FINANCIAL ACCT.FUND.(LOOSELEAF)

7th Edition

ISBN: 9781260482867

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 11E

Identifying effects of transactions on the

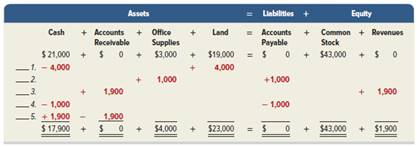

The following table shows the effects of transactions 1 through 5 on the assets, liabilities, and equity of Mulan's Boutique.

Identify the explanation from a through j below that best describes each transaction 1 through 5 and enter it in the blank space in front of each numbered transaction.

- The company purchased $1,000 of office supplies on credit.

- The company collected $1,900 cash from an

account receivable. - The company sold land for $4,000 cash.

- The company paid $1,000 cash in dividends to shareholders.

- The company purchased office supplies for $1,000 cash.

- The company purchased land for $4,000 cash.

- The company billed a client $1,900 for services provided.

- The company paid $1,000 cash toward an account payable.

- The owner invested $1,900 cash in the business in exchange for its common stock.

- The company sold office supplies for $1,900 on credit.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please provide the answer to this general accounting question with proper steps.

Can you explain the correct methodology to solve this general accounting problem?

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

Ch. 1 - Prob. 1MCQCh. 1 - Prob. 2MCQCh. 1 - If the assets of a company increase by $100,000...Ch. 1 - Brunswick borrows $50,000 cash from Third National...Ch. 1 - Geek Squad performs services for a customer and...Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Identify four kinds of external users and describe...Ch. 1 - Prob. 4DQCh. 1 - Prob. 5DQ

Ch. 1 - Prob. 6DQCh. 1 - Prob. 7DQCh. 1 - Prob. 8DQCh. 1 - Prob. 9DQCh. 1 - Prob. 10DQCh. 1 - Prob. 11DQCh. 1 - Prob. 12DQCh. 1 - Prob. 13DQCh. 1 - Prob. 14DQCh. 1 - Why is the revenue recognition principle needed?...Ch. 1 - Prob. 16DQCh. 1 - Prob. 17DQCh. 1 - Prob. 18DQCh. 1 - Prob. 19DQCh. 1 - Prob. 20DQCh. 1 - Prob. 21DQCh. 1 - Prob. 22DQCh. 1 - Prob. 23DQCh. 1 - Prob. 24DQCh. 1 - Prob. 25DQCh. 1 - Prob. 26DQCh. 1 - Prob. 27DQCh. 1 - Prob. 28DQCh. 1 - Prob. 29DQCh. 1 - Prob. 30DQCh. 1 - Prob. 31DQCh. 1 - Prob. 32DQCh. 1 - Prob. 33DQCh. 1 - Prob. 1QSCh. 1 - Prob. 2QSCh. 1 - Prob. 3QSCh. 1 - Prob. 4QSCh. 1 - Prob. 5QSCh. 1 - Prob. 6QSCh. 1 - Prob. 7QSCh. 1 - Prob. 8QSCh. 1 - Prob. 9QSCh. 1 - Prob. 10QSCh. 1 - Prob. 11QSCh. 1 - Identifying items with financial statements P2...Ch. 1 - Prob. 13QSCh. 1 - Prob. 14QSCh. 1 - Prob. 15QSCh. 1 - Computing and interpreting return on assets A2 In...Ch. 1 - Prob. 17QSCh. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Prob. 3ECh. 1 - Prob. 4ECh. 1 - Prob. 5ECh. 1 - Prob. 6ECh. 1 - Prob. 7ECh. 1 - Prob. 8ECh. 1 - Prob. 9ECh. 1 - Prob. 10ECh. 1 - Identifying effects of transactions on the...Ch. 1 - Prob. 12ECh. 1 - Prob. 13ECh. 1 - Prob. 14ECh. 1 - Prob. 15ECh. 1 - Prob. 16ECh. 1 - Prob. 17ECh. 1 - Prob. 18ECh. 1 - Prob. 19ECh. 1 - Prob. 20ECh. 1 - Prob. 21ECh. 1 - Prob. 22ECh. 1 - Using the accounting equation A1 Answer the...Ch. 1 - Prob. 1PSACh. 1 - Prob. 2PSACh. 1 - Prob. 3PSACh. 1 - Prob. 4PSACh. 1 - Prob. 5PSACh. 1 - Prob. 6PSACh. 1 - Prob. 7PSACh. 1 - Prob. 8PSACh. 1 - Prob. 9PSACh. 1 - Prob. 10PSACh. 1 - Prob. 11PSACh. 1 - Prob. 12PSACh. 1 - Prob. 13PSACh. 1 - Prob. 14PSACh. 1 - Identifying effects of transactions on financial...Ch. 1 - Prob. 2PSBCh. 1 - Prob. 3PSBCh. 1 - Prob. 4PSBCh. 1 - Prob. 5PSBCh. 1 - Prob. 6PSBCh. 1 - Prob. 7PSBCh. 1 - Prob. 8PSBCh. 1 - Analyzing transactions and preparing financial...Ch. 1 - Prob. 10PSBCh. 1 - Prob. 11PSBCh. 1 - Prob. 12PSBCh. 1 - Prob. 13PSBCh. 1 - Prob. 14PSBCh. 1 - Prob. 1SPCh. 1 - Prob. 1AACh. 1 - Prob. 2AACh. 1 - Prob. 3AACh. 1 - Prob. 1BTNCh. 1 - Prob. 2BTNCh. 1 - Prob. 5BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License