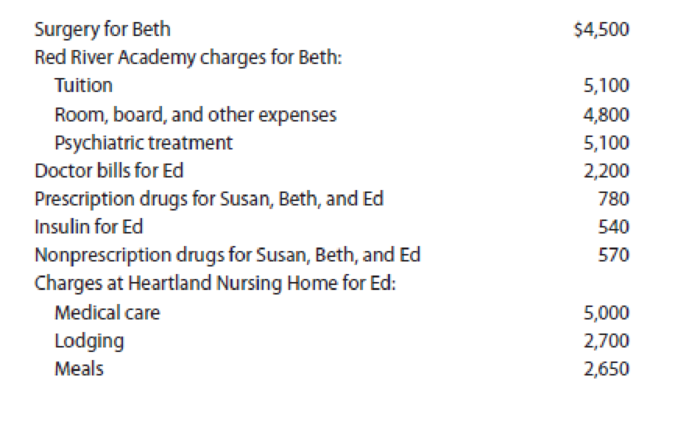

LO.2 During 2019, Susan incurred and paid the following expenses for Beth (her daughter), Ed (her father), and herself:

Beth qualifies as Susan’s dependent, and Ed would also qualify except that he receives $7,400 of taxable retirement benefits from his former employer. Beth’s psychiatrist recommended Red River Academy because of its small classes and specialized psychiatric treatment program that is needed to treat Beth’s illness. Ed, who is a paraplegic and diabetic, entered Heartland in October. Heartland offers the type of care that he requires.

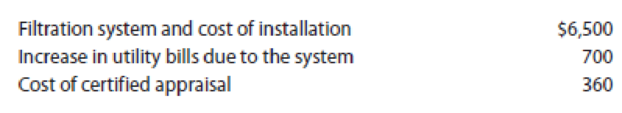

Upon the recommendation of a physician, Susan has an air filtration system installed in her personal residence. She suffers from severe allergies. In connection with this equipment, Susan incurs and pays the following amounts during the year:

The system has an estimated useful life of 10 years. The appraisal was to determine the value of Susan’s residence with and without the system. The appraisal states that the system increased the value of Susan’s residence by $2,200. Ignoring the AGI floor, what is the total of Susan’s expenses that qualifies for the medical expense deduction?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Individual Income Taxes

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardJournal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated…arrow_forward

- Journal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a)arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

- I am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT