Concept explainers

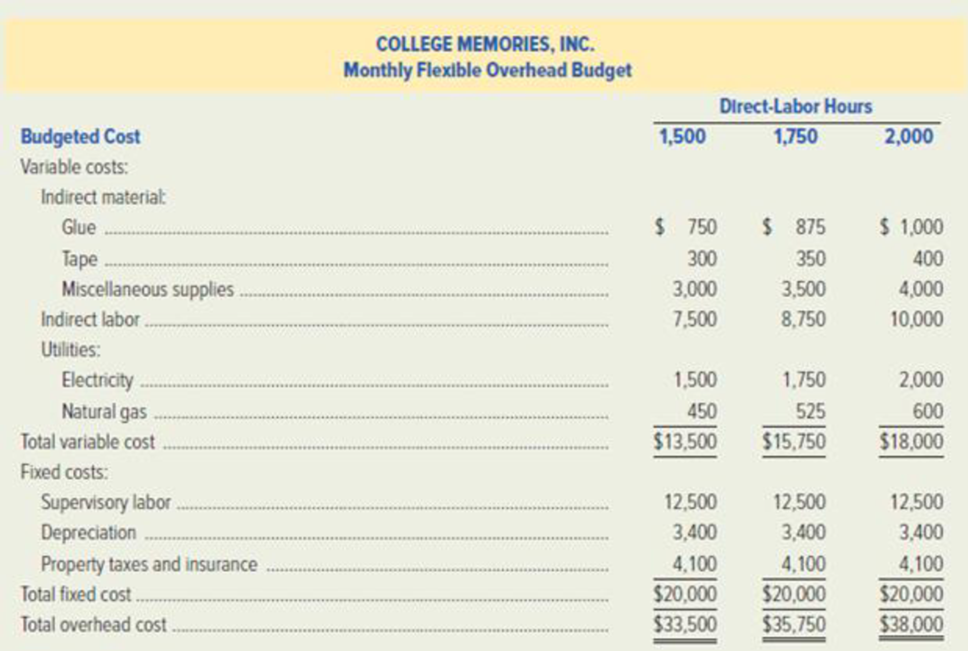

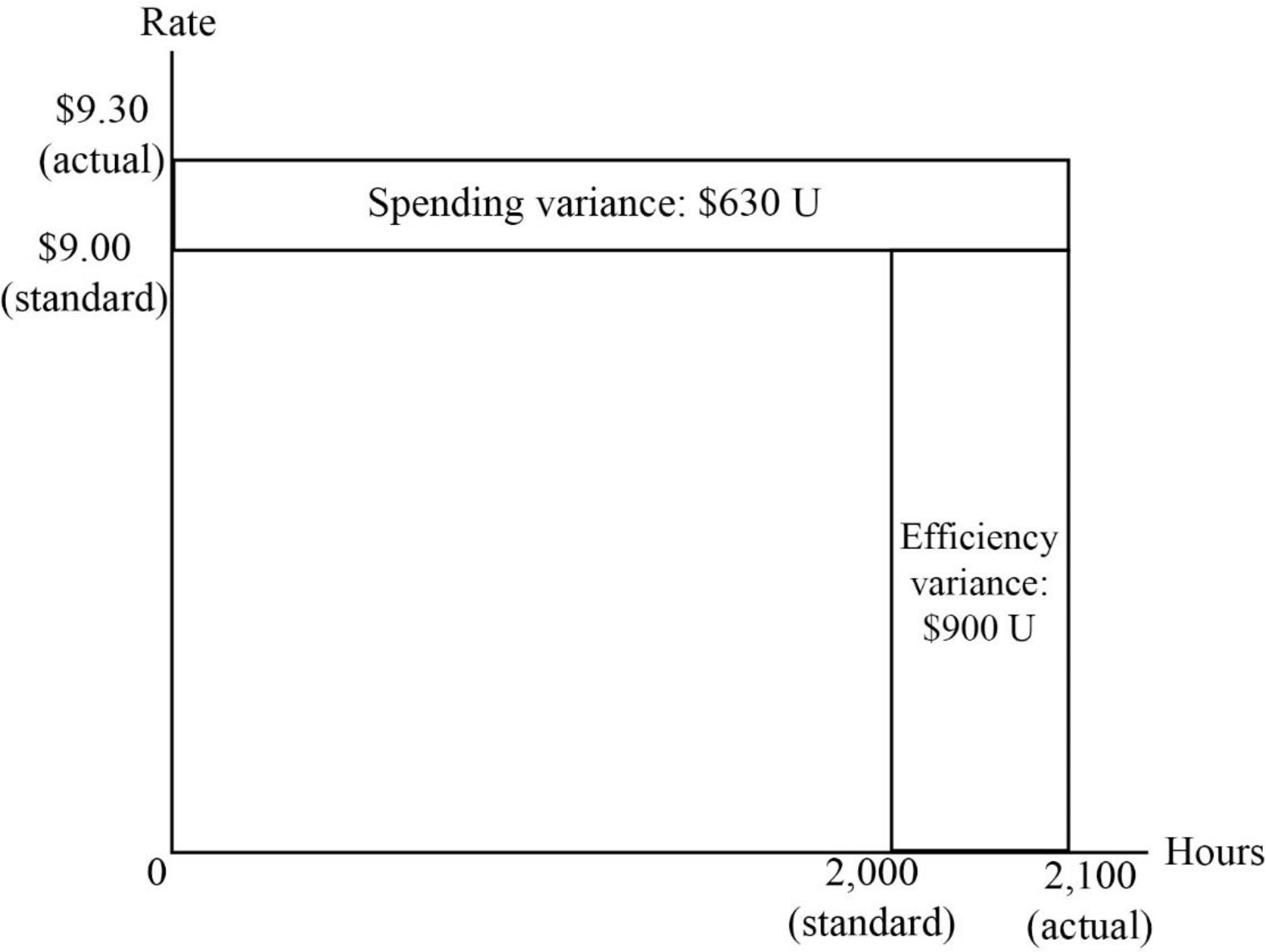

College Memories, Inc. publishes college yearbooks. A monthly flexible

The planned monthly production is 6,400 yearbooks. The standard direct-labor allowance is .25 hour per book and overhead is budgeted and applied on the basis of direct-labor hours. During February, College Memories, Inc. produced 8.000 yearbooks and actually used 2,100 direct-labor hours. The actual overhead costs for the month were as follows:

Required:

- 1. Determine the formula-style flexible overhead budget for College Memories. Inc.

- 2. Prepare a display similar to Exhibit 11–6, which shows College Memories’ variable-overhead variances for February. Indicate whether each variance is favorable or unfavorable.

- 3. Draw a graph similar to Exhibit 11–7, which shows College Memories’ variable-overhead variances for February.

- 4. Interpret each of the variances computed in requirement (2).

- 5. Prepare a display similar to Exhibit 11–8, which shows College Memories’ fixed-overhead variances for February.

- 6. Draw a graph similar to Exhibit 11–9, which depicts the company’s applied and budgeted fixed overhead for February. Show the firm’s February volume variance on the graph.

- 7. Interpret each of the variances computed in requirement (5).

- 8. Prepare

journal entries to record each of the following:- Incurrence of February’s actual overhead cost.

- Application of February’s overhead cost to Work-in-Process Inventory.

- Close underapplied or overapplied overhead into Cost of Goods Sold.

- 9. Draw T-accounts for all of the accounts used in the journal entries of requirement (8). Then

post the journal entries to the T-accounts.

1.

Compute the formula-style flexible overhead budget for incorporation C.

Explanation of Solution

Flexible Budget: A flexible budget is a budget that is prepared for different levels of the output. In other words, it is a budget that adjusts according to the changes in the volume of the activity. The main purpose of preparing flexible budget is to determine the differences among standard and actual result.

The formula-style flexible overhead budget for incorporation C is as follows:

Working note (1):

Compute the standard variable-overhead rate:

Note: X denotes the activity measured in direct-labor hours.

2.

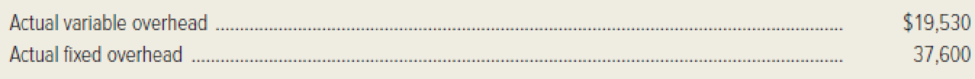

Prepare a diagram showing variable-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable.

Explanation of Solution

Prepare a diagram showing variable-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable as follows:

Figure (1)

Working note (2):

Compute the actual variable overhead rate:

Note:

Variable overhead applied to work-in-process is not used to compute the variances. However, it is included to point out that the flexible-budget amount for variable overhead of $18,000, is the amount that will be applied to Work-in-Process inventory for product.

3.

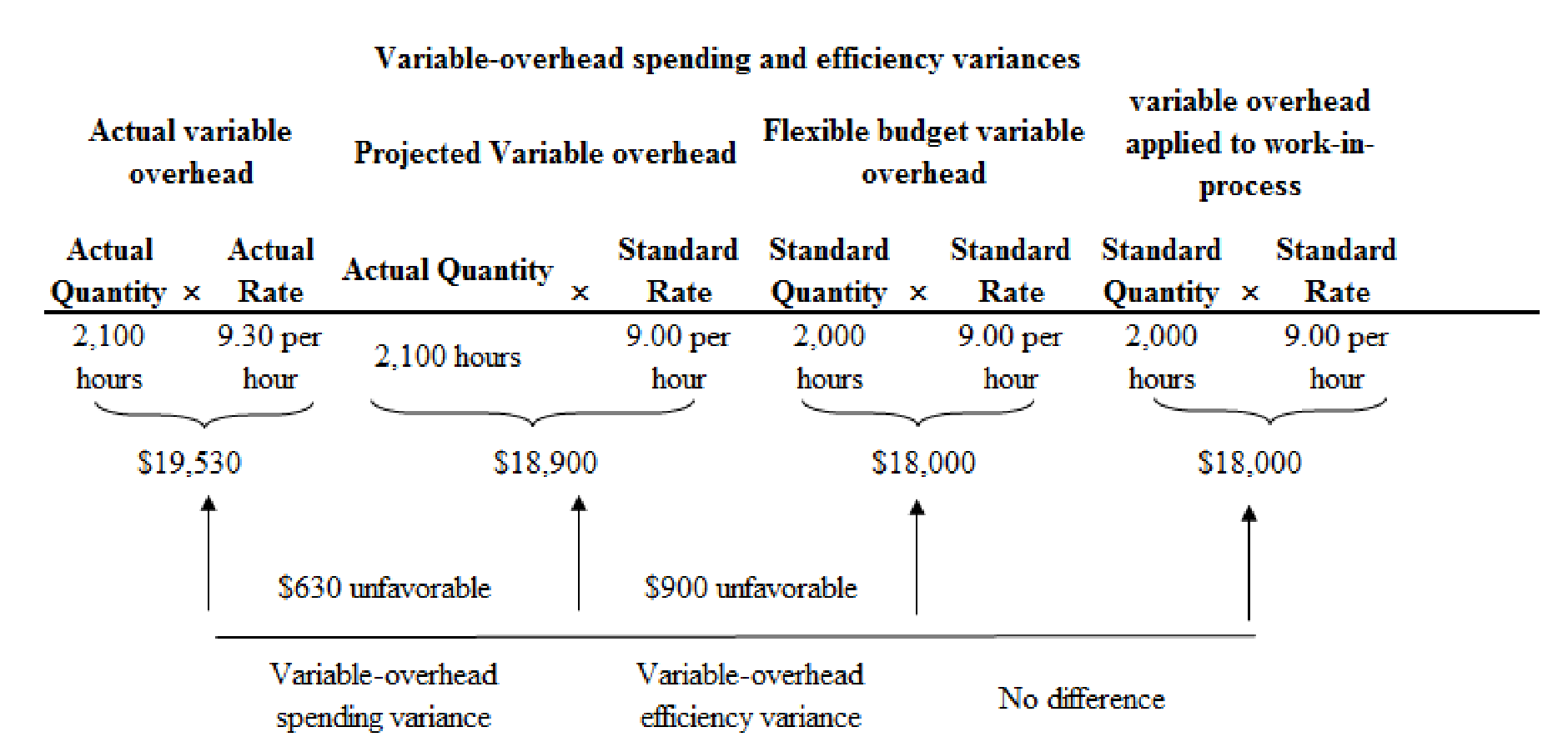

Draw a graph showing variable-overhead variances for the month of February.

Explanation of Solution

Draw a graph showing variable-overhead variances for the month of February as follows:

Figure (2)

4.

Interpret each variances calculated in requirement (2).

Explanation of Solution

- The variable-overhead spending is $630 and it is an unfavorable variance, which indicates that the company has spent more money on variable overhead in the month of February than it should have been spent, for 2,100 direct-labor hours that were used. This is the control variance for variable overhead.

- In this case, the actual direct-labor hours of February exceed the standard allowed direct-labor hours hence it results in a an unfavorable variable-overhead efficiency variance of $900. Thus, the variable-overhead efficiency variance will not disclose any information about the efficiency with which variable-overhead items such as electricity are used. Instead, it results from inefficiency or efficiency, in relation to the standards, in the usage of the cost driver (such as direct-labor hours).

5.

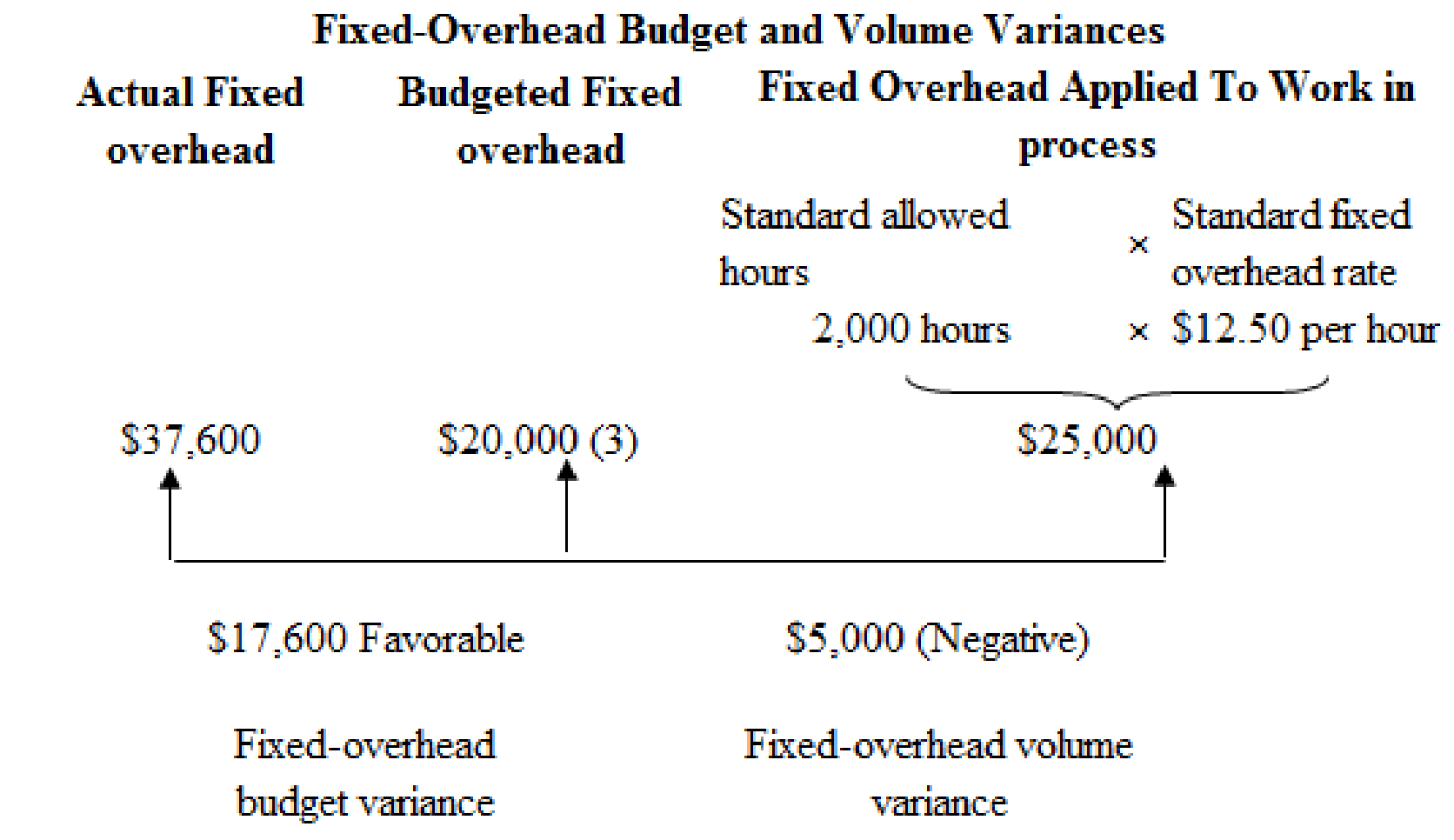

Prepare a diagram showing fixed-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable.

Explanation of Solution

Prepare a diagram showing fixed-overhead variances for the month of February and indicate whether each variance is favorable or unfavorable as follows:

Figure (3)

Working note (3):

Compute the standard fixed overhead rate:

Note: Some accountants would designate a positive volume variance as "unfavorable" and a negative volume variance as "favorable.

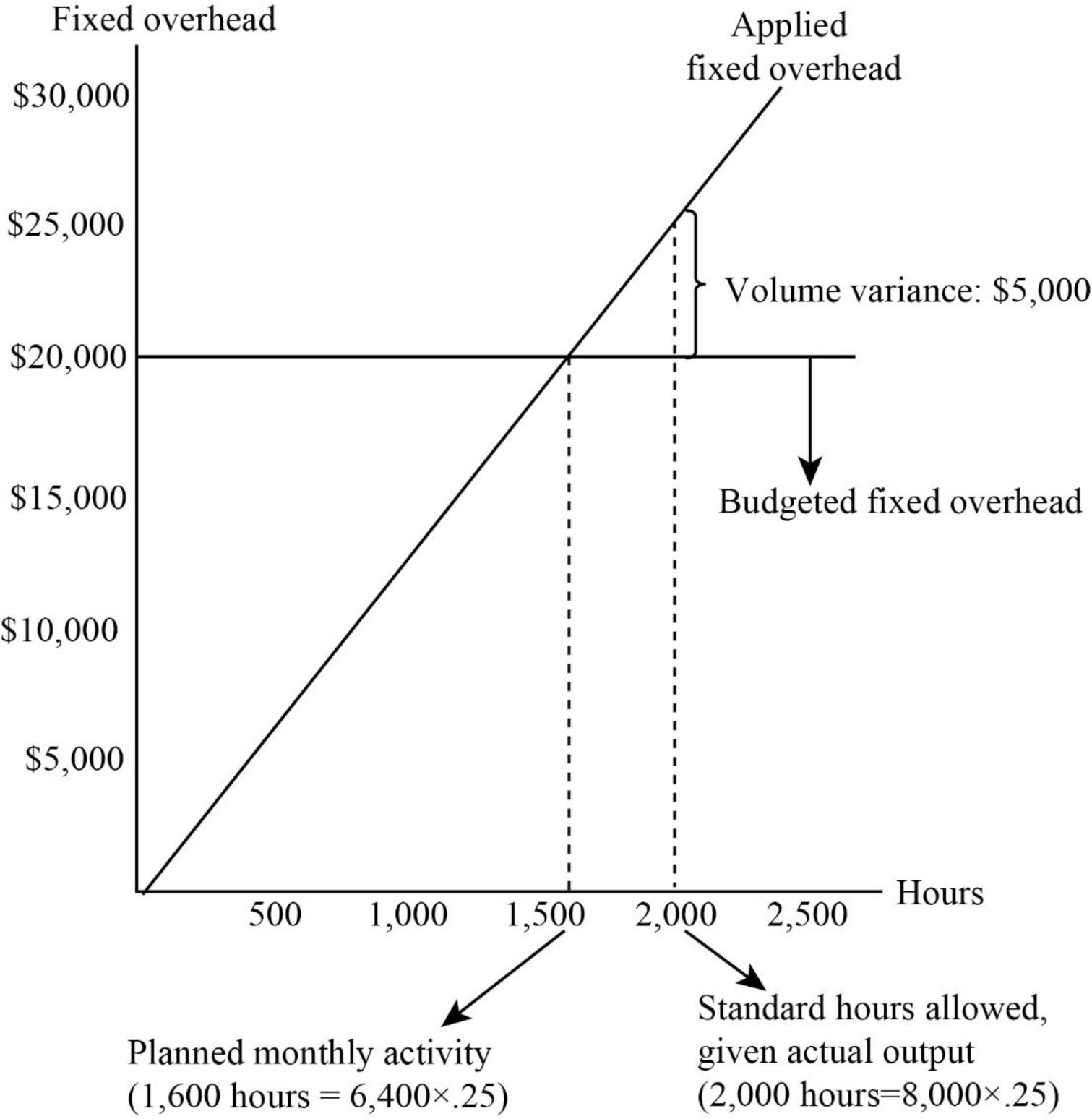

6.

Draw a graph that portrays the company’s applied overhead and budgeted fixed overhead for the month of February, also show the firm’s February volume variance on the graph.

Explanation of Solution

Draw a graph that portrays the company’s applied overhead and budgeted fixed overhead for the month of February, also show the firm’s February volume variance on the graph:

Figure (4)

7.

Interpret each variances ascertained in requirement (5).

Explanation of Solution

- In this case, the actual fixed overhead exceeded the budgeted fixed overhead by $17,600. Hence, there is an unfavorable fixed-overhead budget variance of $17,600.

- The volume variance is the difference between budgeted monthly fixed overhead ($20,000) and the applied fixed overhead ($25,000). The budgeted fixed overhead is used for planning and controlling purposes whereas, the applied fixed overhead graph is used for product costing purposes. In this case, the applied fixed overhead exceeds the budgeted fixed overhead hence there is a negative volume variance of $5,000.

8.

Prepare journal entries to record the given transaction.

Explanation of Solution

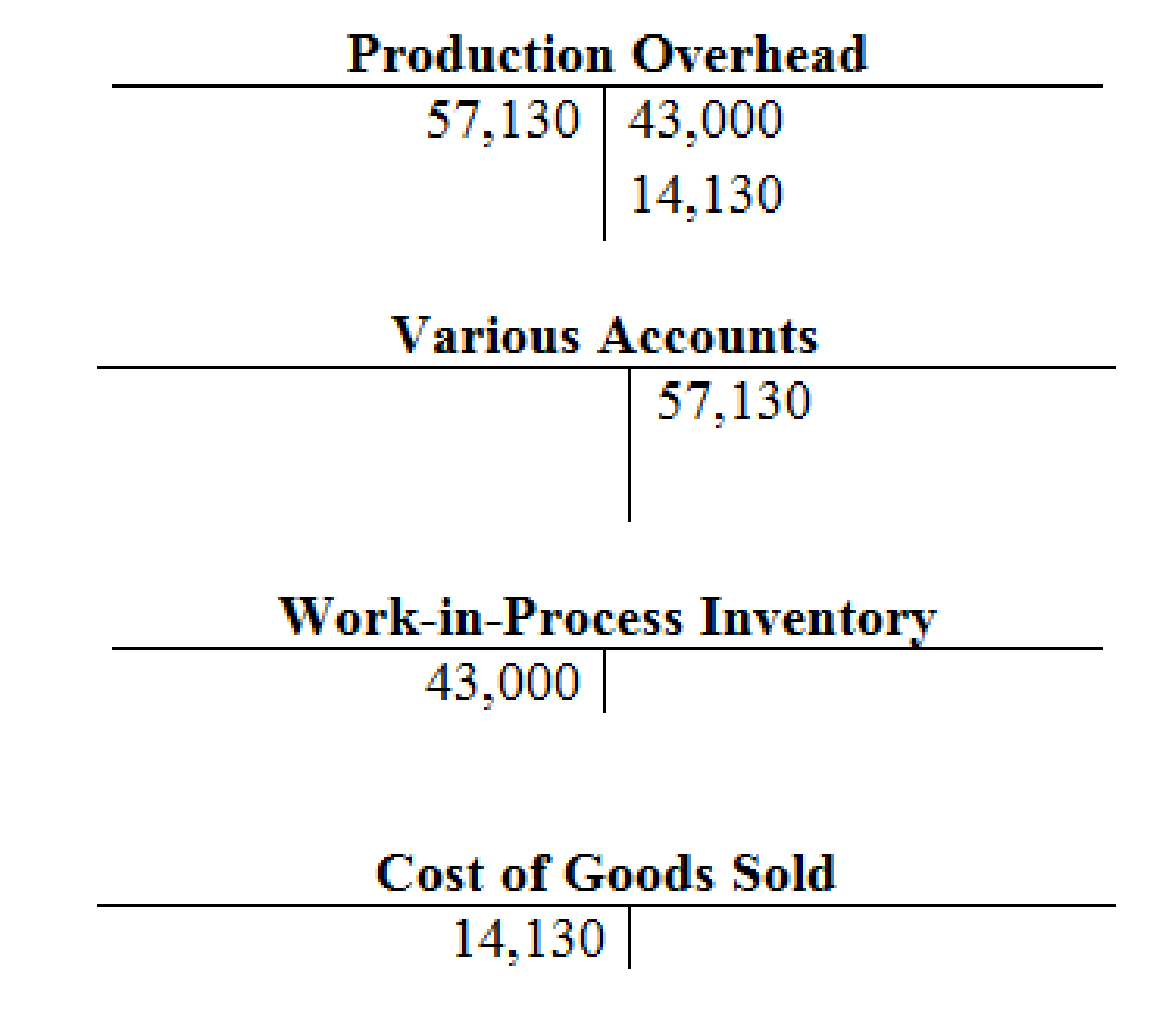

- Prepare journal entry to record the actual overhead costs:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Production overhead (4) | 57,130 | ||

| Various Accounts | 57,130 | ||

| (To record the actual overhead costs) |

Table (1)

- Production overhead is an asset account and it increases the value of an asset. Hence, debit production overhead account with $57,130.

- A various account is an asset account, and it decreases the value of an assets. Hence, credit the various account with $57,130.

Working note (4):

Calculate the raw materials inventory:

- Prepare journal entry to record the work-in-process inventory:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (5) | 43,000 | ||

| Production overhead | 43,000 | ||

| (To record the applied production overhead) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $43,000.

- Production overhead is an asset account and it decreases the value of an asset. Hence, credit production overhead account with $43,000.

Working note (5):

Prepare journal entry to record the cost of goods sold:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Cost of goods sold | 14,130 | ||

| Production Overhead | 14,130 | ||

| (To record the under-applied overhead into cost of goods sold) |

Table (3)

- Cost of goods sold is an expense account and it decreases the value of stockholder’s equity. Hence, debit the cost of goods sold account with $14,130.

- Production overhead is an asset account and it decreases the value of an asset. Hence, credit production overhead account with $14,130.

9.

Draw T-accounts for the journal entries given in requirement (8).

Explanation of Solution

Draw T-accounts for the journal entries given in requirement (8) as follows:

Figure (5)

Want to see more full solutions like this?

Chapter 11 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump follows: Thalassines Kataskeves, S.A. Income Statement—Bilge Pump For the Quarter Ended March 31 Sales $ 410,000 Variable expenses: Variable manufacturing expenses $ 123,000 Sales commissions 50,000 Shipping 21,000 Total variable expenses 194,000 Contribution margin 216,000 Fixed expenses: Advertising (for the bilge pump product line) 27,000 Depreciation of equipment (no resale value) 120,000 General factory overhead 38,000* Salary of product-line manager 113,000 Insurance on inventories 5,000 Purchasing department 49,000† Total fixed expenses 352,000 Net operating loss $ (136,000) *Common costs allocated on the basis of machine-hours. †Common costs allocated on the basis of…arrow_forwardDo companies maintain two sets of depreciation schedules, one for financial reporting and the other one for tax purposes?arrow_forwardnone ??arrow_forward

- Need help with this accounting questionsarrow_forwardCarichem Company produces sanitation products after processing specialized chemicals. The following relates to its activities: 1 Kilogram of chemicals purchased for $4000 and with an additional $2000 is processed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, a gram of Crystal can be sold for $2 and the Cleaning agent can be sold for $8 per litre. At an additional cost of $800, Carichem can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $4 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $600 and made into 200 packs of Softener that can be sold for $4 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carichem have processed each of the products further? What effect does the allocation method have on this decision?arrow_forwardGeneral accountingarrow_forward

- Allocate the two support departments’ costs to the two operating departments using the following methods: a. Direct method b. Step-down method (allocate HR first) c. Step-down method (allocate IS first) d. The Algebraic method.arrow_forwardCan you help me with accounting questionsarrow_forwardFinancial accounting question not use ai please don'tarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,