Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 5EB

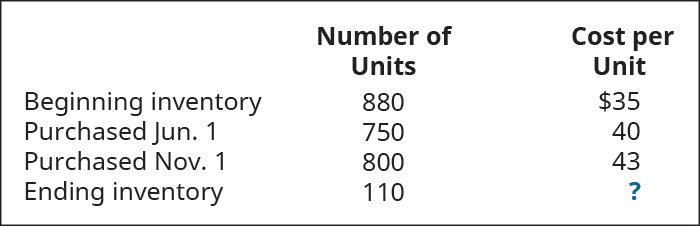

Bleistine Company had the following transactions for the month.

Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations.

A. first-in, first-out (FIFO)

B. last-in, first-out (LIFO)

C. weighted average (AVG)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000.

The unadjusted balances of selected accounts at December 31, 2023 are as follows:

Accounts receivable

$

300,000

Allowance for doubtful accounts (debit)

10,000

Sales revenue (including 80 percent in sales on account)

800,000

Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts.

Required:

1. Prepare the journal entries to record all the transactions during 2022 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)…

Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices.

Use the calculator to adjust the sample size statement.

Use the agreed-upon sample size in Buhi's contract: 996.

In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate.

Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size.

The caveats from Buhi are that you must:

Use the market research standard for your confidence level.

Use a confidence interval that is better than the market research standard for your confidence interval.

The partnership of Keenan and Kludlow paid the following wages during this year:

Line Item Description

Amount

M. Keenan (partner)

$108,000

S. Kludlow (partner)

96,000

N. Perry (supervisor)

54,700

T. Lee (factory worker)

35,100

R. Rolf (factory worker)

27,200

D. Broch (factory worker)

6,300

S. Ruiz (bookkeeper)

26,000

C. Rudolph (maintenance)

5,200

In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following:

ound your answers to the nearest cent.

a. Net FUTA tax for the partnership for this year

b. SUTA tax for this year

Chapter 10 Solutions

Principles of Accounting Volume 1

Ch. 10 - If a company has four lots of products for sale,...Ch. 10 - If a company has three lots of products for sale,...Ch. 10 - When inventory items are highly specialized, the...Ch. 10 - If goods are shipped FOB destination, which of the...Ch. 10 - On which financial statement would the merchandise...Ch. 10 - When would using the FIFO inventory costing method...Ch. 10 - Which accounting rule serves as the primary basis...Ch. 10 - Which type or types of inventory timing system...Ch. 10 - Which of these statements is false? A. If cost of...Ch. 10 - Which inventory costing method is almost always...

Ch. 10 - Which of the following describes features of a...Ch. 10 - Which of the following financial statements would...Ch. 10 - Which of the following would cause periodic ending...Ch. 10 - Which of the following indicates a positive trend...Ch. 10 - What is meant by the term gross margin?Ch. 10 - Can a business change from one inventory costing...Ch. 10 - Why do consignment arrangements present a...Ch. 10 - Explain the difference between the terms FOB...Ch. 10 - When would a company use the specific...Ch. 10 - Explain why a company might want to utilize the...Ch. 10 - Describe the goal of the lower-of-cost-or-market...Ch. 10 - Describe two separate and distinct ways to...Ch. 10 - Describe costing inventory using first-in,...Ch. 10 - Describe costing inventory using last-in,...Ch. 10 - Describe costing inventory using weighted average....Ch. 10 - How long does it take an inventory error affecting...Ch. 10 - What type of issues would arise that might cause...Ch. 10 - Explain the difference between the flow of cost...Ch. 10 - What insights can be gained from inventory ratio...Ch. 10 - Calculate the goods available for sale for...Ch. 10 - Company accepts goods on consignment from R...Ch. 10 - The following information is taken from a companys...Ch. 10 - Complete the missing piece of information...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare Journal entries to record the following...Ch. 10 - If a group of inventory items costing $15,000 had...Ch. 10 - If Wakowski Companys ending inventory was actually...Ch. 10 - Shetland Company reported net income on the...Ch. 10 - Compute Altoona Companys (a) inventory turnover...Ch. 10 - Complete the missing pieces of McCarthy Companys...Ch. 10 - Calculate the goods available for sale for Soros...Ch. 10 - X Company accepts goods on consignment from C...Ch. 10 - Considering the following information, and...Ch. 10 - Complete the missing piece of information...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - If a group of inventory items costing $3,200 had...Ch. 10 - If Barcelona Companys ending inventory was...Ch. 10 - Tanke Company reported net income on the year-end...Ch. 10 - Compute Westtown Companys (A) inventory turnover...Ch. 10 - Complete the missing pieces of Delgado Companys...Ch. 10 - When prices are rising (inflation), which costing...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out (FIFO) cost allocation...Ch. 10 - Use the last-in, first-out (LIFO) cost allocation...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for A76...Ch. 10 - Company Elmira reported the following cost of...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Shana...Ch. 10 - Use the following information relating to Clover...Ch. 10 - When prices are falling (deflation), which costing...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out method (FIFO) cost...Ch. 10 - Use the last-in, first-out method (LIFO) cost...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for B76...Ch. 10 - Company Edgar reported the following cost of goods...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Singh...Ch. 10 - Use the following information relating to Medinas...Ch. 10 - Assume your company uses the periodic inventory...Ch. 10 - Consider the dilemma you might someday face if you...Ch. 10 - Use a spreadsheet and the following excerpts from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The reason why the risk premium of security is determined only by its systematic risk. Introduction: Risk premi...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Why a convertible security not be converted when the market price of stock raises above the conversion price an...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

A company has the opportunity to take over a redevelopment project in an industrial area of a city. No immediat...

Engineering Economy (17th Edition)

Questions For Review

12-4. How is the concept of the value package useful in marketing to consumers and industr...

Business Essentials (12th Edition) (What's New in Intro to Business)

Small Business Analysis Purpose: To help you understand the importance of cash flows in the operation of a smal...

Financial Accounting, Student Value Edition (5th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License