The Two Cost Systems

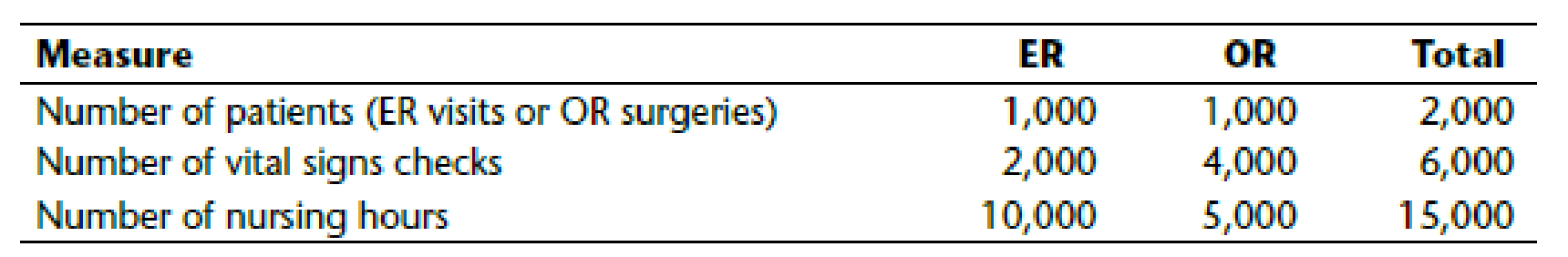

Sacred Heart Hospital (SHH) faces skyrocketing nursing costs, all of which relate to its two biggest nursing service lines—the Emergency Room (ER) and the Operating Room (OR). SHH’s current cost system assigns total nursing costs to the ER and OR based on the number of patients serviced by each line. Total hospital annual nursing costs for these two lines are expected to equal $300,000. The table below shows expected patient volume for both lines.

After discussion with several experienced nurses, Jack Bauer (SHH’s accountant) decided that assigning nursing costs to the two service lines based on the number of times that nurses must check patients’ vital signs might more closely match the underlying use of costly hospital resources. Therefore, for comparative purposes, Jack decided to develop a second cost system that assigns total nursing costs to the ER and OR based on the number of times nurses check patients’ vital signs. This system is referred to as the “vital-signs costing system.” The earlier table also shows data for vital signs checks for lines.

Calculate the amount of nursing costs that the vital-signs costing system assigns to the ER and to the OR.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- Waiting for your solution general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardNeither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows: Income: Joe's salary $ 144,100 Jessie's craft sales 18,400 Interest from certificate of deposit 1,650 Interest from Treasury bond funds 716 Interest from municipal bond funds 920 Expenditures: Federal income tax withheld from Joe's wages $ 13,700 State income tax withheld from Joe's wages 6,400 Social Security tax withheld from Joe's wages 7,482 Real estate taxes on residence 6,200 Automobile licenses (based on weight) 310 State sales tax paid 1,150 Home mortgage interest 26,000 Interest on Masterdebt credit card 2,300 Medical expenses (unreimbursed) 1,690 Joe's employee expenses (unreimbursed) 2,400 Cost of…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning