Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3E

Preparing a

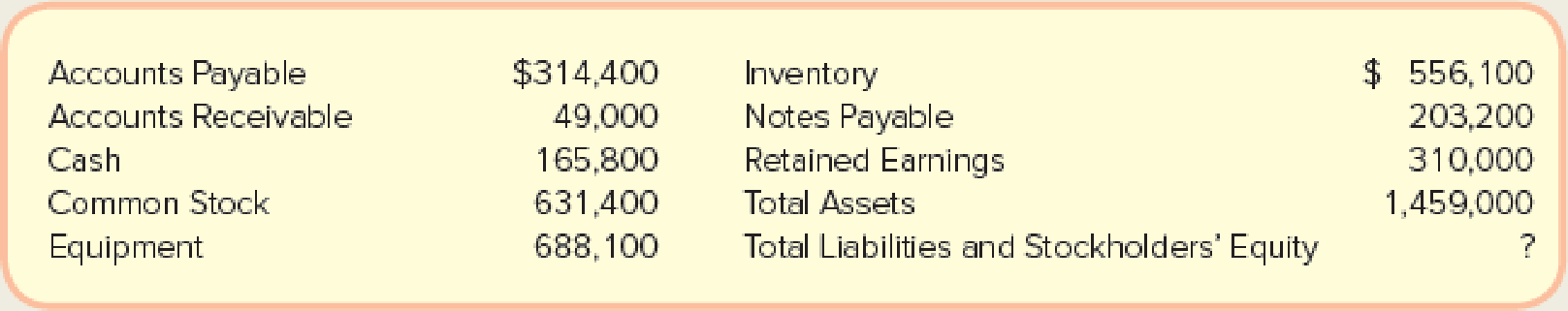

DSW, Inc., is a designer shoe warehouse, selling luxurious and fashionable shoes. Its balance sheet, at July 30, 2016 (the last Saturday of the month), contained the following (listed alphabetically, amounts in thousands).

Required:

- 1. Prepare the balance sheet as of July 30, 2016, solving for the missing amount.

- 2. As of July 30, did most of the financing for assets come from creditors or stockholders?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following data were selected from the records of Fluwars Company for the year ended December 31, current year:

Balances at January 1, current year:

Accounts receivable (various customers)

$

111,500

Allowance for doubtful accounts

11,200

The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return.

The following transactions occurred during the current year:

Sold merchandise for cash, $252,000.

Sold merchandise to Abbey Corp; invoice amount, $36,000.

Sold merchandise to Brown Company; invoice amount, $47,600.

Abbey paid the invoice in (b) within the discount period.

Sold merchandise to Cavendish Inc.; invoice amount, $50,000.

Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods.

Brown paid its account in full within the discount period.

Sold merchandise to Decca Corporation; invoice amount, $42,400.

Cavendish paid its account in full after the…

I want the correct answer with accounting

Solve with explanation and accounting question

Chapter 1 Solutions

Fundamentals Of Financial Accounting

Ch. 1 - Define accounting.Ch. 1 - Prob. 2QCh. 1 - Briefly distinguish financial accounting from...Ch. 1 - The accounting process generates financial reports...Ch. 1 - Explain what the separate entity assumption means...Ch. 1 - List the three main types of business activities...Ch. 1 - What information should be included in the heading...Ch. 1 - What are the purposes of (a) the balance sheet,...Ch. 1 - Explain why the income statement, statement of...Ch. 1 - Briefly explain the difference between net income...

Ch. 1 - Describe the basic accounting equation that...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - Briefly define what an ethical dilemma is and...Ch. 1 - Prob. 18QCh. 1 - Prob. 1MCCh. 1 - Which of the following is true regarding the...Ch. 1 - Which of the following is false regarding the...Ch. 1 - Which of the following regarding retained earnings...Ch. 1 - Prob. 5MCCh. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 7MCCh. 1 - Which of the following is true? a. FASB creates...Ch. 1 - Which of the following would not be a goal of...Ch. 1 - Prob. 10MCCh. 1 - Prob. 1MECh. 1 - Matching Definitions with Terms or Abbreviations...Ch. 1 - Matching Definitions with Terms Match each...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to the Basic...Ch. 1 - Matching Financial Statement Items to the Four...Ch. 1 - Reporting Amounts on the Statement of Cash Flows...Ch. 1 - Prob. 11MECh. 1 - Preparing a Statement of Retained Earnings Stone...Ch. 1 - Relationships among Financial Statements Items...Ch. 1 - Prob. 14MECh. 1 - Relationships among Financial Statements Items...Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Preparing a Balance Sheet DSW, Inc., is a designer...Ch. 1 - Completing a Balance Sheet and Inferring Net...Ch. 1 - Labeling and Classifying Business Transactions The...Ch. 1 - Preparing an Income Statement and Inferring...Ch. 1 - Preparing an Income Statement Home Realty,...Ch. 1 - Prob. 8ECh. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Analyzing and Interpreting an Income Statement...Ch. 1 - Prob. 11ECh. 1 - Matching Cash Flow Statement Items to Business...Ch. 1 - Preparing an Income Statement. Statement of...Ch. 1 - Interpreting the Financial Statements Refer to...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to CP1-3....Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Prob. 2PACh. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PA1-3....Ch. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Interpreting the Financial Statements Refer to PB...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PB1-3....Ch. 1 - Finding Financial Information Answer the following...Ch. 1 - Comparing Financial Information Refer to the...Ch. 1 - Prob. 5SDCCh. 1 - Prob. 6SDCCh. 1 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY