hour Actual labor cost 0.5 P10 3 P12 P12 P83,600 P24,500 Rate variance P310U P900U P300F Efficiency variance P2,000U P1,800F P800 Uarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning