Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 16ME

Preparing an Income Statement, Statement of

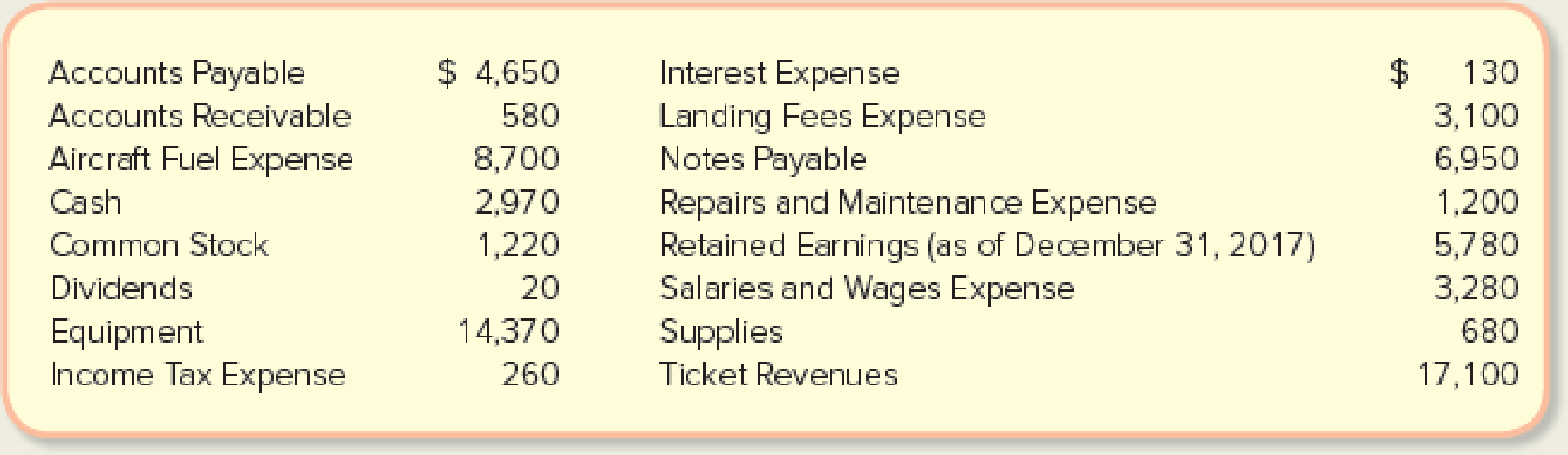

The following information was reported in the December 31, 2017, financial statements of National Airways, Inc. (listed alphabetically, amounts in millions).

- 1. Prepare an income statement for the year ended December 31, 2017.

- 2. Prepare a statement of retained earnings for the year ended December 31, 2017.

TIP: Assume the balance in Retained Earnings was $5,370 (million) at January 1, 2017.

- 3. Prepare a balance sheet at December 31, 2017.

- 4. Using the balance sheet, indicate whether the total assets of National Airways at the end of the year were financed primarily by liabilities or stockholders’ equity.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

I need help with this general accounting question using standard accounting techniques.

Please provide the solution to this general accounting question with accurate financial calculations.

Can you help me solve this general accounting problem with the correct methodology?

Chapter 1 Solutions

Fundamentals Of Financial Accounting

Ch. 1 - Define accounting.Ch. 1 - Prob. 2QCh. 1 - Briefly distinguish financial accounting from...Ch. 1 - The accounting process generates financial reports...Ch. 1 - Explain what the separate entity assumption means...Ch. 1 - List the three main types of business activities...Ch. 1 - What information should be included in the heading...Ch. 1 - What are the purposes of (a) the balance sheet,...Ch. 1 - Explain why the income statement, statement of...Ch. 1 - Briefly explain the difference between net income...

Ch. 1 - Describe the basic accounting equation that...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Describe the equation that provides the structure...Ch. 1 - Prob. 14QCh. 1 - Prob. 15QCh. 1 - Prob. 16QCh. 1 - Briefly define what an ethical dilemma is and...Ch. 1 - Prob. 18QCh. 1 - Prob. 1MCCh. 1 - Which of the following is true regarding the...Ch. 1 - Which of the following is false regarding the...Ch. 1 - Which of the following regarding retained earnings...Ch. 1 - Prob. 5MCCh. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 7MCCh. 1 - Which of the following is true? a. FASB creates...Ch. 1 - Which of the following would not be a goal of...Ch. 1 - Prob. 10MCCh. 1 - Prob. 1MECh. 1 - Matching Definitions with Terms or Abbreviations...Ch. 1 - Matching Definitions with Terms Match each...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to Balance...Ch. 1 - Matching Financial Statement Items to the Basic...Ch. 1 - Matching Financial Statement Items to the Four...Ch. 1 - Reporting Amounts on the Statement of Cash Flows...Ch. 1 - Prob. 11MECh. 1 - Preparing a Statement of Retained Earnings Stone...Ch. 1 - Relationships among Financial Statements Items...Ch. 1 - Prob. 14MECh. 1 - Relationships among Financial Statements Items...Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Preparing a Balance Sheet DSW, Inc., is a designer...Ch. 1 - Completing a Balance Sheet and Inferring Net...Ch. 1 - Labeling and Classifying Business Transactions The...Ch. 1 - Preparing an Income Statement and Inferring...Ch. 1 - Preparing an Income Statement Home Realty,...Ch. 1 - Prob. 8ECh. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Analyzing and Interpreting an Income Statement...Ch. 1 - Prob. 11ECh. 1 - Matching Cash Flow Statement Items to Business...Ch. 1 - Preparing an Income Statement. Statement of...Ch. 1 - Interpreting the Financial Statements Refer to...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to CP1-3....Ch. 1 - Preparing an Income Statement, Statement of...Ch. 1 - Prob. 2PACh. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PA1-3....Ch. 1 - Preparing an Income Statement and Balance Sheet...Ch. 1 - Interpreting the Financial Statements Refer to PB...Ch. 1 - Reporting Amounts on the Four Basic Financial...Ch. 1 - Evaluating Financial Statements Refer to PB1-3....Ch. 1 - Finding Financial Information Answer the following...Ch. 1 - Comparing Financial Information Refer to the...Ch. 1 - Prob. 5SDCCh. 1 - Prob. 6SDCCh. 1 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using accurate calculation methods?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License