Concept explainers

For Exercises 1 through 7, do a complete

a. Draw the

b. Compute the value of the

c. Test the significance of the correlation coefficient at α = 0.01, using Table I.

d. Determine the regression line equation if r is significant.

e. Plot the regression line on the scatter plot, if appropriate.

f. Predict y′ for a specific value of x, if appropriate.

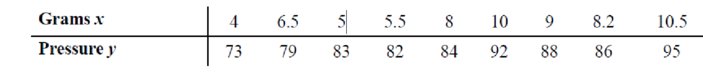

6. Protein and Diastolic Blood Pressure A study was conducted with vegetarians to see whether the number of grams of protein each ate per day was related to diastolic blood pressure. The data are given here. If there is a significant relationship, predict the diastolic pressure of a vegetarian who consumes 8 grams of protein per day. (This information will be used for Exercises 10 and 12.)

a.

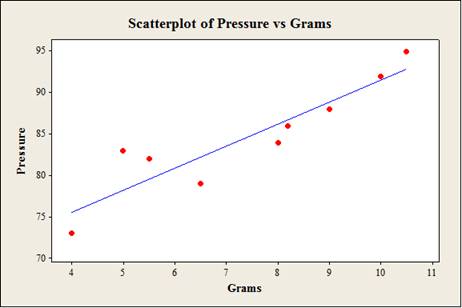

To construct: The scatterplot for the variables the number of grams of protein and the diastolic blood pressure.

Answer to Problem 10.1.6RE

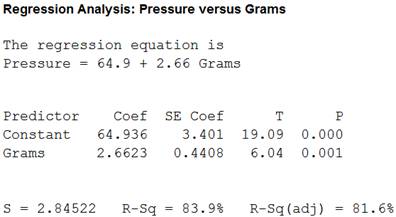

Output using the MINITAB software is given below:

Explanation of Solution

Given info:

The data shows the number of grams of protein (x) and the diastolic blood pressure (y) values.

Calculation:

Step by step procedure to obtain scatterplot using the MINITAB software:

- Choose Graph > Scatterplot.

- Choose Simple and then click OK.

- Under Y variables, enter a column of Pressure.

- Under X variables, enter a column of Grams.

- Click OK.

b.

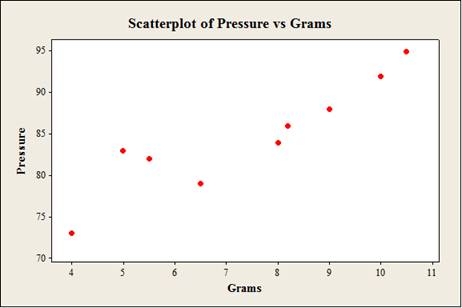

To compute: The value of the correlation coefficient.

Answer to Problem 10.1.6RE

The value of the correlation coefficient is 0.916.

Explanation of Solution

Calculation:

Correlation coefficient r:

Software Procedure:

Step-by-step procedure to obtain the ‘correlation coefficient’ using the MINITAB software:

- Select Stat > Basic Statistics > Correlation.

- In Variables, select x and y from the box on the left.

- Click OK.

Output using the MINITAB software is given below:

From the MINITAB output, the value of the correlation is 0.916.

c.

To test: The significance of the correlation coefficient at

Answer to Problem 10.1.6RE

The conclusion is that, there is a linear relation between the number of grams of protein and the diastolic blood pressure.

Explanation of Solution

Given info:

The level of significance is

Calculation:

The hypotheses are given below:

Null hypothesis:

That is, there is no linear relation between the number of grams of protein and the diastolic blood pressure.

Alternative hypothesis:

That is, there is a linear relation between the number of grams of protein and the diastolic blood pressure.

The sample size is 9.

The formula to find the degrees of the freedom is

That is,

From the “TABLE –I: Critical Values for the PPMC”, the critical value for 7 degrees of freedom and

Rejection Rule:

If the absolute value of r is greater than the critical value then reject the null hypothesis.

Conclusion:

From part (b), the value of r is 0.916 that is the absolute value of r is 0.916.

Here, the absolute value of r is greater than the critical value

That is,

By the rejection rule, reject the null hypothesis.

There is a sufficient evidence to support the claim that “there is a linear relation between the number of grams of protein and the diastolic blood pressure.

d.

To find: The regression equation for the given data.

Answer to Problem 10.1.6RE

The regression equation for the given data is

Explanation of Solution

Calculation:

Regression:

Software procedure:

Step by step procedure to obtain the regression equation using the MINITAB software:

- Choose Stat > Regression > Regression.

- In Responses, enter the column of Pressure.

- In Predictors, enter the column of Grams.

- Click OK.

Output using the MINITAB software is given below:

Thus, regression equation for the given data is

e.

To construct: The scatterplot for the variables the speed and time with regression line.

Answer to Problem 10.1.6RE

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

Step by step procedure to obtain scatterplot using the MINITAB software:

- Choose Graph > Scatterplot.

- Choose with line and then click OK.

- Under Y variables, enter a column of Pressure.

- Under X variables, enter a column of Grams.

- Click OK.

f.

To obtain: The predicted value of the diastolic pressure of a vegetarian who consumes 8 grams of protein per day.

Answer to Problem 10.1.6RE

The predicted value of the diastolic pressure of a vegetarian is 86.232.

Explanation of Solution

Calculation:

Thus, regression equation for the given data is

Substitute x as 8 in the regression equation

Thus, the predicted value of the diastolic pressure of a vegetarian is 86.232.

Want to see more full solutions like this?

Chapter 10 Solutions

Elementary Statistics: A Step By Step Approach

- Using the accompanying Home Market Value data and associated regression line, Market ValueMarket Valueequals=$28,416plus+$37.066×Square Feet, compute the errors associated with each observation using the formula e Subscript ieiequals=Upper Y Subscript iYiminus−ModifyingAbove Upper Y with caret Subscript iYi and construct a frequency distribution and histogram. Square Feet Market Value1813 911001916 1043001842 934001814 909001836 1020002030 1085001731 877001852 960001793 893001665 884001852 1009001619 967001690 876002370 1139002373 1131001666 875002122 1161001619 946001729 863001667 871001522 833001484 798001589 814001600 871001484 825001483 787001522 877001703 942001485 820001468 881001519 882001518 885001483 765001522 844001668 909001587 810001782 912001483 812001519 1007001522 872001684 966001581 86200arrow_forwarda. Find the value of A.b. Find pX(x) and py(y).c. Find pX|y(x|y) and py|X(y|x)d. Are x and y independent? Why or why not?arrow_forwardThe PDF of an amplitude X of a Gaussian signal x(t) is given by:arrow_forward

- The PDF of a random variable X is given by the equation in the picture.arrow_forwardFor a binary asymmetric channel with Py|X(0|1) = 0.1 and Py|X(1|0) = 0.2; PX(0) = 0.4 isthe probability of a bit of “0” being transmitted. X is the transmitted digit, and Y is the received digit.a. Find the values of Py(0) and Py(1).b. What is the probability that only 0s will be received for a sequence of 10 digits transmitted?c. What is the probability that 8 1s and 2 0s will be received for the same sequence of 10 digits?d. What is the probability that at least 5 0s will be received for the same sequence of 10 digits?arrow_forwardV2 360 Step down + I₁ = I2 10KVA 120V 10KVA 1₂ = 360-120 or 2nd Ratio's V₂ m 120 Ratio= 360 √2 H I2 I, + I2 120arrow_forward

- Q2. [20 points] An amplitude X of a Gaussian signal x(t) has a mean value of 2 and an RMS value of √(10), i.e. square root of 10. Determine the PDF of x(t).arrow_forwardIn a network with 12 links, one of the links has failed. The failed link is randomlylocated. An electrical engineer tests the links one by one until the failed link is found.a. What is the probability that the engineer will find the failed link in the first test?b. What is the probability that the engineer will find the failed link in five tests?Note: You should assume that for Part b, the five tests are done consecutively.arrow_forwardProblem 3. Pricing a multi-stock option the Margrabe formula The purpose of this problem is to price a swap option in a 2-stock model, similarly as what we did in the example in the lectures. We consider a two-dimensional Brownian motion given by W₁ = (W(¹), W(2)) on a probability space (Q, F,P). Two stock prices are modeled by the following equations: dX = dY₁ = X₁ (rdt+ rdt+0₁dW!) (²)), Y₁ (rdt+dW+0zdW!"), with Xo xo and Yo =yo. This corresponds to the multi-stock model studied in class, but with notation (X+, Y₁) instead of (S(1), S(2)). Given the model above, the measure P is already the risk-neutral measure (Both stocks have rate of return r). We write σ = 0₁+0%. We consider a swap option, which gives you the right, at time T, to exchange one share of X for one share of Y. That is, the option has payoff F=(Yr-XT). (a) We first assume that r = 0 (for questions (a)-(f)). Write an explicit expression for the process Xt. Reminder before proceeding to question (b): Girsanov's theorem…arrow_forward

- Problem 1. Multi-stock model We consider a 2-stock model similar to the one studied in class. Namely, we consider = S(1) S(2) = S(¹) exp (σ1B(1) + (M1 - 0/1 ) S(²) exp (02B(2) + (H₂- M2 where (B(¹) ) +20 and (B(2) ) +≥o are two Brownian motions, with t≥0 Cov (B(¹), B(2)) = p min{t, s}. " The purpose of this problem is to prove that there indeed exists a 2-dimensional Brownian motion (W+)+20 (W(1), W(2))+20 such that = S(1) S(2) = = S(¹) exp (011W(¹) + (μ₁ - 01/1) t) 롱) S(²) exp (021W (1) + 022W(2) + (112 - 03/01/12) t). where σ11, 21, 22 are constants to be determined (as functions of σ1, σ2, p). Hint: The constants will follow the formulas developed in the lectures. (a) To show existence of (Ŵ+), first write the expression for both W. (¹) and W (2) functions of (B(1), B(²)). as (b) Using the formulas obtained in (a), show that the process (WA) is actually a 2- dimensional standard Brownian motion (i.e. show that each component is normal, with mean 0, variance t, and that their…arrow_forwardThe scores of 8 students on the midterm exam and final exam were as follows. Student Midterm Final Anderson 98 89 Bailey 88 74 Cruz 87 97 DeSana 85 79 Erickson 85 94 Francis 83 71 Gray 74 98 Harris 70 91 Find the value of the (Spearman's) rank correlation coefficient test statistic that would be used to test the claim of no correlation between midterm score and final exam score. Round your answer to 3 places after the decimal point, if necessary. Test statistic: rs =arrow_forwardBusiness discussarrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt