Concept explainers

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income Statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three parts:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

1.

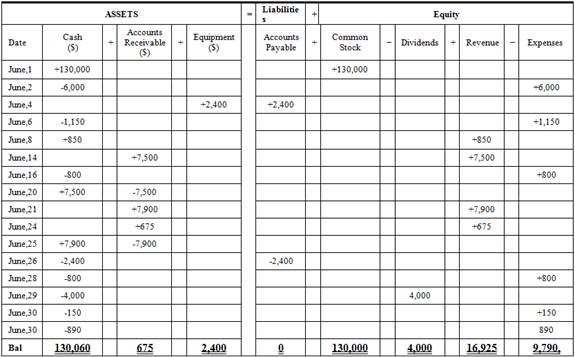

To identify: The effect of given transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $130,060,

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of June 31,20XX.

2.

Explanation of Solution

Prepare income statement.

| N. Company | ||

| Income Statement | ||

| For the month ended June 30,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 16,925 | |

| Total Revenue | 16,925 | |

| Expenses: | ||

| Advertising Expenses | 1,150 | |

| Rent Expenses | 6,000 | |

| Salary Expenses | 1,600 | |

| Telephone Expenses | 150 | |

| Utilities Expenses | 890 | |

| Total Expense | 9,790 | |

| Net income | 7,135 | |

Table (2)

Hence, net income of .N Company as on June 30, 20XX is $7,135

Prepare statement of retained earnings

| N. Company | ||

| Retained Earnings Statement | ||

| For the month ended June 30,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 7,135 | |

| Total | 7,135 | |

| Dividends | (4,000) | |

| Retained earnings | 3,135 | |

Table (3)

Hence, the retained earnings of N Company as on June 30, 20XX are $3,135.

Prepare balance sheet

| N. Company | ||

| Balance sheet | ||

| As on June 30, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 130,060 | |

| Equipment | 2,400 | |

| Accounts Receivables | 675 | |

| Total Assets | 133,135 | |

| Liabilities and | ||

| Liabilities | ||

| Stockholder’s Equity | ||

| Common Stock | 130,000 | |

| Retained earnings | 3,135 | |

| Total stockholders’ equity | 133,135 | |

| Total Liabilities and Stockholder’s equity | 133,135 | |

Table (4)

Hence, the total of the balance sheet of the N Company as on June 30, 20XX is of $133,135.

3.

To prepare: The statement of cash flows of the M Company.

3.

Explanation of Solution

Prepare the cash flow statement:

| N. Company | ||

| Statement of Cash Flows | ||

| Month Ended June 30, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 16,250 | |

| Payments: | ||

| …Advertising Expense | (1,150) | |

| Rent Expenses | (6,000) | |

| Salary Expenses | (1,600) | |

| Telephone Expenses | (150) | |

| Utilities Expense | (890) | (9,790) |

| Net cash from operating activities | 6,460 | |

| Cash flow from investing activities | ||

| Purchase of equipment | (2,400) | |

| Net cash from investing activities | (2,400) | |

| Cash flow from financing activities | ||

| Issued common stock | 130,000 | |

| Less: Payment of cash dividends | (4,000) | |

| Net cash from financing activities | 126,000 | |

| Net increase in cash | 130,060 | |

| Cash balance, June 1,20XX | 0 | |

| Cash balance, June 30,20XX | 130,060 | |

Table (5)

Hence, the cash balance of the N Company as on June 30, 20XX is $130,060.

Want to see more full solutions like this?

Chapter 1 Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

- Please give me true answer this financial accounting questionarrow_forwardPlease given answer accounting questionarrow_forwardA business has a profit margin of 18% on total sales of $50,000,000. The firm holds total debt of $15,000,000, total assets of $60,000,000, and an after-tax interest cost on total debt of 6%. Determine the firm's Return on Assets (ROA).arrow_forward

- Calculate Jenkins' net sales for the period.arrow_forwardNeed solution. General accountingarrow_forwardTownsend Manufacturing has a predetermined overhead rate of $5 per machine hour. Last year, the company incurred $128,700 of actual manufacturing overhead cost, and the account was $4,500 over-applied. How many machine hours were used during the year?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning