Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 40P

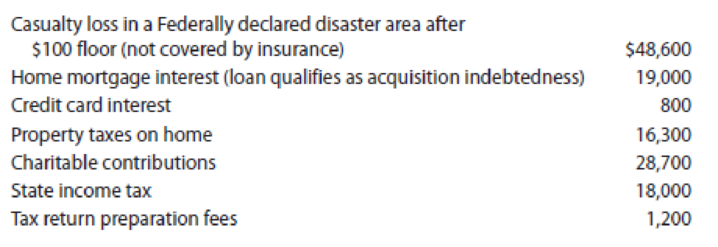

LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows:

Calculate the amount of itemized deductions the Gibsons may claim for the year.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

use the high-low method to calculate Smithson's fixed costs per month.

General accounting question

The analyst's estimate of total assets at year-end should be closest to ?

Chapter 10 Solutions

Individual Income Taxes

Ch. 10 - Prob. 1DQCh. 10 - Prob. 2DQCh. 10 - Prob. 3DQCh. 10 - Prob. 4DQCh. 10 - LO.2 David, a sole proprietor of a bookstore, pays...Ch. 10 - LO.2 Jayden, a calendar year taxpayer, paid 16,000...Ch. 10 - Prob. 7DQCh. 10 - Prob. 8DQCh. 10 - Prob. 9DQCh. 10 - Prob. 10DQ

Ch. 10 - LO.5 Thomas purchased a personal residence from...Ch. 10 - Prob. 12DQCh. 10 - Prob. 13DQCh. 10 - LO.6, 8 William, a high school teacher, earns...Ch. 10 - LO.2 Barbara incurred the following expenses...Ch. 10 - Prob. 16CECh. 10 - Prob. 17CECh. 10 - Prob. 18CECh. 10 - Prob. 19CECh. 10 - Prob. 20CECh. 10 - Prob. 21CECh. 10 - Prob. 22PCh. 10 - Prob. 23PCh. 10 - LO.2 Paul suffers from emphysema and severe...Ch. 10 - LO.2 For calendar year 2019, Jean was a...Ch. 10 - LO.2 During 2019, Susan incurred and paid the...Ch. 10 - In May, Rebeccas daughter, Isabella, sustained a...Ch. 10 - Prob. 28PCh. 10 - Prob. 29PCh. 10 - Prob. 30PCh. 10 - Prob. 31PCh. 10 - Prob. 32PCh. 10 - Prob. 33PCh. 10 - Prob. 34PCh. 10 - On December 27, 2019, Roberta purchased four...Ch. 10 - Prob. 36PCh. 10 - Prob. 37PCh. 10 - Prob. 38PCh. 10 - LO.2, 3, 4, 5, 6, 7 Linda, who files as a single...Ch. 10 - LO.2, 3, 4, 5, 6, 7 For calendar year 2019, Stuart...Ch. 10 - Prob. 41CPCh. 10 - Marcia, a shareholder in a corporation with stores...Ch. 10 - Prob. 4RPCh. 10 - Prob. 1CPACh. 10 - Prob. 2CPACh. 10 - Prob. 3CPACh. 10 - Kurstie received a 800 state income tax refund...Ch. 10 - Which of the following would preclude a taxpayer...Ch. 10 - Prob. 6CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai given answer accounting questionsarrow_forwardNeed help with this question solution general accountingarrow_forwardOn January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forward

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31 Assume that Pharoah earned net income of $3,441,340 during 2023. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per sharearrow_forwardI want to correct answer general accounting questionarrow_forwardHi expert please give me answer general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License