Concept explainers

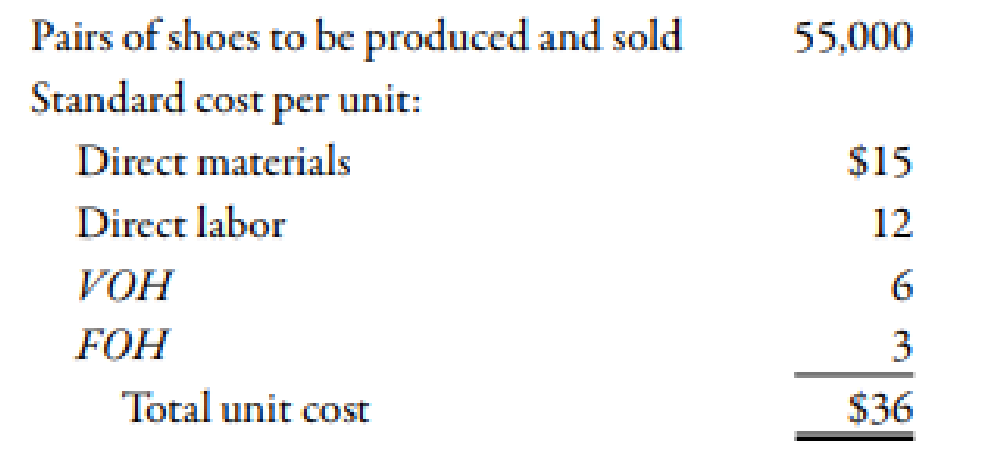

Shumaker Company manufactures a line of high-top basketball shoes. At the beginning of the year, the following plans for production and costs were revealed:

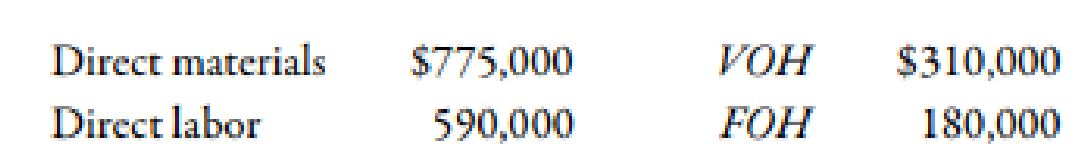

During the year, a total of 50,000 units were produced and sold. The following actual costs were incurred:

There were no beginning or ending inventories of raw materials. In producing the 50,000 units 63,000 hours were worked, 5% more hours than the standard allowed for the actual output.

Required:

- 1. Using a flexible budget, prepare a performance report comparing expected costs for the actual production with actual costs.

- 2. Determine the following: (a) Fixed overhead spending and volume variances and (b) Variable overhead spending and efficiency variances.

1.

Construct the performance report by comparing the expected costs for the actual production with actual costs with the help of flexible budget.

Explanation of Solution

Flexible Budgets:

Flexible budgets are prepared for various levels of activities or outputs. This enables the entity to know the result for the selected level of activity.

Performance report of the variances:

| Budgeted variance | |||

| Overhead cost item |

Actual cost (A) ($) |

Actual Costs (B) ($) |

Spending variance ($) |

| Direct material | 775,000 | 750,0001 | 25,000 (U) |

| Direct labor | 590,000 | 600,0002 | 10,000 (F) |

| Variable overhead | 310,000 | 300,0003 | 10,000 (U) |

| Fixed overhead | 180,000 | 165,0004 | 15,000 (U) |

| Total | 1,855,000 | 1,815,000 | 40,000 (U) |

Table (1)

Working Note:

1. Calculation of actual cost of direct material:

2. Calculation of actual cost of direct labor:

3. Calculation of actual cost of variable overhead:

4. Calculation of actual cost of fixed overhead:

2.

Calculate the value of fixed overhead spending and volume variance. Also, calculate the value of variable overhead spending and efficiency variance.

Explanation of Solution

(a).

Use the following formula to calculate fixed overhead spending variance:

Substitute $180,000 for actual fixed overhead and $165,000 for budgeted fixed overhead in the above formula.

Therefore, the fixed overhead spending variance is $15,000 (U).

Use the following formula to calculate volume variance:

Substitute $165,000 for budgeted fixed overhead, $2.50 for fixed overhead rate and $60,000 for standard hours in the above formula.

Therefore, the volume variance is $15,000 (U).

(b).

Use the following formula to calculate variable overhead spending variance:

Substitute $310,000 for actual overhead, $5.00 for standard variable overhead and 63,000 hours for actual hours in the above formula.

Therefore, the variable overhead spending variance is $5,000 (F).

Use the following formula to calculate variable efficiency variance:

Substitute 63,000 hours for actual hours, 60,000 hours for standard hours and $5.00 for applied variable overhead in the above formula.

Therefore, the efficiency variance is $15,000 (U).

Working Note:

1. Calculation of standard hours:

2. Calculation of fixed overhead rate:

First, hours allowed computed so as calculating the fixed overhead rate:

3. Calculation of variable overhead rate

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Please give me true answer this financial accounting questionarrow_forwardNeed help with this financial accounting questionarrow_forwardFor the purposes of the 20x0 annual financial statements, how would the additional shares of Series A preferred stock issued from Company Y to Company Y's original investor on November 1 20X0 affect the measurment of the company Y's series A preferred stock purchased on may 1, 20x0?arrow_forward

- Suppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forwardSuppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forwardSuppose you have an investment account that earns an annual 9% interest rate, compounded monthly. It took $500 to open the account, so your opening balance is $500. You choose to make fixed monthly payments of $230 to the account each month. Complete the table below to track your savings growth. Months Amount in account (Principal) 9% Interest gained (Remember to divide by 12 for monthly interest) Monthly Payment 1 2 3 $500 $230 $230 $230 $230 + $230 $230 10 6 $230 $230 8 9 $230 $230 10 $230 11 $230 12 What is the total amount gained in interest over this first year of this investment plan?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub