Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 61BPSB

Problem 1-61B

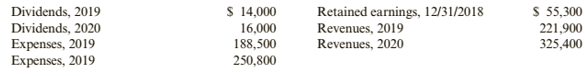

Magical Experiences Vacation Company has the following data available:

Required:

Prepare retained earnings statements for 2019 and 2020.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

2. What does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciation

No chatgpt

What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

I need help

10. What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

Chapter 1 Solutions

Cornerstones of Financial Accounting

Ch. 1 - Define accounting. How does accounting differ from...Ch. 1 - Prob. 2DQCh. 1 - What is accounting entity?Ch. 1 - Prob. 4DQCh. 1 - Prob. 5DQCh. 1 - Prob. 6DQCh. 1 - Define the terms revenue and expense. How are...Ch. 1 - Name and briefly describe the purpose of the four...Ch. 1 - What types of questions are answered by the...Ch. 1 - Prob. 10DQ

Ch. 1 - Write the fundamental accounting equation. Why is...Ch. 1 - What information is included in the heading of...Ch. 1 - Define current assets and current liabilities. Why...Ch. 1 - Prob. 14DQCh. 1 - Name the two main components of stockholders;...Ch. 1 - Prob. 16DQCh. 1 - How does the multiple-step income statement differ...Ch. 1 - Explain the items reported on a retained earnings...Ch. 1 - Name and describe the three categories of the...Ch. 1 - Prob. 20DQCh. 1 - Prob. 21DQCh. 1 - Prob. 22DQCh. 1 - Prob. 1MCQCh. 1 - Prob. 2MCQCh. 1 - At December 31, Pitt Inc. has assets of $12,900...Ch. 1 - Prob. 4MCQCh. 1 - Prob. 5MCQCh. 1 - Prob. 6MCQCh. 1 - Use the following information for Multiple-Choice...Ch. 1 - Use the following information for Multiple-Choice...Ch. 1 - Which of the following statements regarding the...Ch. 1 - Prob. 10MCQCh. 1 - Which of the following statements concerning...Ch. 1 - Which of the following sentences regarding the...Ch. 1 - Prob. 13MCQCh. 1 - Prob. 14CECh. 1 - Cornerstone Exercise 1-15 Using the Accounting...Ch. 1 - Cornerstone Exercise 1-16 Financial Statements...Ch. 1 - Prob. 17CECh. 1 - Cornerstone Exercise 1-18 Balance Sheet An...Ch. 1 - Cornerstone Exercise 1-19 Income Statement An...Ch. 1 - Cornerstone Exercise 1-20 Retained Earnings...Ch. 1 - Prob. 21BECh. 1 - Prob. 22BECh. 1 - Brief Exercise 1-23 Business Activities Marni...Ch. 1 - Brief Exercise 1-24 The Accounting Equation...Ch. 1 - Prob. 25BECh. 1 - Brief Exercise 1-26 Income Statement An analysis...Ch. 1 - Retained Earnings Statement Listed below are...Ch. 1 - Brief 1-28 Statement of Cash Flows Listed are...Ch. 1 - Prob. 29BECh. 1 - Prob. 30BECh. 1 - Exercise 1-31 Decisions Based on Accounting...Ch. 1 - Prob. 32ECh. 1 - Prob. 33ECh. 1 - Exercise 1-34 Business Activities Bill and Steve...Ch. 1 - Exercise 1-35 Accounting Concepts OBJECTIVE 06° A...Ch. 1 - Exercise 1-36 The Fundamental Accounting Equation...Ch. 1 - Exercise 1-37 Balance Sheet Structure The...Ch. 1 - Exercise 1-38 Identifying Current Assets and...Ch. 1 - Exercise 1-39 Current Assets and Current...Ch. 1 - Exercise 1-40 Depreciation OBJECTIVE 0° Swanson...Ch. 1 - Exercise 1-41 Stockholders Equity OBJECTIVE o On...Ch. 1 - Prob. 42ECh. 1 - Prob. 43ECh. 1 - Prob. 44ECh. 1 - Prob. 45ECh. 1 - OBJECTIVE 6 Exercise 1-46 Income Statement ERS...Ch. 1 - Exercise 1-47 Multiple-Step Income Statement The...Ch. 1 - Exercise 1-48 Income Statement The following...Ch. 1 - Prob. 49ECh. 1 - Exercise 1-50 Statement of Cash Flows OBJECTIVE o...Ch. 1 - Exercise 1-51 Relationships Among the Financial...Ch. 1 - Exercise 1-52 Relationships Among the Financial...Ch. 1 - Exercise 1-53 Relationships Among the Financial...Ch. 1 - Prob. 54ECh. 1 - Prob. 55ECh. 1 - Problem 1-56A Applying the Fundamental Accounting...Ch. 1 - Problem 1-57A Accounting Relationships Information...Ch. 1 - Prob. 58APSACh. 1 - Prob. 59APSACh. 1 - Problem 1-60A Income Statement and Balance Sheet...Ch. 1 - Problem 1-61A Retained Earnings Statement Dittman...Ch. 1 - Problem 1-62A Retained Earnings Statements The...Ch. 1 - Problem 1-63A Income Statement, Retained Earnings...Ch. 1 - Problem 1-64A Stockholders' Equity Relationships...Ch. 1 - Problem 1-65A Relationships Among Financial...Ch. 1 - Problem 1-563 Applying the Fundamental Accounting...Ch. 1 - Problem 1-57B The Fundamental Accounting Equation...Ch. 1 - Problem 1-583 Arrangement of the Income Statement...Ch. 1 - Prob. 59BPSBCh. 1 - Problem 1-60B Income Statement and Balance Sheet...Ch. 1 - Problem 1-61B Retained Earnings Statement Magical...Ch. 1 - Problem 1-62B Retained Earnings Statements The...Ch. 1 - Problem1-63B Income Statement, Retained Earnings...Ch. 1 - Prob. 64BPSBCh. 1 - Problem 1-65B Relationships Among Financial...Ch. 1 - Prob. 66CCh. 1 - Prob. 67.1CCh. 1 - Prob. 67.2CCh. 1 - Prob. 68.1CCh. 1 - Prob. 68.2CCh. 1 - Prob. 69.1CCh. 1 - Prob. 69.2CCh. 1 - Case 1-70 Financial Statement Analysis Reproduced...Ch. 1 - Prob. 70.2CCh. 1 - Case 1-70 Financial Statement Analysis Reproduced...Ch. 1 - Prob. 71CCh. 1 - Prob. 72CCh. 1 - Prob. 73.1CCh. 1 - Prob. 73.2CCh. 1 - Prob. 73.3CCh. 1 - Case 1-73 Research and Analysis Using the Annual...Ch. 1 - Prob. 73.5CCh. 1 - Prob. 73.6CCh. 1 - Prob. 73.7CCh. 1 - Prob. 74.1CCh. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Prob. 74.3CCh. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Case 1-74 Comparative Analysis: Under Armour,...Ch. 1 - Prob. 75.1CCh. 1 - Prob. 75.2CCh. 1 - Case 1-75 CONTINUING PROBLEM: FRONT ROW...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed answerarrow_forwarddont use ai What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardFill in the attached balance sheet with the data provided on the SEC for years 2020, 2021 and 22 NIKE, INC BALANCE SHEET Financial Statements 2020 2021 2022 Assets Current Assets Cash and Cash Equivalents [insert value] [insert value] [insert value] Accounts Receivable Net [insert value] [insert value] [insert value] Inventory [insert value] [insert value] [insert value] Other Current Assets [insert value] [insert value] [insert value] Total Current Assets $ - $ - $ - Non-Current Assets Property, Plant and Equipment Net [insert value] [insert value] [insert value] Intangibles [insert value] [insert value] [insert value] Other Assets [insert value] [insert value] [insert value] Total Non-Current/Fixed Assets $ - $…arrow_forward

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets helparrow_forwardNo chatgpt What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardWhat is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsneed helparrow_forward

- What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assetsarrow_forwardNo AI 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardNeed help ! 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forward

- 4. If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardCalculate the times-interest-earned ratios for PEPSI CO, Given the following informationarrow_forwardCalculate the times-interest-earned ratios for Coca Cola in 2020. Explain if the times-interest-earned ratios is adequate? Is the times-interest-earned ratio greater than or less than 2.5? What does that mean for the companies' income? Can the company afford the interest expense on a new loan?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License