Concept explainers

Make or Buy Decision

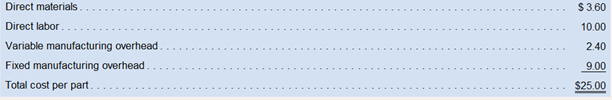

Han Products manufactures 30,000 units of part S-6 each year for use on its production line. At this level of activity, the cost per unit for part S-6 is:

An outside supplier has offered to sell 30,000 units of part S-6 each year to Han Products for $21 per part. If Han Products accepts this offer, the facilities now being used manufacture part S-6 could be rented to another company at an annual rental of $80,000. However, Han Products has determined that two-thirds of the fixed manufacturing

Required:

What is the financial advantage (disadvantage) of accepting the outside supplier’s offer?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Introduction To Managerial Accounting

- Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)arrow_forwardHahn Manufacturing purchases a key component of one of its products from a local supplier. The current purchase price is $1,500 per unit. Efforts to standardize parts succeeded to the point that this same component can now be used in five different products. Annual component usage should increase from 150 to 750 units. Management wonders whether it is time to make the component in-house rather than to continue buying it from the supplier. Fixed costs would increase by about $40,000 per year for the new equipment and tooling needed. The cost of raw materials and variable overhead would be about $1,100 per unit, and labor costs would be $300 per unit produced. so What other considerations might be important?arrow_forwardBBB Company has capacity to produce 150,000 units a year and sell it for $96 each. The costs of producing and selling 150,000 units are as follows (attached) Required 1. Suppose BBB is currently producing and selling 120,000 units. At this level of production and sales, its fixed costs are the same as given in the preceding table. WWW Company wants to place a onetime special order for 30,000 units at $75 each. Should BBB accept this one-time special order? Show your calculations. 2. Suppose BBB is currently producing and selling 150,000 units. (a) should BBB accept WWW offer one-time special order? Show your calculations. (b) at what price would BBB be indifferent between accepting the special order and continuing to sell to its regular customers at $96 per unit.arrow_forward

- please need answerarrow_forwardRakesharrow_forwardABC Company (ABC) currently produces 6,000 units of M1 (a component uses in many electric appliances) per year under normal capacity and sells M1 at $66 per unit. The company is considering the possibility to buy a similar component from an outside supplier. If ABC accepts the supplier’s offer, all variable manufacturing costs will be eliminated, but 60% of the fixed manufacturing overhead will have to be absorbed by other products. The released factory equipment could be used to produce a net income of $66,000. The cost to produce M1 is as follows.Direct materials $105,000 Direct labor $45,000Total overhead $90,000. The total overhead costs include variable handling costs of $5 per unit. The remainder of the overhead costs consists of 10% variable costs and 90% fixed costs. A very good foreign manufacturer, 3Z Company (3Z) has offered to sell the component at $36 per unit, plus $0.5 shipping cost per unit. GQ Company (GQ), a new local manufacturer, has alsooffered to…arrow_forward

- Two alternative suppliers are offering to provide a system to recover an organic compound from a process stream in your company's chemical production facility. The cost of the two identical options are quoted as follows: Supplier #1: Total cost of $175,000; 70% of which must be paid now, and the balance to be paid in 12 months time upon completion of the installation of the system. Supplier #2: Total price of $180,000; 25% to be paid now, and the balance to be paid in 3 equal installments at 4 month intervals. You are asked to proceed with the project using the lower cost supplier. Assuming a nominal annual interest rate of 12%, compounded monthly, which one do you choose?arrow_forwardRegis Company manufactures plugs at a cost of $36 per unit, which includes $8 of fixed overhead. Regis needs 30,000 of these plugs annually (as part of a larger product it produces). Orlan Company has offered to sell these units to Regis at $33 per unit. If Regis decides to purchase the plugs, $60,000 of the annual fixed overhead cost will be eliminated, and the company may be able to rent the facility previously used for manufacturing the plugs. If Regis Company purchases the plugs but does not rent the unused facility, the company would:arrow_forwardDivision Y has asked Division X of the same company to supply it with 5,600 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $36 per unit. Division X has the capacity to produce 22,400 units of part L763 per year. Division X expects to sell 20,160 units of part L763 to outside customers this year at a price of $37.60 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $28 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 5,600 parts this year from Division X to Division Y? (Round your final answers…arrow_forward

- Division Y has asked Division X of the same company to supply it with 6,200 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $39 per unit. Division X has the capacity to produce 24,800 units of part L763 per year. Division X expects to sell 22,320 units of part L763 to outside customers this year at a price of $41.20 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $31 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 6,200 parts this year from Division X to Division Y? Note: Round your final…arrow_forwardDivision G has asked Division F of the same company to supply it with 5,000 units of part WD26 this year to use in one of its products. Division G has received a bid from an outside supplier for the parts at a price of $19.00 per unit. Division F has the capacity to produce 25,000 units of part WD26 per year. Division F expects to sell 21,000 units of part WD26 to outside customers this year at a price of $18.00 per unit. To fill the order from Division G, Division F would have to cut back its sales to outside customers. Division F produces part WD26 at a variable cost of $12.00 per unit. The cost of packing and shipping the parts for outside customers is $2.00 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division G. 1.What is the lowest price the F Division should charge for the internal transfers of its goods? 2.What is the highest price the G Division should charge for the internal transfers of its goods?arrow_forwardDivision Y has asked Division X of the same company to supply it with 8,400 units of part L763 this year to use in one of its products. Division Y has received a bid from an outside supplier for the parts at a price of $50 per unit. Division X has the capacity to produce 33,600 units of part L763 per year. Division X expects to sell 30,240 units of part L763 to outside customers this year at a price of $54.40 per unit. To fill the order from Division Y, Division X would have to cut back its sales to outside customers. Division X produces part L763 at a variable cost of $42 per unit. The cost of packing and shipping the parts for outside customers is $2 per unit. These packing and shipping costs would not have to be incurred on sales of the parts to Division Y. Required: a. What is the range of transfer prices within which both the Divisions' profits would increase as a result of agreeing to the transfer of 8,400 parts this year from Division X to Division Y? (Round your final answers…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning