COST ACCOUNTING

16th Edition

ISBN: 9781323169261

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 10.25E

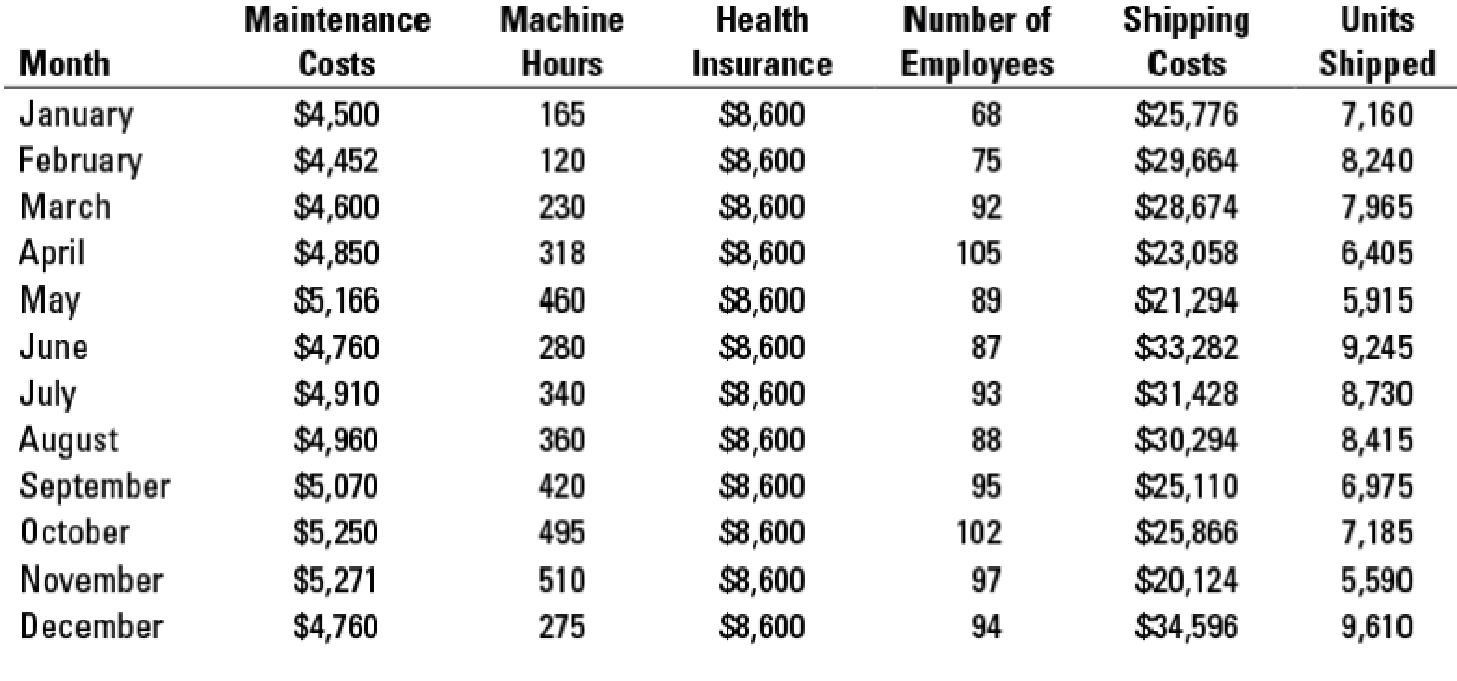

Account analysis, high-low. Stein Corporation wants to find an equation to estimate some of their monthly operating costs for the operating budget for 2018. The following cost and other data were gathered for 2017:

- 1. Which of the preceding costs is variable? Fixed? Mixed? Explain.

Required

- 2. Using the high-low method, determine the cost function for each cost.

- 3. Combine the preceding information to get a monthly operating cost function for the Stein Corporation.

- 4. Next month, Stein expects to use 400 machine hours, have 80 employees, and ship 9,000 units. Estimate the total operating cost for the month.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Using the high-low method, determine the cost function for each cost.

Which of the preceding costs is variable? Fixed? Mixed? Explain.

Armer Company is accumulating data to use in preparing its annual profit plan for the coming year.

The cost behavior pattern of the maintenance costs must be determined. The accounting staff has

suggested the use of linear regression to derive an equation for maintenance hours and costs.

Data regarding the maintenance hours and costs for the last year and the results of the regression

analysis follow:

Maintenance

Machine

Month

Cost

Hours

$ 4,200

Jan.

480

Feb.

3,000

320

Mar.

3,600

400

Apr.

2,820

300

May

4,350

500

June

2,960

310

July

3,030

320

Aug.

4,470

520

Sept.

4,260

490

Oct.

4,050

470

Nov.

3,300

350

Dec.

3,160

340

Sum

$43, 200

4,800

$ 3,600

$

$

$ 684.65

Average

400

Average cost per hour

a (intercept)

b (coefficient)

9.00

7.2884

Standard error of the estimate

34.469

R-squared

0.99724

t-value for b

60.105

At 400 hours of activity, Armer management can be approximately two-thirds confident that the

maintenance costs will be in the range of

Chapter 10 Solutions

COST ACCOUNTING

Ch. 10 - What two assumptions are frequently made when...Ch. 10 - Describe three alternative linear cost functions.Ch. 10 - What is the difference between a linear and a...Ch. 10 - High correlation between two variables means that...Ch. 10 - Name four approaches to estimating a cost...Ch. 10 - Describe the conference method for estimating a...Ch. 10 - Describe the account analysis method for...Ch. 10 - List the six steps in estimating a cost function...Ch. 10 - When using the high-low method, should you base...Ch. 10 - Describe three criteria for evaluating cost...

Ch. 10 - Define learning curve. Outline two models that can...Ch. 10 - Discuss four frequently encountered problems when...Ch. 10 - Prob. 10.13QCh. 10 - All the independent variables in a cost function...Ch. 10 - Multicollinearity exists when the dependent...Ch. 10 - HL Co. uses the high-low method to derive a total...Ch. 10 - A firm uses simple linear regression to forecast...Ch. 10 - In regression analysis, the coefficient of...Ch. 10 - A regression equation is set up, where the...Ch. 10 - What would be the approximate value of the...Ch. 10 - Estimating a cost function. The controller of the...Ch. 10 - Identifying variable-, fixed-, and mixed-cost...Ch. 10 - Various cost-behavior patterns. (CPA, adapted)....Ch. 10 - Matching graphs with descriptions of cost and...Ch. 10 - Account analysis, high-low. Stein Corporation...Ch. 10 - Account analysis method. Gower, Inc., a...Ch. 10 - Prob. 10.27ECh. 10 - Estimating a cost function, high-low method. Lacy...Ch. 10 - Linear cost approximation. Dr. Young, of Young and...Ch. 10 - Cost-volume-profit and regression analysis....Ch. 10 - Regression analysis, service company. (CMA,...Ch. 10 - High-low, regression. May Blackwell is the new...Ch. 10 - Learning curve, cumulative average-time learning...Ch. 10 - Learning curve, incremental unit-time learning...Ch. 10 - High-low method. Wayne Mueller financial analyst...Ch. 10 - High-low method and regression analysis. Market...Ch. 10 - High-low method; regression analysis. (CIMA,...Ch. 10 - Regression, activity-based costing, choosing cost...Ch. 10 - Interpreting regression results. Spirit...Ch. 10 - Cost estimation, cumulative average-time learning...Ch. 10 - Cost estimation, incremental unit-time learning...Ch. 10 - Regression; choosing among models. Apollo Hospital...Ch. 10 - Multiple regression (continuation of 10-42). After...Ch. 10 - Cost estimation. Hankuk Electronics started...Ch. 10 - Prob. 10.45PCh. 10 - Interpreting regression results, matching time...Ch. 10 - Purchasing department cost drivers, activity-based...Ch. 10 - Purchasing department cost drivers, multiple...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cost data for BC Billing Solutions for the year 2020 is as follows: A. Using the high-low method, express the company’s overtime wages as an equation wherexrepresents number of invoices processed. Assume BC has monthly fixed costs of $3,800. B. Predict the overtime wages if 9,000 invoices are processed. D. Using Excel, create a scatter graph of the cost data and explain the relationship between the number of invoices processed and overtime wage expense.arrow_forwardYou are doing some financial analysis research for your work and managed to get (incomplete) data. You will use this data to deduce the required information. You can assume 365 days in a year. a) Alpha Co. reported a cost of goods sold of $64,380.00 and an accounts payable balance of $16,700.00 last year. Compute the average time taken to pay suppliers. Discuss the significance of a longdays’ costs in payables for the firm. b) Bravo Ltd. equity multiplier is 1.93, its total asset turnover is 2.65, and its profit margin is 4.20 percent. Compute the Return on Equity (ROE). Explain the impact on ROE, should the total asset turnover decline next year. c) Charlie Inc. has a profit margin of 7.90 percent, a total asset turnover of 1.54, and a Return on Equity (ROE) of 13.47 percent. Solve for the debt-equity ratio. d) Delta GMBH’s ROE is 8.9 percent. Sales are $2,956,000.00. Total debt ratio is 0.3743. Total debt is $964,000.00. Determine the return on assets (ROA).arrow_forwardNext month, Stein expects to use 400 machine hours, have 80 employees, and ship 9,000 units. Estimate the total operating cost for the month.arrow_forward

- The following were the data obtained by the manager for the first 3 quarters for 2020: Maintenance Machine Quarter Costs Hours 1st quarter 1,520,000 50,000 2nd quarter 1,718,300 62,000 3rd quarter 1,526,000 46,000 How much is the expected maintenance costs for November 2020, if the expected machine hours is 33,000?arrow_forwardUsing account analysis, Pymble Co. wishes to estimate employees' automobile expenses as a function of miles driven. Costs for the past quarter, during which 58,000 miles were driven, are classified as follows: Item Classification Cost $3,200 11,200 3,900 1,800 2,100 Fuel Variable Fixed Fixed Variable Fixed Depreciation Insurance Maintenance Parking Predict the total cost for the coming quarter for which the employees' auto travel budget would be 65,000 miles: $arrow_forwardIntegrated Excel: Preparing a Contribution Format Income Statement Using the High-Low Method Jay Corporation has provided data from a two-year period to aid in planning. The Controller has asked you to prepare a contribution format income statement. Budgeted information for Quarter 1 of 2024: Sales in units Sales price per unit After analyzing expenses, the company has determined the following cost patterns. Cost of Goods Sold (per unit) Sales Commissions (per dollar of sales). Administrative Salaries (per quarter) Rent Expense (per quarter) Depreciation Expense (per quarter) Shipping has been determined to be a mixed cost with the following total costs and units: 2022 Quarter 1 Quarter 2 Quarter 3 Quarter 4 2023 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Cost $ 67,000 $ 94,000 $ 89,800 $ 92,600 $ 72,500 $80,000 $ 84,000 $ 100,000 17,000 $ 48.00 Units 12,500 21,000 13,800 20,000 13,700 14,000 14,300 22,500 $29.00 9.50€ $ 45,000 $ 27,000 $ 36,000 Required: Use the data to answer the…arrow_forward

- Various Financial data for 2019 and 2020 follows. Calculate the total productivity measure and the partial measures for labour, raw materials, and energy for this company for both years. 2019 $75,000 Output: Input: Sales Total Productivity Partial Lab Productivity Partial Material Productivity Labour Materials Energy Other 19,150 21,620 12,250 8,300 61,320 For your answers, write value rounded to two decimal points. Include zeros if applicable and do not include any symbols. (Examples: 3.445 should be written as 3.45, 3.000 should be written as 3.00) 2019 2020 2020 $92,300 22,150 25,120 26,730 5,170 79,170 Partial Energy Partial Other For your answers below, type one of the options exactly as provided in the brackets. Based on the results the company overall is The company's best improvement is seen in The company's biggest decline is seen in (improving / declining). (labour / material / energy / other). (labour / material / energy / other).arrow_forwardNeed Help Please Provide answerarrow_forward[The following information applies to the questions displayed below.] Alden Company's monthly data for the past year follow. Management wants to use these data to predict future variable and fixed costs. Month Units Sold Total Cost Month Units Sold Total Cost 1 324,500 $ 162,000 7 355,500 $ 245,564 2 169,500 105,750 8 274,500 156,250 3 269,500 210,100 9 75,100 60,500 4 209,500 104,500 10 154,500 135,125 5 294,500 206,000 11 6 194,500 116,500 12 98,500 104,500 98,500 77,150 Problem 18-1A (Algo) Part 1 1. Estimate both the variable costs per unit and the total monthly fixed costs using the high-low method. (Do not round intermediate calculations.) High-Low method - Calculation of variable cost per unit Total cost at the high point Variable costs at the high point: Volume at the high point: Variable cost per unit Total variable costs at the high point Total fixed costs High-Low method - Calculation of fixed costs Total cost at the low point Variable costs at the low point: Volume at the…arrow_forward

- H3. Show proper step by step calculationarrow_forwardI am having trouble computing the revenue for the income statement.Use the following revenue and cost information for the income statement. Note that the revenue you use will depend on the pricing level options you chose in Milestone Two. Also, assume that after accounting for weekends and other holidays, there were 20 business days in the first month of operation. For example, if you chose a sales price of $20 per collar, the actual number of collars sold in the month was 33 per day or 33 x 20 = 660 per month.arrow_forwardanswer pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY