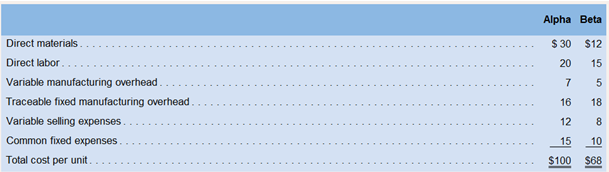

Cane Company manufactures two products called A1pia d Beta that sell for $120 and $80, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity produce 100,000 units of each product. Its average cost per unit for each product at this level of activity are given below:

The company considers its traceable fixed manufacturing

Required:

(Answer each question independently unless instructed otherwise.)

Assume that Cane expects to produce and sell 95,000 Alphas dining the current vex. One of Cane’s sales representatives has found a new customer who is willing to buy 10,000 additional Alphas for a price of $80 per emit; however pursuing this opportunity will decrease Alpha sales to regular customers by 5,000 units. What is the financial advantage (disadvantage) of accepting the new customer’s order?

Concept Introduction:

Financial advantage (disadvantage): Financial advantage (disadvantage) refers to the incremental profit or loss, a company will earn in situations like acceptance of a special order, dropping of a business line, etc.

It is calculated by only considering the relevant costs. The incremental revenues and incremental costs are taken together to calculate financial advantage or disadvantage. Financial advantage refers to incremental net operating income and financial disadvantage refers to incremental net operating loss.

To calculate:

Financial advantage (disadvantage) of accepting the new customer’s order for Alpha

Answer to Problem 5F15

Solution:

The financial disadvantage of accepting the new customer’s order for Alpha is $ 145,000.

Explanation of Solution

The incremental net operating profit (loss) is the difference between incremental revenues and costs.

| Alpha - Incremental Net operating profit (Loss) (in $) | ||

| Incremental Revenue ( $ 80/ unit X 10,000 additional units) | 800,000 | |

| Less: | ||

| Incremental costs - | ||

| Direct material ( $ 30/ units X 10,000 additional units) | 300,000 | |

| Direct labor ( $ 20/ unit X 10,000 additional units) | 200,000 | |

| Variable manufacturing overhead ( $ 7/ unit X 10,000 additional units) | 70,000 | |

| Variable selling expenses ( $ 12/ unit X 10,000 additional units) | 120,000 | |

| Total incremental costs | (690,000) | |

| Less: Foregone Sales revenue due to acceptance of order ( $ 120 per unit X 5,000 units ) | (600,000) | |

| Add: Decrease in costs related to the sales forgone | 345,000 | |

| Alpha - Incremental net operating income (Loss) | (145,000) | |

Given, the information for the product Alpha −

- Additional sales units = 10,000 units

- Selling price per unit = $ 80 per unit

- Direct Material per unit = $ 30 per unit

- Direct Labor per unit = $ 20 per unit

- Variable manufacturing overhead per unit = $ 7 per unit

- Variable selling expenses per unit = $ 12 per unit

- Foregone number of units due to acceptance of offer = 5,000 units

- Sales price per unit for regular sales = $ 120 per unit

Calculations:

- Incremental revenue

- Incremental costs

- Foregone Sales revenue due to acceptance of offer

- Decrease in cost due to sales forgone −

- Incremental Net operating income (Loss)

Thus, the financial disadvantage of accepting the new customer’s order for Alpha = $ 145,000.

Want to see more full solutions like this?

Chapter 11 Solutions

Introduction To Managerial Accounting

- Multiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardNonearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education