Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 6E

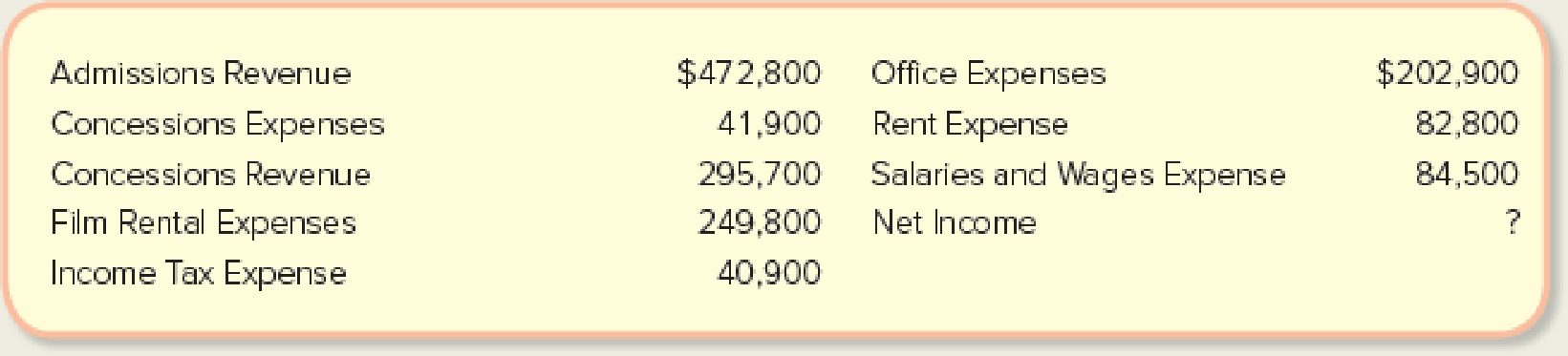

Preparing an Income Statement and Inferring Missing Values

Cinemark Holdings, Inc., operates movies and food concession counters throughout the United States. Its income statement for the quarter ended September 30, 2016, reported the following (accounts are listed alphabetically in thousands):

Required:

- 1. Solve for the missing amount by preparing an income statement for the quarter ended September 30, 2016.

- 2. What are Cinemark’s main source of revenue and two biggest expenses?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Headland Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August.

Because August is their vacation period, vacation pay is also listed.

Earnings to Weekly

Vacation Pay to Be

Employee

July 31

Pay

Received in August

Mark Hamill

$5,180

$280

Karen Robbins

4,480

230

$460

Brent Kirk

3,680

190

380

Alec Guinness

8,380

330

Ken Sprouse

8,980

410

820

Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacations are taken the second

and third weeks of August by Robbins, Kirk, and Sprouse. The state unemployment tax rate is 2.5% and the federal is 0.8%, both on a

$7,000 maximum. The FICA rate is 7.65% on employee and employer on a maximum of $142,800 per employee. In addition, a 1.45%

rate is charged both employer and employee for an employee's wages in excess of $142,800.

Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for the…

The direct materials variance is computed when the materials are purchased

Action to increase net income

Chapter 1 Solutions

Fundamentals Of Financial Accounting

Ch. 1 - Define accounting.Ch. 1 - Prob. 2QCh. 1 - Briefly distinguish financial accounting from...Ch. 1 - The accounting process generates financial reports...Ch. 1 - Explain what the separate entity assumption means...Ch. 1 - List the three main types of business activities...Ch. 1 - What information should be included in the heading...Ch. 1 - What are the purposes of (a) the balance sheet,...Ch. 1 - Explain why the income statement, statement of...Ch. 1 - Briefly explain the difference between net income...

Ch. 1 - Describe the basic accounting equation that...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - Briefly define what an ethical dilemma is and...Ch. 1 - Prob. 18QCh. 1 - Prob. 1MCCh. 1 - Which of the following is true regarding the...Ch. 1 - Which of the following is false regarding the...Ch. 1 - Which of the following regarding retained earnings...Ch. 1 - Prob. 5MCCh. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 7MCCh. 1 - Which of the following is true? a. FASB creates...Ch. 1 - Which of the following would not be a goal of...Ch. 1 - Prob. 10MCCh. 1 - Prob. 1MECh. 1 - Matching Definitions with Terms or Abbreviations...Ch. 1 - Matching Definitions with Terms Match each...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to the Basic...Ch. 1 - Matching Financial Statement Items to the Four...Ch. 1 - Reporting Amounts on the Statement of Cash Flows...Ch. 1 - Prob. 11MECh. 1 - Preparing a Statement of Retained Earnings Stone...Ch. 1 - Relationships among Financial Statements Items...Ch. 1 - Prob. 14MECh. 1 - Relationships among Financial Statements Items...Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Preparing a Balance Sheet DSW, Inc., is a designer...Ch. 1 - Completing a Balance Sheet and Inferring Net...Ch. 1 - Labeling and Classifying Business Transactions The...Ch. 1 - Preparing an Income Statement and Inferring...Ch. 1 - Preparing an Income Statement Home Realty,...Ch. 1 - Prob. 8ECh. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Analyzing and Interpreting an Income Statement...Ch. 1 - Prob. 11ECh. 1 - Matching Cash Flow Statement Items to Business...Ch. 1 - Preparing an Income Statement. Statement of...Ch. 1 - Interpreting the Financial Statements Refer to...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to CP1-3....Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Prob. 2PACh. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PA1-3....Ch. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Interpreting the Financial Statements Refer to PB...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PB1-3....Ch. 1 - Finding Financial Information Answer the following...Ch. 1 - Comparing Financial Information Refer to the...Ch. 1 - Prob. 5SDCCh. 1 - Prob. 6SDCCh. 1 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 5-18 (Algo) Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. WalCo TarMart Costbet Beginning Accounts Receivable $1,795 6,066 609 Ending Accounts Receivable $2,742 6,594 645 Net Sales $320,427 65,878 66,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required C Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your answers in millions rounded to 1 decimal place.) Receivables Turnover Ratio: WalCo S TarMart. S CostGet S Choose Numerator Choose Numerator "ValCo FarMart CostGet 320,427 $ 65.878 66,963 Choose Denominator Receivables turnover ratio 2,742.0 116.9 times 0 times 0 times Average Collection Period Choose Denominator Average…arrow_forwardWhat is the Whistleblower Protection Act of 1989 (amended in 2011)?arrow_forwardWhat are the differences between IFRS and GAAP? What are the smiliarities between IFRS and GAAP?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

IAS 10 Events After the Reporting Period; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=ijYZlb1_ZyQ;License: Standard Youtube License