Concept explainers

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three components,

- Cash flow from operating activities.

- Cash flow from investing activities.

- Cash flow from financing activities.

1.

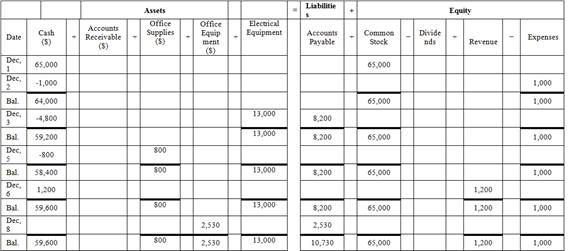

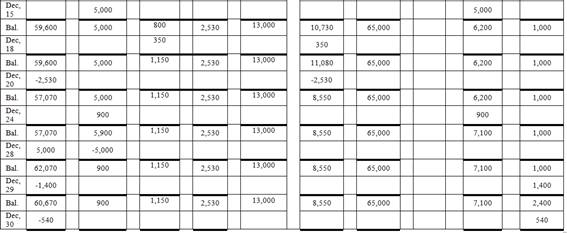

To identify: The effect of transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $59,180,

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of December 31,20XX.

2.

Explanation of Solution

Prepare income statement.

| S. Electric | ||

| Income Statement | ||

| For the month ended December 31,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 7,100 | |

| Total Revenue | 7,100 | |

| Expenses: | ||

| Rent Expenses | 1000 | |

| Salary Expenses | 1,400 | |

| Utilities Expenses | 540 | |

| Total Expense | 2,940 | |

| Net income | 4,160 | |

Table (2)

Hence, net income of .S Electric as on December 31, 20XX is $4,160.

Prepare statement of retained earnings.

| S. Electric | ||

| Retained Earnings Statement | ||

| For the month ended December 31,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 4,160 | |

| Total | 4,160 | |

| Dividends | (950) | |

| Retained earnings | 3,210 | |

Table (3)

Hence, the retained earnings of S Electric as on December 31, 20XX are $3,210.

Prepare balance sheet.

| S. Electric | ||

| Balance sheet | ||

| As on December 31, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 59,180 | |

| Accounts Receivables | 900 | |

| Office Supplies | 1,150 | |

| Office Equipment | 2,530 | |

| Electric Equipment | 13,000 | |

| Total Assets | 76,760 | |

| Liabilities and | ||

| Liabilities | ||

| Accounts Payable | 8,550 | |

| Stockholder’s Equity | ||

| Common Stock | 65,000 | |

| Retained earnings | 3,210 | |

| Total stockholders’ equity | 68,210 | |

| Total Liabilities and Stockholder’s equity | 76,760 | |

Table (4)

Hence, the total of the balance sheet of the S Electric as on December 31, 20XX is of $76,760.

3.

To prepare: The statement of cash flows of the S Electric.

3.

Explanation of Solution

Prepare the cash flow statement.

| S. Electric | ||

| Statement of Cash Flows | ||

| Month Ended December 31, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 6,200 | |

| Payments: | ||

| Supplies | (800) | |

| Rent Expenses | (1,000) | |

| Salary Expenses | (1,400) | |

| Utilities | (540) | (3,740) |

| Net cash from operating activities | 2,460 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,530) | |

| Purchase of electric equipment | (4,800) | |

| Net cash from investing activities | (7,330) | |

| Cash flow from financing activities | ||

| Issued common stock | 65,000 | |

| Less: Payment of cash dividends | (950) | |

| Net cash from financing activities | 64,050 | |

| Net increase in cash | 59,180 | |

| Cash balance, December 1,20XX | 0 | |

| Cash balance, December 31,20XX | 59,180 | |

Table (5)

Hence, the cash balance of the S Electric as on December 31, 20XX is $59,180.

4.

To identify: The changes in (a) total assets, (b) total liabilities, and (c) total equity.

4.

Explanation of Solution

If the owner of the company invests $49,000 cash instead of $65,000 for common stock and borrows $16,000 from the bank, then the effect on assets, liabilities and equity is,

- On assets- There is no change in assets, as in both the cases cash balance increases.

- On liabilities- There is an increase of $16,000 in accounts payable account and liability of S electric will increase.

- On equity- The common stock is decreased by $16,000 and common stock are the part of equity so equity decreases by $16,000.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardZebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forward

- Lika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning