Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 9PA

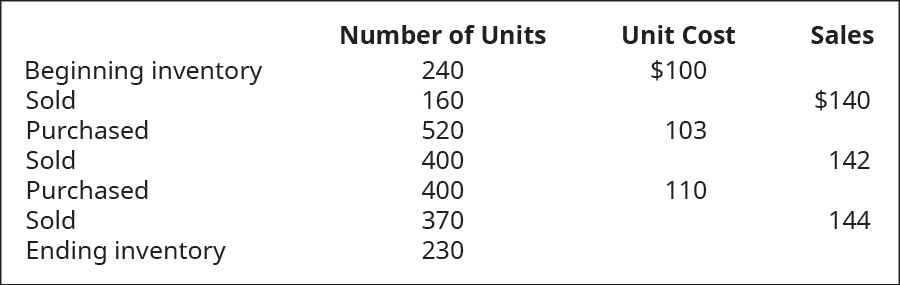

Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

1) Identify whethere the company is paying out dividends based on the attached statement.

2) Describe in detail how that the company’s dividend payouts have changed over the past five years.

3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyneed help

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyno ai

Chapter 10 Solutions

Principles of Accounting Volume 1

Ch. 10 - If a company has four lots of products for sale,...Ch. 10 - If a company has three lots of products for sale,...Ch. 10 - When inventory items are highly specialized, the...Ch. 10 - If goods are shipped FOB destination, which of the...Ch. 10 - On which financial statement would the merchandise...Ch. 10 - When would using the FIFO inventory costing method...Ch. 10 - Which accounting rule serves as the primary basis...Ch. 10 - Which type or types of inventory timing system...Ch. 10 - Which of these statements is false? A. If cost of...Ch. 10 - Which inventory costing method is almost always...

Ch. 10 - Which of the following describes features of a...Ch. 10 - Which of the following financial statements would...Ch. 10 - Which of the following would cause periodic ending...Ch. 10 - Which of the following indicates a positive trend...Ch. 10 - What is meant by the term gross margin?Ch. 10 - Can a business change from one inventory costing...Ch. 10 - Why do consignment arrangements present a...Ch. 10 - Explain the difference between the terms FOB...Ch. 10 - When would a company use the specific...Ch. 10 - Explain why a company might want to utilize the...Ch. 10 - Describe the goal of the lower-of-cost-or-market...Ch. 10 - Describe two separate and distinct ways to...Ch. 10 - Describe costing inventory using first-in,...Ch. 10 - Describe costing inventory using last-in,...Ch. 10 - Describe costing inventory using weighted average....Ch. 10 - How long does it take an inventory error affecting...Ch. 10 - What type of issues would arise that might cause...Ch. 10 - Explain the difference between the flow of cost...Ch. 10 - What insights can be gained from inventory ratio...Ch. 10 - Calculate the goods available for sale for...Ch. 10 - Company accepts goods on consignment from R...Ch. 10 - The following information is taken from a companys...Ch. 10 - Complete the missing piece of information...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Akira Company had the following transactions for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare Journal entries to record the following...Ch. 10 - If a group of inventory items costing $15,000 had...Ch. 10 - If Wakowski Companys ending inventory was actually...Ch. 10 - Shetland Company reported net income on the...Ch. 10 - Compute Altoona Companys (a) inventory turnover...Ch. 10 - Complete the missing pieces of McCarthy Companys...Ch. 10 - Calculate the goods available for sale for Soros...Ch. 10 - X Company accepts goods on consignment from C...Ch. 10 - Considering the following information, and...Ch. 10 - Complete the missing piece of information...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Bleistine Company had the following transactions...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - If a group of inventory items costing $3,200 had...Ch. 10 - If Barcelona Companys ending inventory was...Ch. 10 - Tanke Company reported net income on the year-end...Ch. 10 - Compute Westtown Companys (A) inventory turnover...Ch. 10 - Complete the missing pieces of Delgado Companys...Ch. 10 - When prices are rising (inflation), which costing...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Trini Company had the following transactions for...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out (FIFO) cost allocation...Ch. 10 - Use the last-in, first-out (LIFO) cost allocation...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for A76...Ch. 10 - Company Elmira reported the following cost of...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Shana...Ch. 10 - Use the following information relating to Clover...Ch. 10 - When prices are falling (deflation), which costing...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - DeForest Company had the following transactions...Ch. 10 - Calculate the cost of goods sold dollar value for...Ch. 10 - Use the first-in, first-out method (FIFO) cost...Ch. 10 - Use the last-in, first-out method (LIFO) cost...Ch. 10 - Use the weighted-average (AVG) cost allocation...Ch. 10 - Prepare journal entries to record the following...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Calculate a) cost of goods sold, b) ending...Ch. 10 - Compare the calculations for gross margin for B76...Ch. 10 - Company Edgar reported the following cost of goods...Ch. 10 - Assuming a companys year-end inventory were...Ch. 10 - Use the following information relating to Singh...Ch. 10 - Use the following information relating to Medinas...Ch. 10 - Assume your company uses the periodic inventory...Ch. 10 - Consider the dilemma you might someday face if you...Ch. 10 - Use a spreadsheet and the following excerpts from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

(Record inventory transactions in the periodic system) Wexton Technologies began the year with inventory of 560...

Financial Accounting (12th Edition) (What's New in Accounting)

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

The circumstances where a firm can increase its share price by cutting its dividend and investment. Introductio...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Determining Acquisition Cost. Haply, Inc. incurred the following expenditures when acquiring a new assembly mac...

Intermediate Accounting (2nd Edition)

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forward20 Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds.arrow_forward13 Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License