Sell or Process Further Decisions

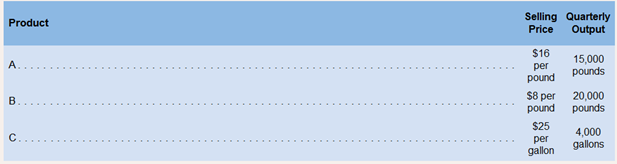

Dorsey Company manufactures three products from a common input in a joint processing operation Joint

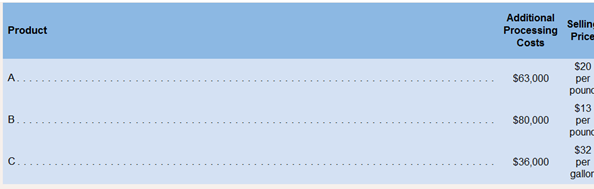

Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and imit selling prices after further processing are given below:

Required:

What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-oil point

2. Based on analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Introduction To Managerial Accounting

- Sell or Process Further, Basic Analysis Shenista Inc. produces four products (Alpha, Beta, Gamma, and Delta) from a common input. The joint costs for a typical quarter follow: The revenues from each product are as follows: Alpha, 100,000; Beta, 93,000; Gamma, 30,000; and Delta, 40,000. Management is considering processing Delta beyond the split-off point, which would increase the sales value of Delta to 75,000. However, to process Delta further means that the company must rent some special equipment that costs 15,400 per quarter. Additional materials and labor also needed will cost 8,500 per quarter. Required: 1. What is the operating profit earned by the four products for one quarter? 2. CONCEPTUAL CONNECTION Should the division process Delta further or sell it at split-off? What is the effect of the decision on quarterly operating profit?arrow_forwardVenezuela Oil Inc. transports crude oil to its refinery where it is processed into main products gasoline, kerosene, and diesel fuel, and by-product base oil. The base oil is sold at the split-off point for $1,000,000 of annual revenue, and the joint processing costs to get the crude oil to split-off are $10,000,000. Additional information includes: Required: Determine the allocation of joint costs using the net realizable value method, rounding the sales value percentages to the nearest tenth of a percent. (Hint: Reduce the amount of the joint costs to be allocated by the amount of the by-product revenue.)arrow_forwardBreegle Company produces three products (B-40, J-60, and H-102) from a single process. Breegle uses the physical volume method to allocate joint costs of 22,500 per batch to theproducts. Based on the following information, which product(s) should Breegle continue toprocess after the split-off point in order to maximize profit? a. B-40 only b. J-60 only c. H-102 only d. B-40 and H-102 onlyarrow_forward

- Computing joint costssales value at split-off and net realizable value methods D.L. Manufacturing Inc.s joint cost of producing 1,000 units of Product A, 500 units of Product B, and 500 units of Product C is 20,000. The unit sales values of the three products at the split-off point are Product A20, Product B200, and Product C160. Ending inventories include 100 units of Product A, 200 units of Product B, and 300 units of Product C. a. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their sales value at split off. b. Assume that Product C can be sold for 200 a unit if it is processed after split-off at a cost of 25 a unit. Compute the amount of joint cost that would be included in the ending inventory valuation of the three products on the basis of their net realizable values.arrow_forwardJoint cost allocation market value at split-off method Sugar Sweetheart, Inc., jointly produces raw sugar, granulated sugar, and caster sugar. After the split-off point, raw sugar is immediately sold for 0.20 per pound, while granulated and castersugar are processed further. The market value of the granulated sugar and caster sugar is estimatedto both be 0.25 at the split-off point. One batch of joint production costs 1,640 and yields 3,000pounds of raw sugar, 3,600 pounds of granulated sugar, and 2,000 pounds of caster sugar at thesplit-off point. Allocate the joint costs of production to each product using the market value atsplit-off method.arrow_forwardClarion Industries produces two joint products, Y and Z. Prior to the split-off point, the company incurred costs of $36,000. Product Y weighs 25 pounds and product Z weighs 75 pounds. Product Y sells for $150 per pound and product Z sells for $125 per pound. Based on a physical measure of output, allocate joint costs to products Y and Z.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,