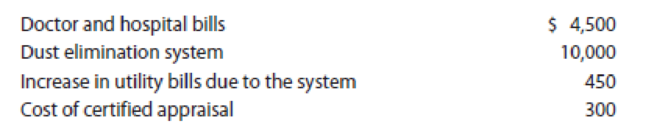

LO.2 Paul suffers from emphysema and severe allergies and, upon the recommendation of his physician, has a dust elimination system installed in his personal residence. In connection with the system, Paul incurs and pays the following amounts during 2019:

In addition, Paul pays $750 for prescribed medicines.

The system has an estimated useful life of 20 years. The appraisal was to determine the value of Paul’s residence with and without the system. The appraisal states that his residence was worth $350,000 before the system was installed and $356,000 after the installation. Paul’s AGI for the year was $50,000. How much of the medical expenses qualify for the medical expense deduction in 2019?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Individual Income Taxes

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT